The Keiretsu Forum Northwest & Rockies Roadshow offers investors the opportunity to hear a selection of presentations from top emerging startups across multiple industries, as well as the latest news from past presenter companies. The topic for March was Term Sheets & Cap Tables and we brought together thought leaders like Mike Volker, Rob Tucci, Karen Howlett, and Mark Girouard to deliver keynote speeches at the virtual event. We try to provide investors with best practices using their knowledge and expertise on the subject.

Joining us for our first forum meeting in Vancouver was Mike Volker, CEO of WUTIF (Western University Technology Innovation Fund), an entrepreneurial angel fund, and president of the Vancouver Angel Network, VANTEC, and Keiretsu Forum Vancouver Chapter. In his keynote, he offered his insights on how investors can protect their investments. We walk you through the key takeaways of his presentation, especially common challenges investors face and suggestions on how to mitigate them.

WHAT CONSTITUTES A TERM SHEET?

According to Mike, whether it's a pre-seed, late-stage, or a Series-A round, the key components of a Term Sheet are securities, valuation (pre-or post-stage), Shareholder Agreement(s) (SHAG), amount, board & governance, legal compliance, rights, restrictions, vesting and CAP tables. Each Term Sheet must include a fully diluted CAP table with options. In the past, when it came to issuing securities, the preferred choice of shares was common shares, but more recently, especially in the U.S., there has been a shift to other classes of Preferred Shares. Other forms of securities offered also include SAFEs, debt instruments such as notes and debentures, and other than Common Shares; all of these instruments are convertible into Common Shares. This is an important factor when planning an exit.

THE DECLINING SECURITY OF SAFEs

Background

SAFE stands for "Simple Agreement for Future Equity" and was created and issued as a simple replacement for convertible bonds. In practice, SAFEs allow startups and investors to achieve the same overarching goals as convertible bonds, although SAFEs are not debt instruments.

The Challenge for Investors

SAFEs offer little benefit to investors, they offer no ownership, no rights, and are fraught with a lot of uncertainty.

Entrepreneurs, on the other hand, benefit from SAFEs because they avoid the valuation question, act as money savers because they don't have to issue many special classes of shares, and can defer legal fees. There are some precautions in using SAFEs, and the SEC and FINRA caution investors against using SAFEs.

Proposed Solution

Safety: Simple Agreement for Future Equity with Shares Today. This is a simple arrangement for future equity, done by issuing shares.

- Instead of a SAFE, issue common shares priced at valuation CAP

- Include a term (in a subscription agreement) to allow conversion to a new class

Result

Using this method, when Common Shares are issued, they include provisions in your standard subscription agreement that allows the conversion of what the investor buys and saves the Common Shares to convert those into the new class of shares. This provides investors with safety in the form of common or preferred shares and they enjoy all the rights and securities as shareholders.

