Your equity pie deserves better than a guess. (Want to keep this as a subtext after the title)

What's better than pumpkin pie? Equity pie, obviously.

But slicing that pie can be tricky. As an entrepreneur, you want to offer compelling equity to attract and retain top talent, but you also need to leave enough room for future hires, investors, and your own slice. So, how do you decide how much to set aside for your Employee Stock Option Plan (ESOP)?

Let's dig into the data.

The Benchmark Slice: 8–10%

Most early-stage companies start by setting aside 8–10% of their equity for ESOPs. Why this range?

According to Carta's data from 2016–2024, if you granted each hire the median equity amount, an 8% ESOP pool would comfortably cover your first 50 hires. That's roughly the team size most startups reach by the Series B stage.

Here's how that plays out:

- At the 50th percentile, 8% covers:

- Your first 10–15 employees with fair median equity

- Up to 50 employees with careful planning

- At the 75th percentile, 10% helps you:

- Stay generous through Series A

- Continue attracting top-tier talent.

- At the 90th percentile, even 10% might only get you through the Seed stage, especially if you're offering equity at the high end of the market.

A Guiding Framework

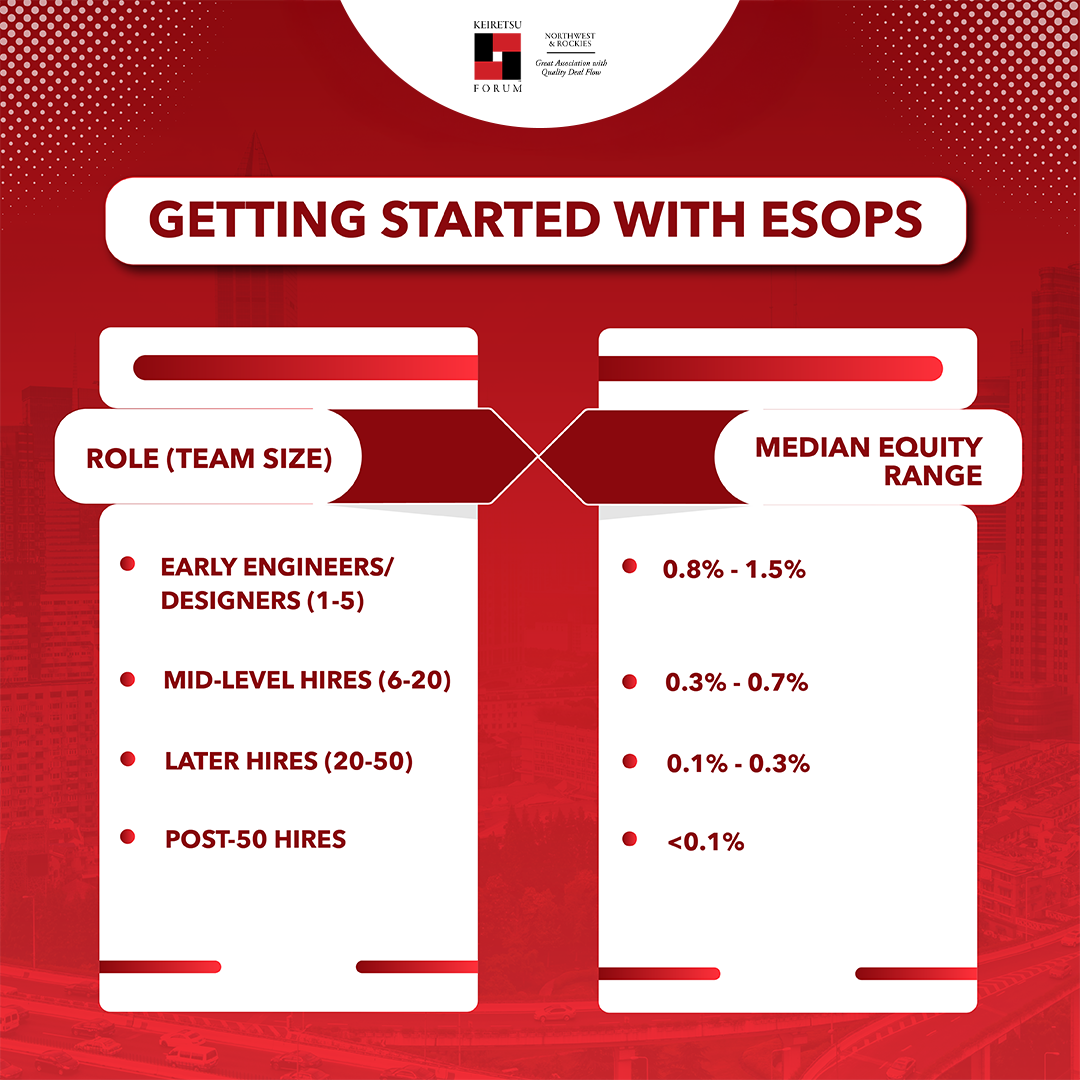

As you begin hiring and distributing equity, it's helpful to have a general reference for how much equity is typically granted based on role and seniority. While actual numbers will vary depending on your stage, risk profile, and location, having a benchmark keeps you grounded and avoids arbitrary or overly generous offers. Here is a simplified range of median equity grants drawn from industry norms:

Use this as a starting point when structuring offers, adjusting them based on the role's importance, the hiring stage, and market competitiveness.

Don't Be Afraid to Top It Off

Investors may ask you to set aside a larger ESOP upfront, but that's not your only chance to allocate equity. You can always top off your ESOP pool in future rounds, but ensure it's done before raising capital so the current cap table absorbs the dilution. This flexibility allows you to remain competitive without locking up too much equity too early.

Remember These Common Mistakes!

Even with the best intentions, it's easy to misstep when setting up and managing an ESOP. Many entrepreneurs undervalue or overpromise equity, which can lead to issues during hiring or fundraising.

Here are some common pitfalls to watch out for:

- Over-allocating too early: You don't need 15–20% in your pool on Day 1.

- Under-allocating and scrambling before a round: Replenishing an ESOP post-term sheet weakens your negotiation power.

- One-size-fits-all grants: Tailor grants based on role, risk, and timing of joining.

- Not communicating equity clearly: Many employees don't understand what 0.5% really means. Educate them using plain language and visuals.

Your ESOP Strategy Checklist

A well-structured ESOP can be a powerful lever for growth, but only when planned with intention. Instead of guessing or copying someone else's cap table, anchor your decisions in real data, your hiring roadmap, and the culture you want to build.

To recap:

- Based on your team growth projections, start with an 8–10% ESOP pool.

- Revisit and replenish the pool ahead of major fundraising rounds.

- Offer equity grants in line with market expectations and role-specific benchmarks.

- Educate your team. Equity should feel tangible and valuable, not confusing.

Remember, equity isn't just compensation. It's a signal of trust, ownership, and shared ambition. Get it right early, and it becomes a magnet for the kind of team that will help you achieve your business goals.