For years, early-stage investing celebrated the long game. Entrepreneurs were encouraged to “move fast and break things,” prioritize growth over revenue, and trust that capital would keep flowing. But the investment climate is shifting. Today, more and more angels are demanding that businesses demonstrate a clear path to revenue, often within 12–18 months.

This new “Revenue Rule” isn’t just a passing trend. The number of active US angel investors climbed to 63,000 in 2023 (up 8% year-over-year), with the average deal size rising to $420,000 (a 15% jump), clear evidence of a growing and intensifying market, but also of higher expectations placed on the leaders.

The push for early monetization is validated by market performance. Companies that demonstrated early revenue streams attracted 50% more funding from angels in 2023 compared to pre-revenue companies. The shift reflects deeper changes in the angel ecosystem and the realities of today’s capital markets—backed by data and investor reports.

Why the Revenue Rule Matters Now

The biggest reason is the current capital environment. The venture funding boom of the past decade has cooled, as higher interest rates, market corrections, and more cautious investors have made capital less abundant. The global angel investment market stood at $27.83 billion in 2024 and is projected to more than double by 2033, but this growth comes with increasing selectivity and discipline. Angels, often serving as the first source of outside funding, now need stronger assurances that companies won’t burn through cash without a clear monetization strategy.

This shift is also redefining how investors think about risk. Angel investing has always carried high failure rates, but the demand for a revenue pathway within 12–18 months introduces an additional safeguard. By focusing on companies that can move quickly from product-market fit to monetization, angels are effectively reducing reliance on uncertain follow-on rounds.

Institutional expectations also play a crucial role. As angel-backed companies progress to later funding stages, venture firms and private equity groups increasingly want to see tangible revenue. According to the Angel Capital Association’s 2025 Angel Funders Report, capital is concentrating at the earliest stages, and deal structures are evolving. Portfolio companies that show clear traction and early monetization pathways are outperforming those reliant solely on growth narratives. Angels who push for monetization early are not only protecting their own capital but also setting portfolio companies up for smoother fundraising down the road.

What Angels Are Looking For

When investors talk about a 12–18 month revenue pathway, they are not insisting on profitability from day one. Instead, they want to see that entrepreneurs understand how to translate vision into revenue and can demonstrate measurable traction within a defined window. Angels tend to prioritize businesses that can validate demand through paying pilots or subscription models, because these early signals of adoption reduce uncertainty.

Another marker is operational discipline. Investors are gravitating toward leaner companies that can reach early revenue milestones without consuming excessive capital. This naturally ties into clearer unit economics, where even small-scale revenue makes sense in terms of cost structure and margins. Beyond that, angels value companies with scalable sales strategies that can transform a handful of initial customers into repeatable, sustainable revenue growth.

The broader message is that you do not need ready-to-market products to attract angel support. Just show that there are plans to monetize the idea, which will generate decent traction.

