Each year, the Angel Funders Report by the Angel Capital Association (ACA) captures how investors and entrepreneurs are adapting to a rapidly changing early-stage ecosystem. The 2025 edition, built from data across 250+ ACA member organizations in the U.S. and Canada, is particularly interesting. Despite slower exits, compressed valuations, and a more challenging fundraising climate, angel investors continue to show remarkable resilience.

If you’re an investor navigating new market realities or an entrepreneur raising capital this year, here are the data, shifts, and signals you can’t afford to ignore.

Angels Are Doubling Down on the Earliest Rounds

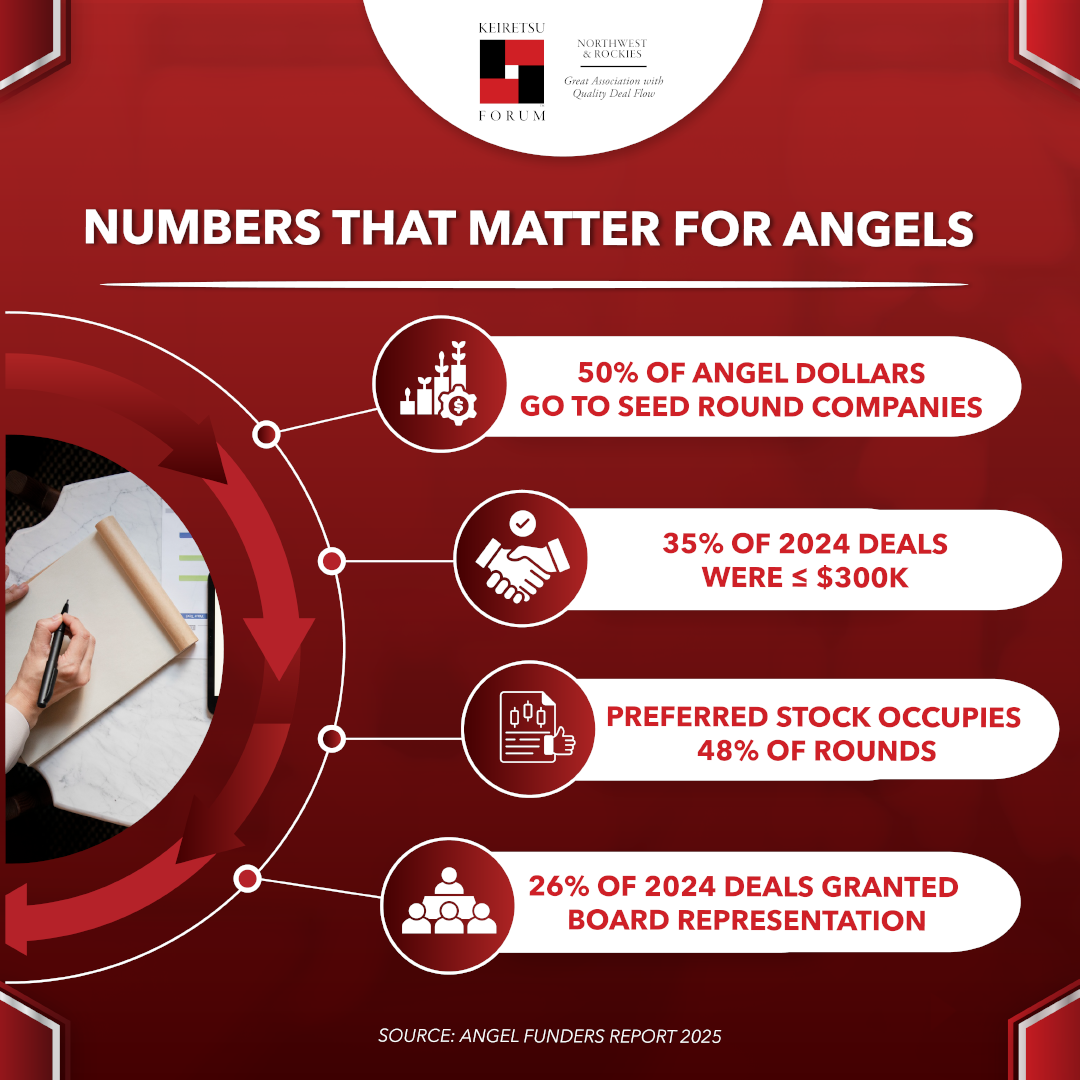

The biggest trend in 2025 is the fact that capital is flowing earlier than ever. More than 50% of angel investments this year were concentrated in the pre-seed and seed stages, reaffirming that angels remain the first movers in fueling innovation.

In an era when many venture funds have pulled back from riskier, early rounds, angels are stepping in to keep promising businesses alive and agile. Angels have stepped up to offer validation, mentorship, and momentum when it matters most.

For entrepreneurs, this is your signal: early traction, clarity of vision, and sound capital strategy are more valuable than ever in attracting early angel confidence.

Valuations Compress, But Smarter Money Prevails

The data shows a bifurcated market. Steady or rising valuations at the earliest stages, contrasted with sharp declines at later rounds. Early-stage companies are holding their ground as investors focus on sustainable growth and fundamentals over hype.

The median angel investment per deal rose to around $30,000, while syndicates pooled up to $3 million on average. Yet, individual investors are diversifying across more deals to manage exposure — a sign of disciplined optimism rather than risk aversion.

This shift tells us two things: investors are leaning into early rounds where valuations make sense, and entrepreneurs can no longer rely on inflated pricing. The new normal favors those who can show capital efficiency, measurable progress, and defensible business models.

Hybrid Models Redefine Angel Networks

Structure is evolving as fast as strategy. The report highlights a growing trend toward hybrid models — networks that combine pooled funds with individual participation.

These “network + fund” structures offer investors flexibility and speed while ensuring consistent deal flow. They also give entrepreneurs access to broader expertise and funding depth within a single ecosystem.