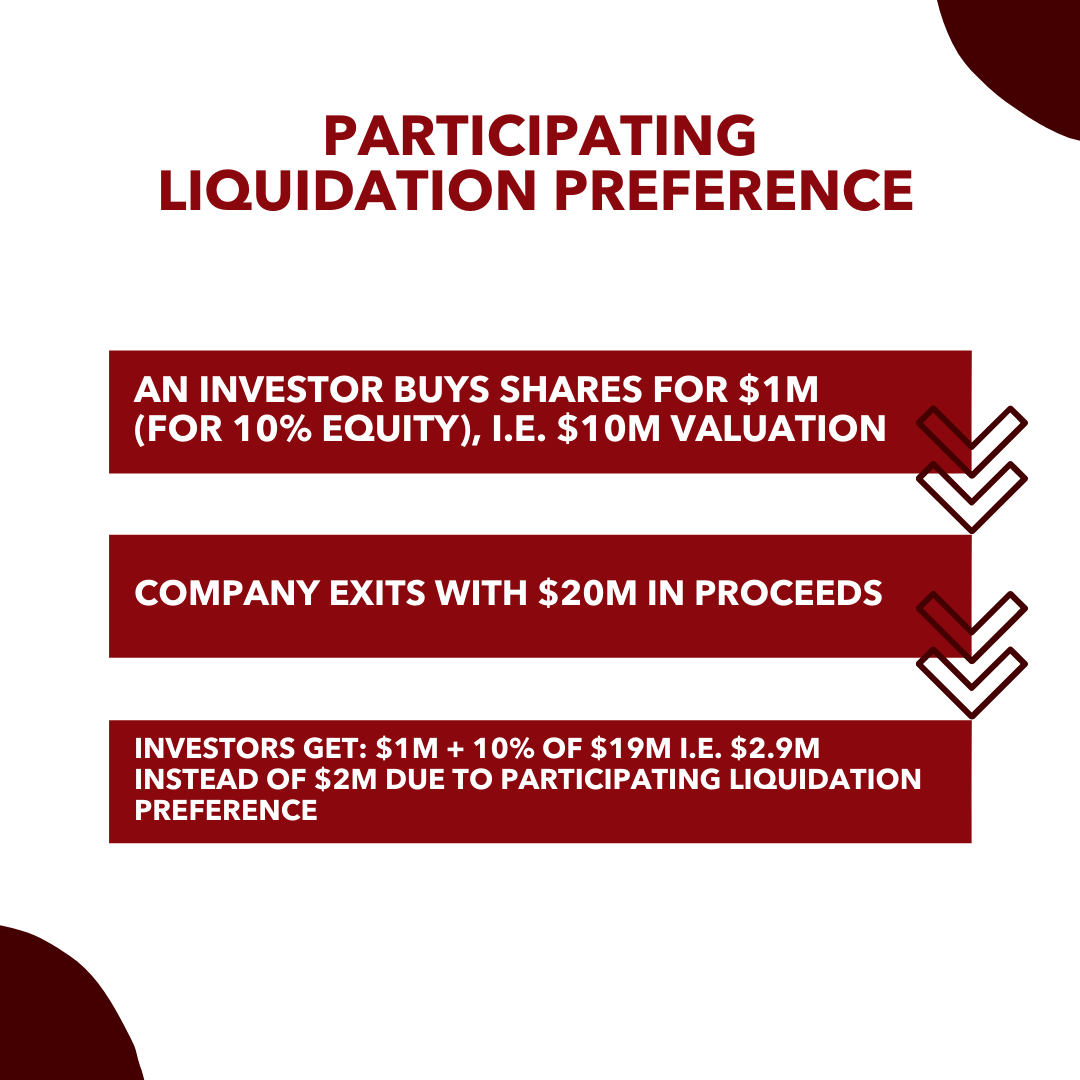

WHY SHOULD AN INVESTOR CHOOSE LIQUIDATION PREFERENCE?

Through his keynote, Mike continues to highlight the importance of Liquidation Preference over common or preferred shares. He states that it plays an important role during the time of exit as investors get their capital back and then participate in the remaining cash balance on an as-if-converted basis. This helps reduce high valuations by increasing the IRR potential. In the event of an exit, investors who have a liquidation preference get their invested capital back and the rest is distributed to the remaining investors. Mike provides us with real-world examples of WUTIF investing in 3 different companies, all with different outcomes. The purpose of these examples is to give investors an idea of when Liquidity Preference may or may not be a good strategy.

EXAMPLES:

