Elon Musk skipped on due diligence before spending $44 billion on Twitter. As of early January 2024, the social media brand may be worth 70% less than Musk's buying price. Due diligence oversights led to the collapse of crypto firm FTX in 2022. It is reported that founder Sam Bankman-Fried played video games during meetings with Sequoia investors. Yet, red flags went unnoticed as $8 billion in customer assets vanished! In the late 2010s, questions mounted around Theranos’ blood testing technology, as the company used fake demos to project innovation. Starstruck investors like Rupert Murdoch were in the red. The three stories above have a common theme.

Greater investor diligence into leadership, structure, and financial dealings could have unearthed huge problems before they caused implosions like FTX and Theranos. Yet prominent investors failed to do the right due diligence. While there is no way to eliminate risk entirely, it helps to take cautious steps before signing the dotted line. Today, we will examine due diligence for angel investing with fresh eyes and understand what it entails. Read on to know why due diligence often falls by the wayside in investing and what it achieves for investors and startups when done just right! Here we go.

Why Due Diligence Oversights Happen in Business

It is fair to ask why investors cut corners on due diligence. Well, human psychology and macros provide some clues. The rapid change in global technology, loose Fed policies, and an influx of money into private markets create an environment ripe for due diligence oversights. An increased capital flow into private markets has sometimes led to a lack of thorough evaluation, with investors chasing returns and easy money.

Due diligence standards erode when investors chase returns in a low-interest rate environment. Herd mentality makes it tempting to skip careful analysis if others are investing. The Fear of Missing Out or FOMO suggests you shouldn't pause to overthink a hot deal.

Confirmation bias causes early positive signs to boost belief, while the sunk cost fallacy makes it hard to walk away early if issues emerge. Given these dynamics, it is unsurprising that diligence is sacrificed. But experienced investors know avoiding diligence is a can of worms. So, let's take a closer look, shall we?

Angel Due Diligence Definition and What Angel Investing Achieves

Before examining the contours of due diligence in angel investments, it helps to understand its roots. Diligence comes from the Latin diligo – meaning to love, esteem or choose. In the mid-15th century, due diligence became a phrase that meant reasonable care, only becoming legalese in the 1930s to ensure information disclosure in securities trade. Today, it is a process of asking the right questions. It means verifying all facts, claims, and forecasts before making an angel investment, buying real estate, or orchestrating an M&A.

To do due diligence is to undertake a process by which angels validate claims and risks.

Proper due diligence serves a vital purpose in angel investing. The nature of the risk demands the effort. It is about making thorough investigations. Due diligence refers to informed risk, not eliminating uncertainties. Startups inherently involve leaps of faith but these flights should be grounded in due diligence. The amount of time and expertise it takes makes it daunting for any angel to conduct an effective DD report themselves.

A well-thought-out, extensive DD report ensures that investors can judge companies efficiently based on their investment goals and choose whether or not to proceed with funding.

Favorable outcomes emerge when the right expertise is involved in the DD process. Consider having apt subject matter experts and industry veterans to understand the opportunities in the sector. It is also helpful for investors to stay in touch with the companies after the initial funding round. While many would claim due diligence for a young company is not worth the time and 'might not involve much data', you’d be surprised at the intricate and rich analysis even a pre-MVP, zero-revenue company may entail.

Keiretsu Forum facilitates a five-stage due diligence (DD) process to thoroughly research potential investment opportunities. Learn more.

Why is Due Diligence Important in Angel Investing?

Angels do due diligence because it serves several functions, benefiting both angels and startups in an investment. To mitigate oversights, there is a call for restoring standards, including audits to scrutinize spending and governance. Strengthening diligence processes will ensure that only the best companies survive a higher bar of scrutiny. Three key advantages include:

- Verify Facts: Allows angels to verify financial, leadership, product, and other critical information about the startup.

- Make Informed Investments: This leads to more accurate pricing and permits the investors to back out if significant issues are unearthed during due diligence.

- Reducing Knowledge Gap: Creates awareness, clearer expectations, and increased comfort for both parties, leading to better-informed decisions.

