In the first half of 2025, Series A activity in the U.S. took a curious turn. According to Carta’s data, deal count fell by nearly 18% year over year, while total cash raised declined by 23%. Yet, despite this contraction in activity, valuations at the Series A stage continue to climb, reaching a median pre-money valuation of around $48 million in Q2.

This entire situation, with fewer deals, less capital deployed, and rising valuations, reveals a fundamental shift in investor behavior. Rather than spreading capital across a broad pool of early-growth companies, investors are concentrating their bets on fewer high-performing businesses. The result: a Series A market that’s increasingly selective, slower to move, but more expensive to enter.

What The Data Means: A Selective Market Driving Higher Valuations

Series A rounds have historically served as the gateway from proof of concept to scalable growth. However, current data from Carta highlights a structural tightening in that transition. Deal volume has dropped sharply, while aggregate capital invested at this stage has followed suit.

But valuations tell a different story. The median pre-money valuation of nearly $48 million marks a significant year-over-year rise, suggesting that investors are willing to pay a premium for companies that meet today’s higher performance standards.

This dynamic reflects a rebalancing of capital: fewer checks being written, but at higher entry points. The message to both investors and business leaders is clear: Series A is no longer a milestone defined by fundraising ability; it’s now a test of operational maturity.

What Brought Us To This Position?

