The investment process comes with many challenges and rewards. As an investor, it's up to you to overcome the challenges and reap the rewards, but how do you do it? One simple tactic that always helps is asking questions!

When it comes to investing, you don’t just need to ask questions, you need to ask the right questions. The questions that you ask during the due diligence process can give you an insight into the companies and teams that can help you make your final decision to invest in a company.

Norman Boone has compiled a list of questions every investor should ask themselves and entrepreneurs before investing. He is an experienced leader, entrepreneur, long-term angel investor, and member of the Keiretsu Forum NorCal region. He gave the keynote address at the Denver/Boulder chapter meeting at our May 2022 Roadshow.

Whether you're investing for the first time or have been investing for years, here are some key questions Norman asks himself and the entrepreneur during due diligence and before writing a check.

The most important Question Investors need to ask themselves! (With examples!)

Do you have space in your allocation?

If you plan to invest in a new business, it is important that you have sufficient funds allocated for the investment.

Do you love the product idea?

Does it appeal to you? Do you find it practical? If the answer to both of these questions is no, you need to reconsider your investment decision. Norman explained that Northern California-based Earth Grid is working on underground tunnels almost as large as roadways, and he thinks they will eventually work with power lines, water lines, and more. This is a global opportunity as their competitor in the region PG&E (power company) has had major problems with fires on overhead power lines. Investing in the company could be a great opportunity to create more beauty and less harm to the environment.

What is the quality of management and the board?

Most fledgling companies probably don't have a board of directors at this stage of their growth. Norman went on to say that if the company has a board of directors, you need to look at how involved they are. Also, the quality of the team such as management, entrepreneurs, and core decision-makers. Norman cites the company Epilogue Systems as an example. When he joined Epilogue Systems as part of the due diligence team, he appreciated CEO Mike Graham's ability to act on recommendations and his willingness to accept feedback.

Is there an exit plan?

No sane investor wants to lose money on an investment. Therefore, it is important to assess whether the company has a clear plan and path towards an exit.

Is the Term Sheet fair?

The Term Sheet is an essential document that contains all investment terms. As an investor, it is important to understand the details of the Term Sheet and the financial terms contained within. It is necessary to read the Term Sheet frequently to ensure that you are getting the best deal from your investment. To make money from a company, it is imperative to understand the Term Sheet.

Operational Efficiency

Norman went on to ask, does the business model make sense for you? Can it be scaled? With the current business model, will the company deliver on its promises? Or do they need to change their operating structure as they grow? The more effective the business model, the more likely it is to succeed in the future.

Is the market ready for this innovation?

The market plays a significant role in the success of a company. As an investor, you want to know if this company is an attractive investment. You want to know if there is a large market for the product or service you are investing in and if that market is ready for innovation. Example: Turn Technologies is one of the companies that Norman believes has great technology and a way to connect gig workers with employers.

Competitive Landscape

Competitive landscape analysis is a proactive way to understand how a company competes with its competitors. By leveraging on its strengths, the company can make up the ground between itself and its competitors.

Do the economics/financials make sense?

Understanding the numbers in a company's financial statements is a vital skill for investors. Meaningful interpretation and analysis of balance sheets, profit, and loss statements, and cash flow statements to identify a company's investment quality is fundamental to making informed decisions.

The impact of technology

A company's technology is critical to its success. Norman gives another example of Epilogue Systems. In his experience, their technology overwhelmed unicorn-sized competitors. He loves their management and their technology, what they do and how it makes them useful.