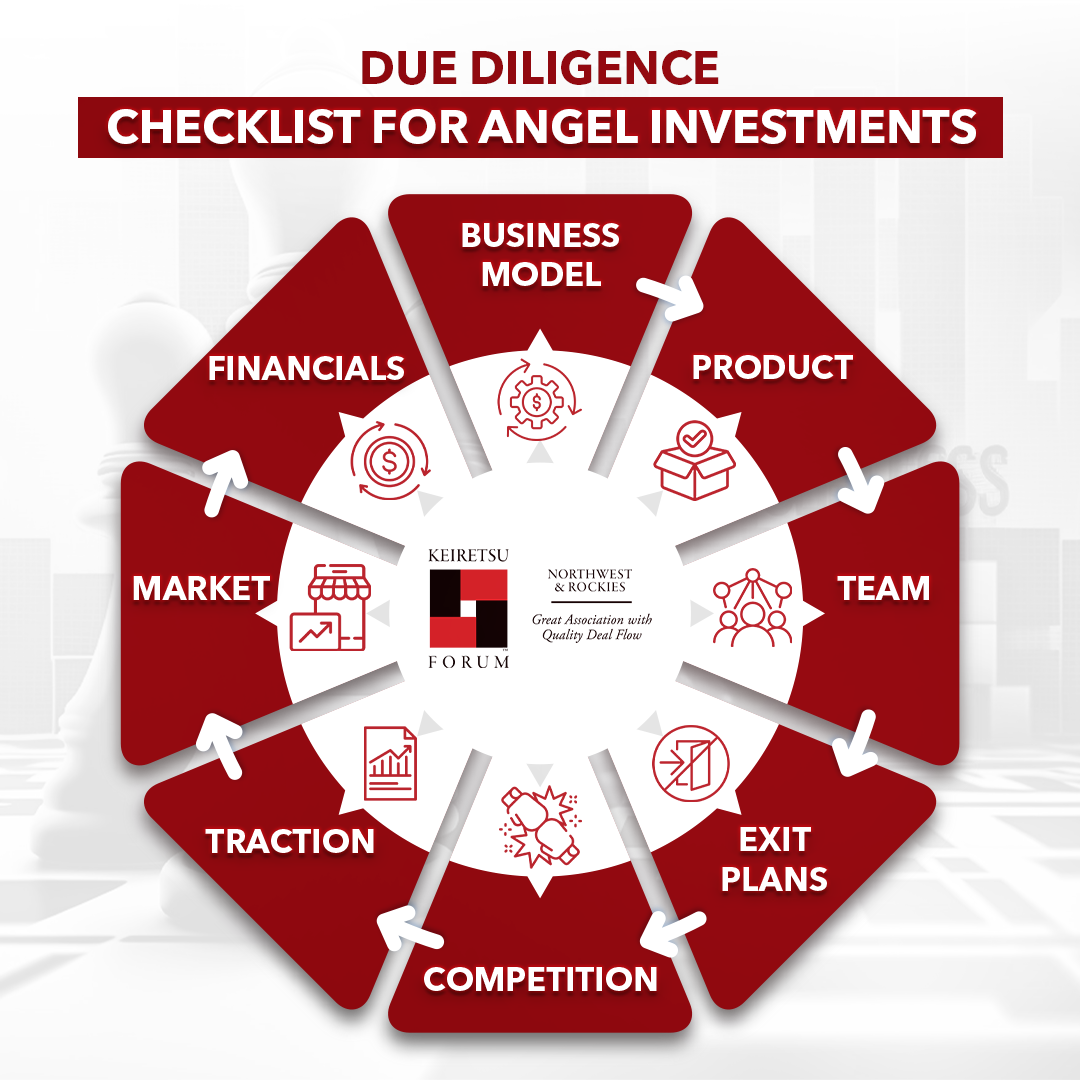

Startup Business Due Diligence Checklist: Areas to Explore

While due diligence should be tailored to each company, the following categories warrant investigation:

- Company Overview – How do founders describe the startup's purpose and business model? Is their presentation clear and credible? Assess the CEO's ability to inspire.

- Market Opportunity – Do claims around growth projections and demand drivers seem plausible? Evaluate the management team's understanding of the market, customers, and competition.

- Competition – Does the portrayal of competitive dynamics ring true? Is the startup's edge sustainable?

- Traction – What hard evidence indicates the progress made so far? Do metrics imply real momentum?

- Product – Does the current product demo inspire confidence in the team's abilities? Is the roadmap realistic?

- Team – What relevant talents and experience do the founders possess? Do background checks surface ethical red flags? Ensure the leadership team possesses the necessary skill set and experience or has plans to fill gaps.

- Exit – Understand the target exit plan, whether through acquisition or IPO and assess its feasibility.

- Growth Strategy – Thoroughly analyze the company's growth strategy, ensuring it is sustainable and well-calculated.

- Legal Checks – Investigate any past or pending legal actions, lawsuits, tax liabilities, or criminal convictions.

- Financials – Do spending, growth assumptions, and runway look prudent? Do the numbers add up? Scrutinize assumptions, avoid hand-waving, and ensure realistic cash flow timing and expense management.

- Governance – Will oversight mechanisms like the board provide adequate investor protections?

Angel investors play a pivotal role in fostering innovation, but success hinges on diligent investment practices. Proper due diligence is the armor against the inherent risks of not just the early-stage investment landscape but even the mega deals valued in billions. In a nutshell, angels should do due diligence now more than ever:

- Due diligence oversights are common: The rapid pace of tech, loose monetary policies, and FOMO lead to investors neglecting proper evaluation, sometimes with disastrous consequences (e.g., FTX, Theranos).

- Angel investors must do due diligence: Startup investments are inherently risky, and careful investigation helps validate claims, mitigate risks, and make informed decisions.

- Due diligence benefits both angels and startups: It enables accurate pricing, strengthens trust, and ensures that the best companies receive funding.

- Key areas to explore in due diligence: Assess company vision, market opportunity, competition, product, team, traction, potential exit, growth strategy, financials, governance, and legal aspects.

- Diligence practices can be tailored: Adapt your approach based on the specific company, but always be thorough and ask the right questions.

Sources:

https://blog.factright.com/ftx

https://investing1012dot0.substack.com/p/the-diligence-thats-due

https://www.angelinvestmentnetwork.net/startup-due-diligence/

https://www.fool.com/terms/d/due-diligence/

https://www.smartsheet.com/due-diligence-guide#:~:text=A%20Brief%20History%20of%20Due,an%20informed%20decision%20before%20buying.