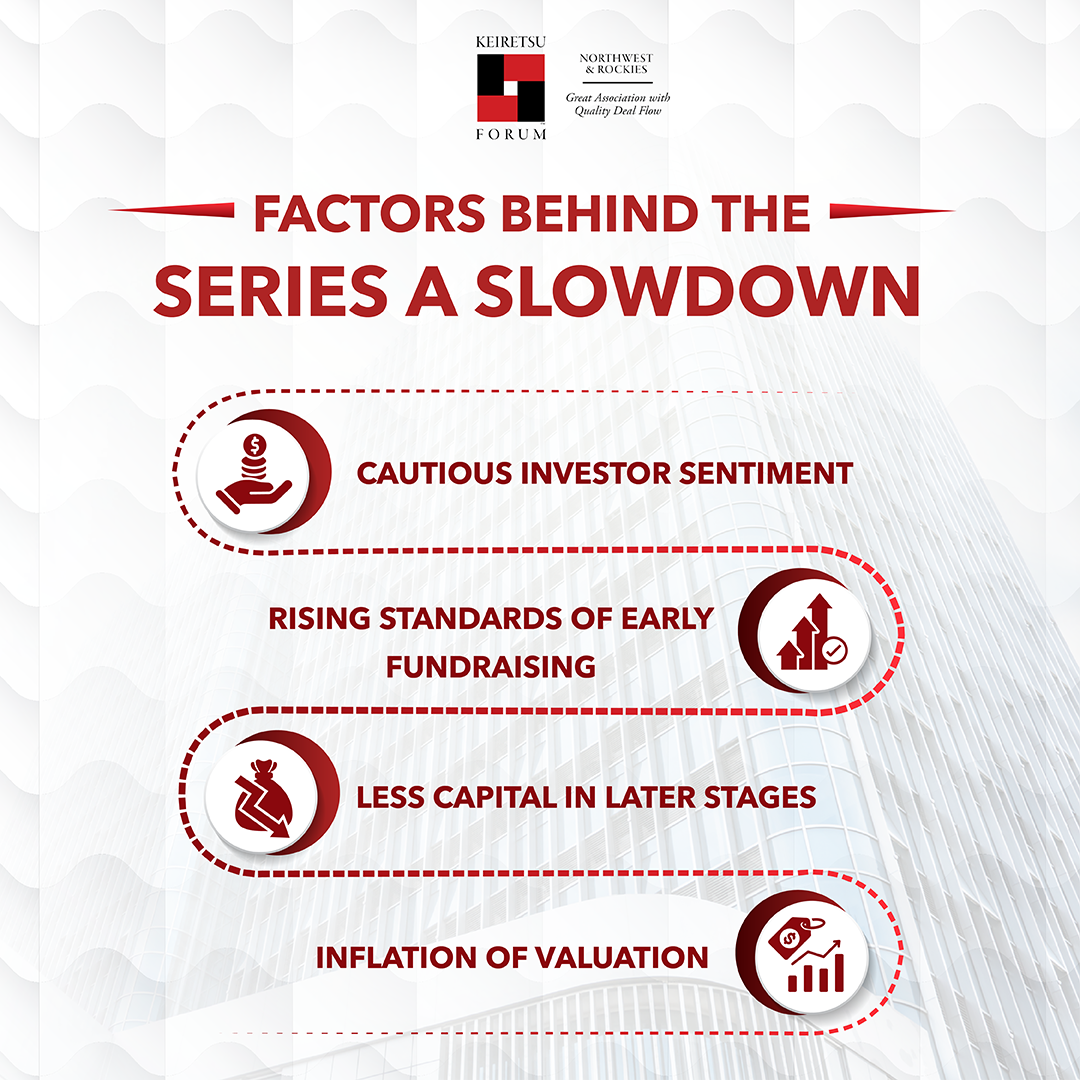

Several factors are shaping this trend. First, investors have become more disciplined following two years of market correction and shifting macroeconomic conditions. The era of funding growth at any cost is over; profitability and sustainability now dominate investor priorities.

Second, the bar for raising a Series A has moved upward. Where once early momentum and a strong narrative might have sufficed, today’s investors expect substantial revenue traction, product-market fit, and credible financial discipline. Businesses with $5–10 million in ARR, efficient cost structures, and proven customer retention are the ones breaking through.

Third, capital scarcity at later stages has had a trickle-down effect. As Series B and C investors tighten their filters, early-stage investors are responding by deploying capital more cautiously. Companies that cannot yet demonstrate growth efficiency are turning to bridge rounds or extensions, delaying their Series A until they can justify premium valuations.

Finally, valuation inflation in select sectors, particularly AI, deep tech, and biotech, is skewing the data. These industries attract investors willing to pay top-tier prices for the potential of exponential returns, even as deal activity elsewhere is subdued.

So What Does This Mean For Investors?

For angel investors, this environment requires recalibrating both mindset and strategy. With fewer Series A rounds, deal access has become more competitive. The companies that do raise are often oversubscribed, and valuations are stretched compared to historical norms.

This means you must evaluate deals with greater precision. High valuations may indicate strong traction, but they also reduce upside potential and amplify risk. In this market, the quality and potential of the business matter far more than the momentum of its sector.

Additionally, you may need to reconsider entry points. Participating earlier, at the seed or bridge round level, allows you to build relationships before institutional investors dominate the cap table. Conversely, later-stage participation may offer more data transparency, though at reduced returns. Either way, diversification and domain expertise will be key advantages in navigating the new funding reality.

Entrepreneurs, Here’s How You Can Navigate…

For business leaders preparing to raise Series A capital, the path forward demands stronger fundamentals and greater patience. Investors are now looking for deals that back their innovation and vision with strong performance. That means demonstrating revenue consistency, healthy unit economics, and operational efficiency.

The narrative still matters, but data must support it. Businesses that clearly articulate why their market is expanding now, how their product uniquely captures that growth, and why they can scale efficiently stand out. Companies that fail to build this alignment between story and metrics risk being filtered out much before discussing numbers with investors.

It’s also important to approach valuation with perspective. While a high valuation may appear attractive in the short term, it comes with expectations for rapid scaling and increased investor scrutiny. Overvaluation at Series A can create pressure in later rounds, particularly if growth stalls or market conditions shift.

Finally, bridge or extension rounds should not be seen as setbacks. The perception of bridge rounds has changed, and investors understand that it represents strategic flexibility, allowing you to hit stronger metrics before entering a priced round. So go ahead, take that bridge if you need to.

The New Rules of the Game

The Series A market of 2025 is more focused. Deal activity may have slowed, and capital deployment may be down, but the quality threshold has never been higher. For angel investors, this means playing fewer hands, but with greater conviction. For entrepreneurs, it means building the kind of operational resilience and financial clarity that earns investor confidence.