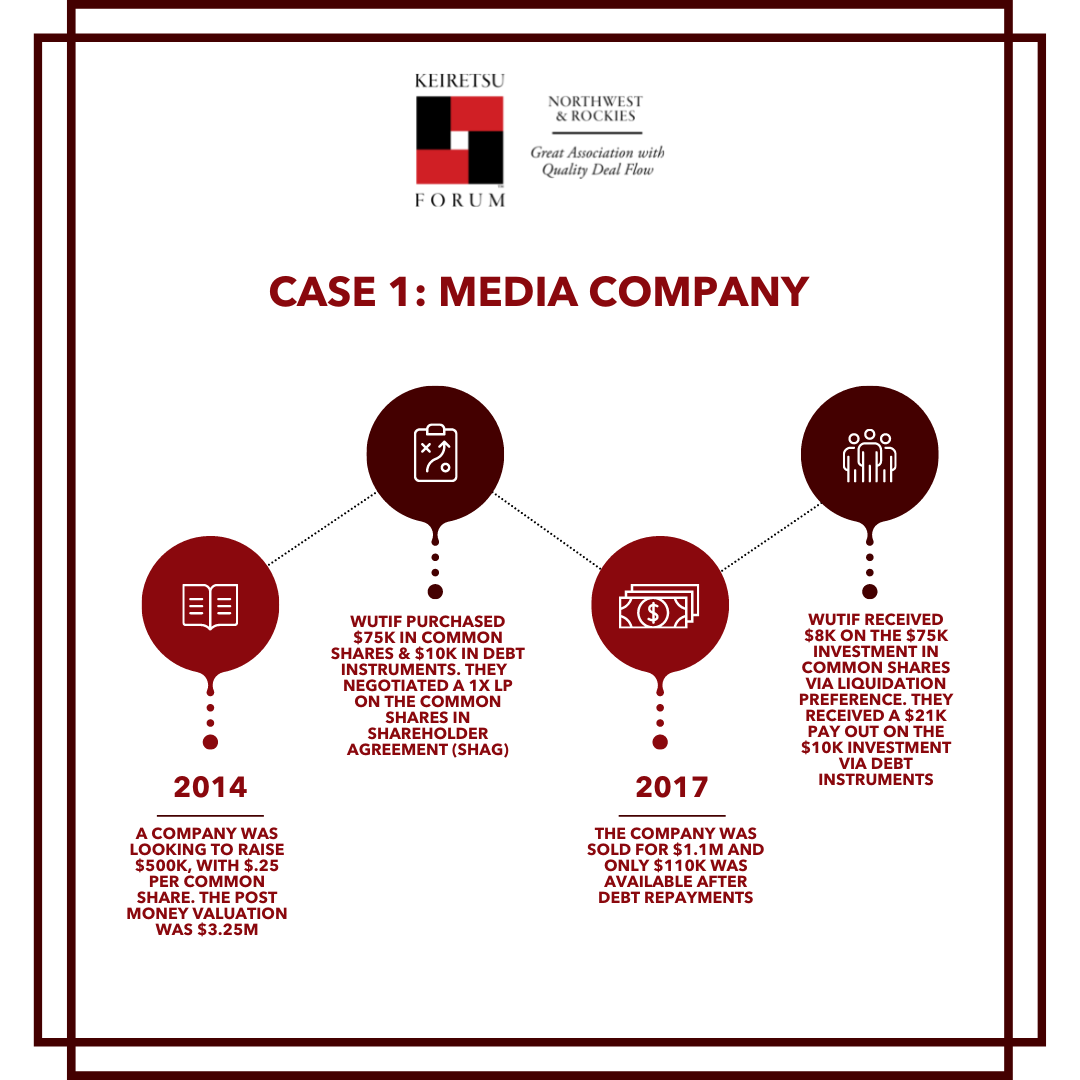

Case 1: In 2014, a Media Company was looking to raise $500K with a post-money valuation of $3.25M. WUTIF purchased $75K in Common Shares and negotiated a 1X Participating Liquidation Preference on Common Shares. This right was covered in the Shareholders Agreement (SHAG) and approved by all Shareholders. In 2017, the company was sold for only $1.12M, and after repaying all the company debts $110K was available to distribute amongst the Investors. WUTIF received $8K in proceeds due to liquidation preference. WUTIF had also invested $10K in debt instruments which gave them a pay-out of $21K. In an alternative scenario, if WUTIF had invested their initial amount of $75K in debt instruments instead of equity, they would have received a payout of $41K.

Lessons Learned: A liquidation preference offers recovery when the company does not achieve projected profits; it is a better option than investing more in equity or purchasing preferred shares. It's also better to invest in debt instruments, especially when the company's financial outlook doesn't look promising.