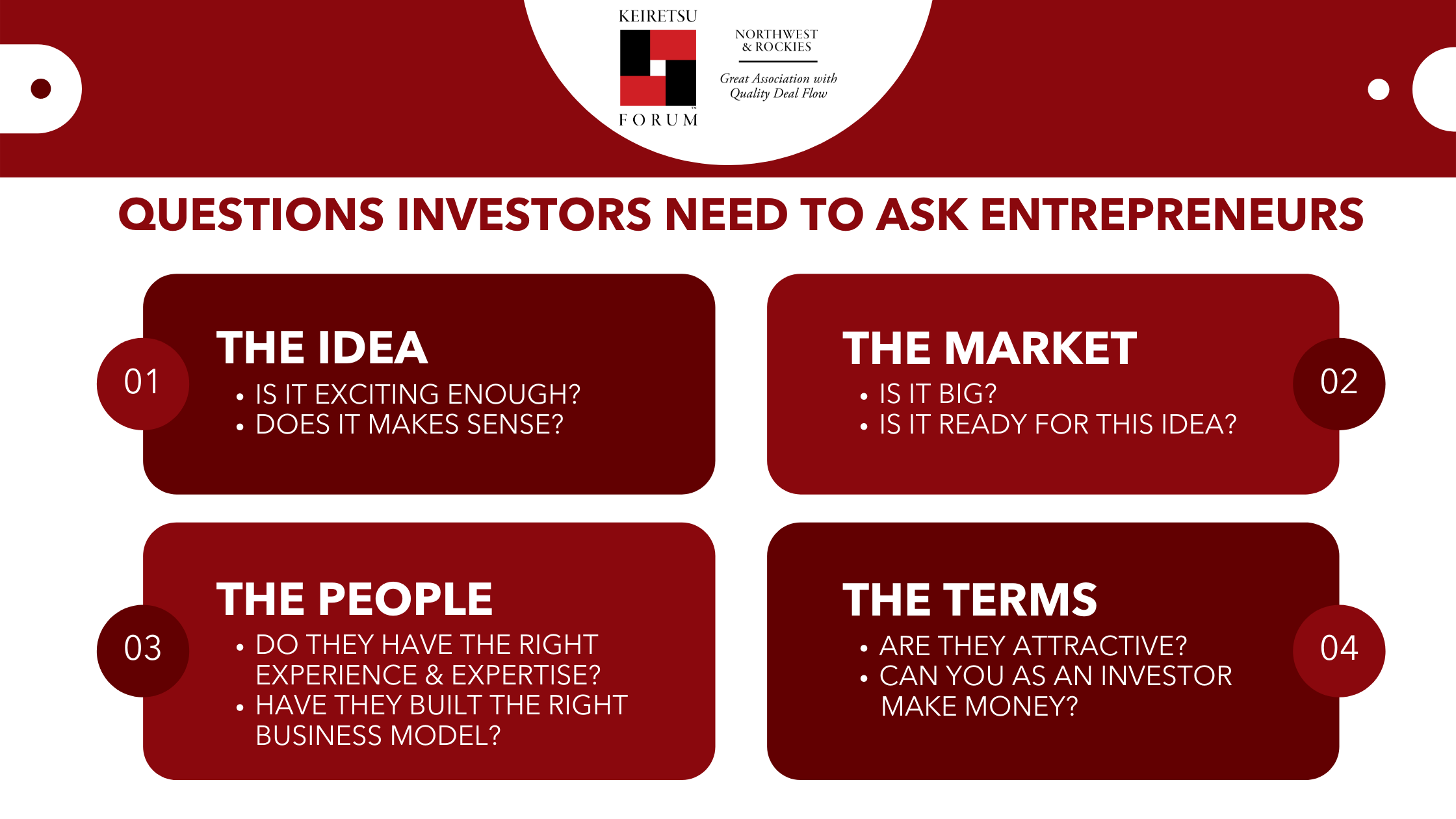

Here are Questions Investors Need to Ask Entrepreneurs

The infographic below summarizes 4 key areas where questions can be asked.

Questions Investors need to ask themselves before finally writing a check

Even if investors like a company, there are a few other factors to consider before closing a deal.

- Is there room in your allocation?

- Have your questions been answered in a way that makes you feel comfortable?

- Will it help you build diversity in assets?

- Are you passionate about this company and its people?

- Will this affect your decision to proceed and the investment amount?

Final advice for all investors

Norman recalls the advice given to him by Keiretsu Forum founder Randy Williams when he joined Keiretsu Forum.

- Don’t invest in your first year – use it to learn;

- Attend as many sessions and deep dives as you can;

- Do at least 1, preferably 2 due diligence projects;

- Seek insights from more experienced people in Keiretsu;

At the end of the day, what matters to Norman is the big picture, does the company have a real possibility of becoming successful? What are the obstacles and how do they get around them? Does the company have a clear vision of what it wants to achieve? As a longtime financial advisor, Norman explained that you can only invest in what you can afford to lose. As an investor, you need to be careful and ask the right questions every step of the way.

ABOUT THE SPEAKER

Norman Boone is an experienced leader and entrepreneur. He founded and successfully sold two companies - one a financial advisory firm and the other a software SaaS firm. He is a board member of many non-profit organizations, a university, and professional associations. He also authored a textbook for the financial services industry and a variety of articles and columns. He is currently retired and is focused on consumer fairness, scaling of successful non-profits, and consulting to non–profits, and is an active angel investor. Click here to watch his keynote address.