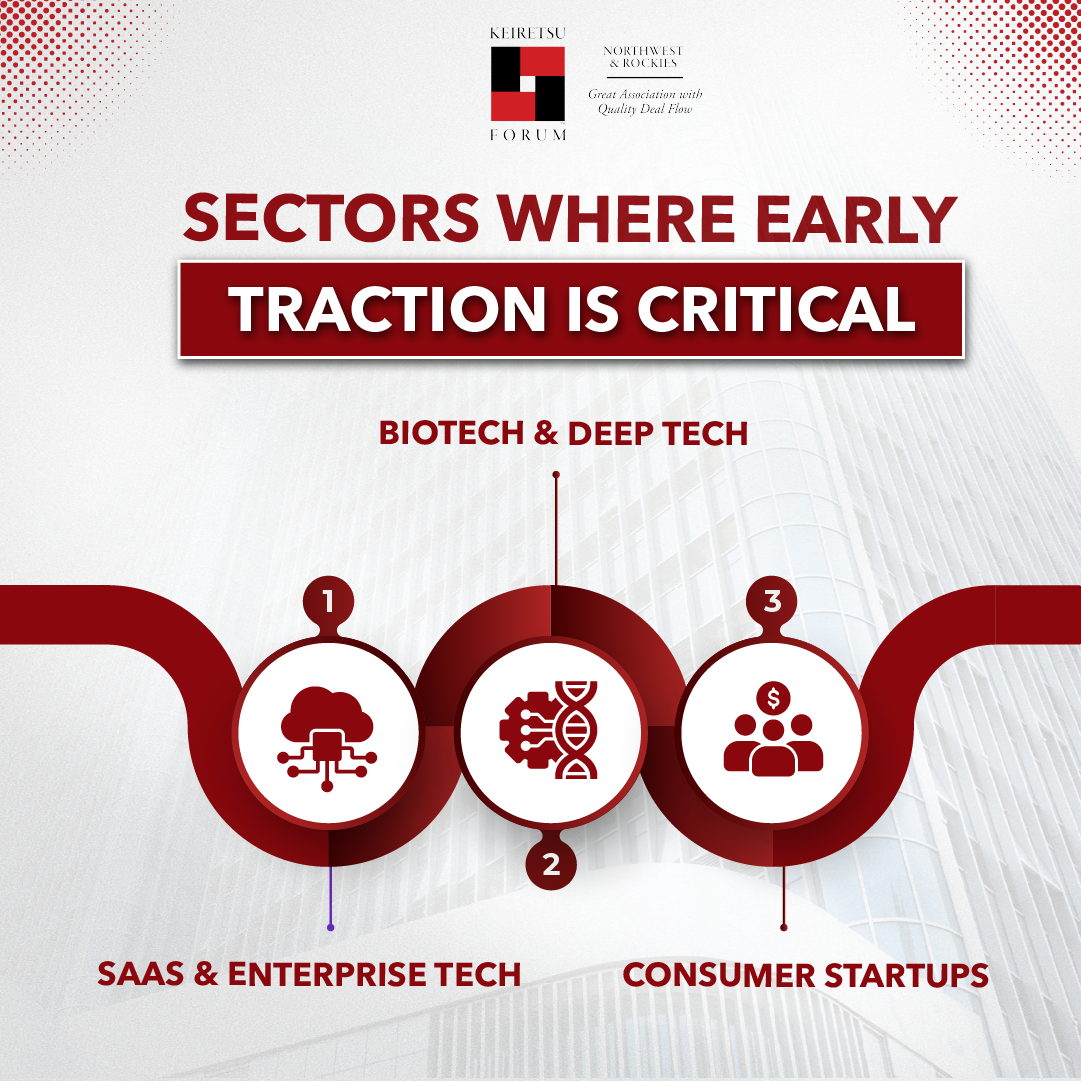

Sectors Where the Rule Hits Hardest

Not all industries can operate on the same timelines. Angels know this, but the appetite for early revenue is reshaping investment theses across sectors:

- SaaS & Enterprise Tech: Expected to secure early contracts or pilots quickly, even if enterprise sales cycles are long.

- Consumer Startups: Pressured to show traction through e-commerce sales, D2C channels, or early retail partnerships.

- Biotech & Deep Tech: The toughest case. Angels here often balance long R&D timelines with strategic partnerships, grants, or early licensing revenue to show momentum.

The key takeaway: even in capital-intensive fields, investors expect some pathway. Whether through non-dilutive funding, pilot deals, or hybrid revenue models.

What This Means for Entrepreneurs

For entrepreneurs, the 12–18-month revenue rule forces an early reckoning with business fundamentals. You can no longer rely solely on vision-driven storytelling in your pitches. You must outline specific revenue strategies, timelines for execution, and the necessary resources to make it happen. This raises the bar for fundraising presentations, where investors now look for evidence of monetization alongside innovation.

It also reshapes product development priorities. Features must align with paying use cases rather than just expanding user bases, meaning that customer willingness to pay becomes a guiding principle from the outset. At the same time, the emphasis on capital efficiency rewards entrepreneurs who can demonstrate progress without repeatedly tapping the market for new rounds. In practice, this means smaller, disciplined teams that stretch dollars further.

Ultimately, this discipline strengthens resilience. Ventures that establish early revenue streams are far better equipped to weather downturns and more attractive to future investors who increasingly seek proof of traction.

The Bigger Picture: A More Disciplined Ecosystem

Angel investing will always carry risk. But as markets evolve, so too must strategies. The 12–18 month revenue rule represents a pragmatic shift: a recognition that the fastest path to building great companies is often the one that proves commercial traction early.

For angels, the message is clear: back businesses that can make money sooner. For entrepreneurs, the challenge is equally clear: build companies that can show the world that people want your product and they’re willing to pay for it.

References:

https://coinlaw.io/angel-investor-statistics/

https://www.businessresearchinsights.com/market-reports/angel-investment-market-113487