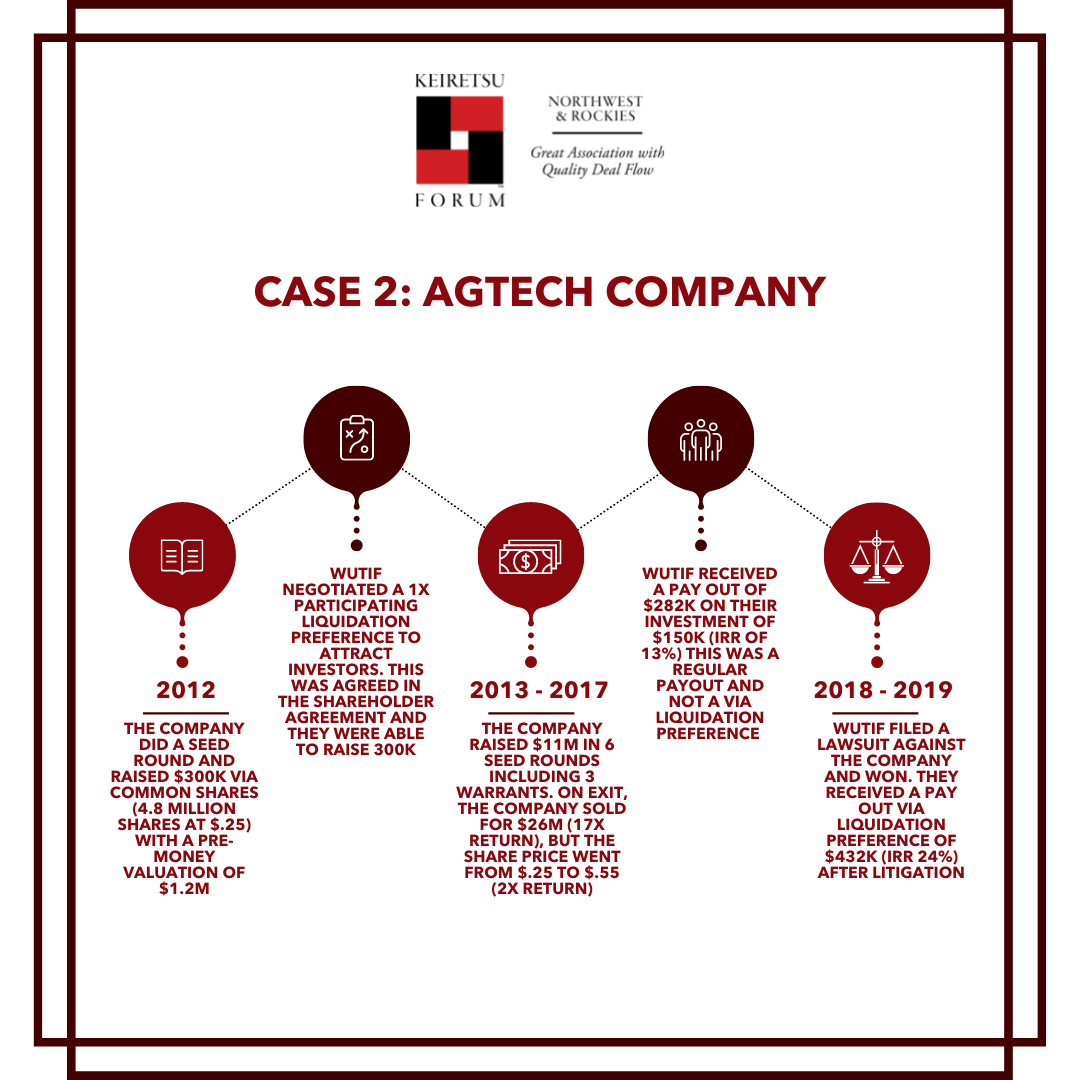

Case 2: In 2012, an Agtech Company did a seed round with a pre-money valuation of $1.2M and it raised $300K via Common Shares. Since the company was having difficulty in raising funds, WUTIF negotiated a 1X Participating Liquidation Preference to attract investors and thus $300K. From 2013 to 2017, the company raised $11M in 6 seed rounds. They also exercised warrants during these seed rounds by lowering the price of the warrants originally offered to attract investors who could exercise them before their expiration date. On exit, the company was sold for $26M, which was a 17X return based on the original valuation of $1.2M. However, the share price only saw a 2X return. The investors only got a 2X return on investment. WUTIF received $282K on their investment of $150K by way of regular payout. Their special right for Liquidation Preference was not honored by the company. WUTIF filed a lawsuit against the company and won, after which their right to Liquidation Preference was honored and they received a payout of $432K.

Lessons Learned: As an investor, be careful when including special clauses in shareholder agreements, they are only agreements that can be easily broken. The only way to enforce a shareholder agreement is through litigation. In this case, having preferred shares would be better than adding special clauses.