However, the report notes a decline in board or observer participation, dropping from 34% to 26%. That’s a double-edged signal — investors may be trading hands-on influence for faster deal participation. But data from past ACA reports suggest that active governance improves outcomes. Smart investors will find ways to stay engaged without slowing down.

Returns Hold Strong — and Angels Keep Reinventing

Despite a cooling exit market, angels continue to outperform. The report cites average IRRs of 24–28%, with the top quartile reaching up to 40%. Around 13% of angel-backed companies achieved liquidity through acquisitions or IPOs — more than twice the success rate of non-angel-backed peers.

Even more encouraging, nearly 75% of angels reinvested their returns into new companies. That is a significant vote of confidence in the ecosystem’s long-term health.

While exits are taking longer, disciplined investors who maintain portfolio diversity, exercise patience, and double down on winners are still seeing strong outcomes.

The Capital Flows Tell a Clear Story: Tech Is Still King

This may seem like a no-brainer, yet it is essential to note that 68% of total angel capital in 2025 went into technology-led industries — including AI, healthtech, fintech, life sciences, and climate tech.

This concentration reflects two trends: investors are gravitating toward sectors driving systemic transformation, and entrepreneurs in these spaces are increasingly data-driven and capital-efficient.

Geographically, early-stage investing has gone borderless. With remote due diligence and virtual syndication, angels can now invest across regions seamlessly. Meanwhile, specialized networks, sector- or mission-focused groups, are rising fast, often outperforming traditional generalist models.

Closing Thoughts

The Angel Funders Report 2025 captures a decisive moment in early-stage investing. Angels are rewriting the playbook, shifting from instinct to intelligence, from volume to value, and from local to global reach.

For investors, the message is clear: adapt to data, lean into discipline, and keep your capital where innovation is strongest.

For entrepreneurs, the takeaway is just as direct: clarity, traction, and transparency are your greatest currencies.

The ecosystem is changing fast, but for those paying attention to the right signals, 2025 isn’t a slowdown. It’s an inflection point.