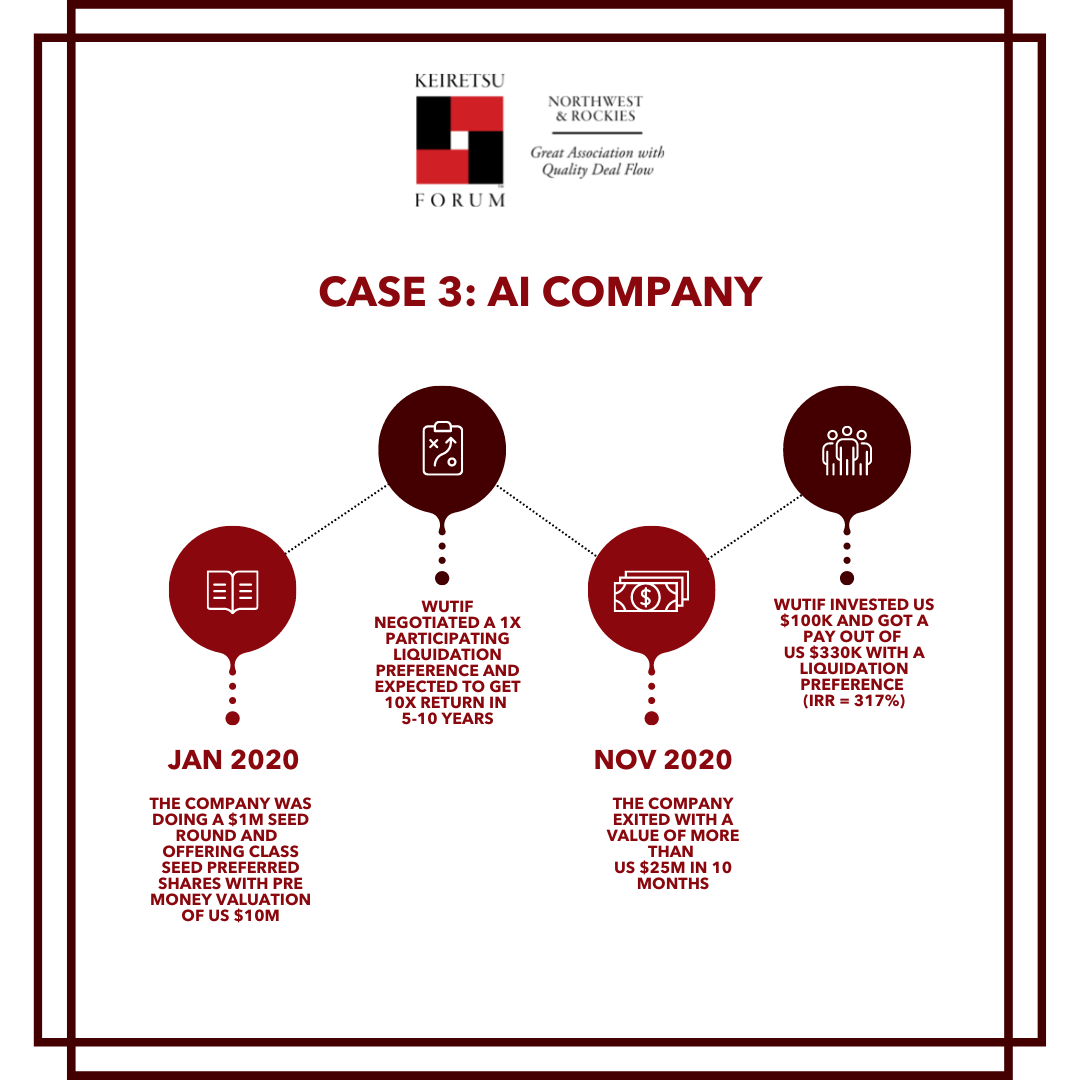

Case 3: In 2020, an AI company did a seed round for $1M with a pre-money valuation of US $10M and was offering Class Seed Preferred Shares. WUTIF negotiated a 1X Participating Liquidation Preference with the expectation of a 10X exit in 5 to 10 years. The company exited 10 months later with an exit value of a little more than US $25M. WUTIF received US $330K on their investment of US $100K by way of Liquidation Preference.

Lessons Learned: In this case, with a large payout, the cost to shareholders is minimal. Participating LPs moderated the high valuations and the company was able to raise the necessary capital. A 2x return in 1 year is better than a 10x return in 5 years.

INVESTOR TO-DO LIST

Mike states that you must always put your interests first. Keep this in mind the next time you invest, negotiate a term sheet, or plan an exit. Instead of chasing 10x returns all the time, investors should start thinking more about IRR than multiples. As an investor, it's time to become vary of SAFEs, or even better avoid them altogether. The easiest way to mitigate high valuations is to opt for liquidation preferences, warrants, and sweeteners. Last but not least, please be aware of legal documents, they are not binding and do not guarantee the expected results.

ABOUT THE SPEAKER

Michael ‘Mike’ Volker is an Entrepreneur active in the development of new high technology ventures. A University of Waterloo Engineering grad, Mike started his own company (Volker-Craig Ltd) in 1973. After selling his company in 1981 he decided to work with entrepreneurs in building new companies. Recently he directed Simon Fraser University's Innovation Office. Presently, he is chairman of TIMIA Capital, [TCA.V] a public company that invests in young growth companies. He is CEO of WUTIF - the Western Universities Technology Innovation Fund - an "angel" fund for startups. Mike is President of the Vancouver Angel Network, VANTEC, and the Vancouver chapter of Keiretsu Forum. He's chairman of New Ventures BC - an annual business competition. Mike was chairman of the Vancouver Enterprise Forum for several years. Click here to watch his keynote address.