“$16 million for a company without revenue? Are we back in 2021?”

If you’ve caught yourself thinking this lately, you’re not alone.

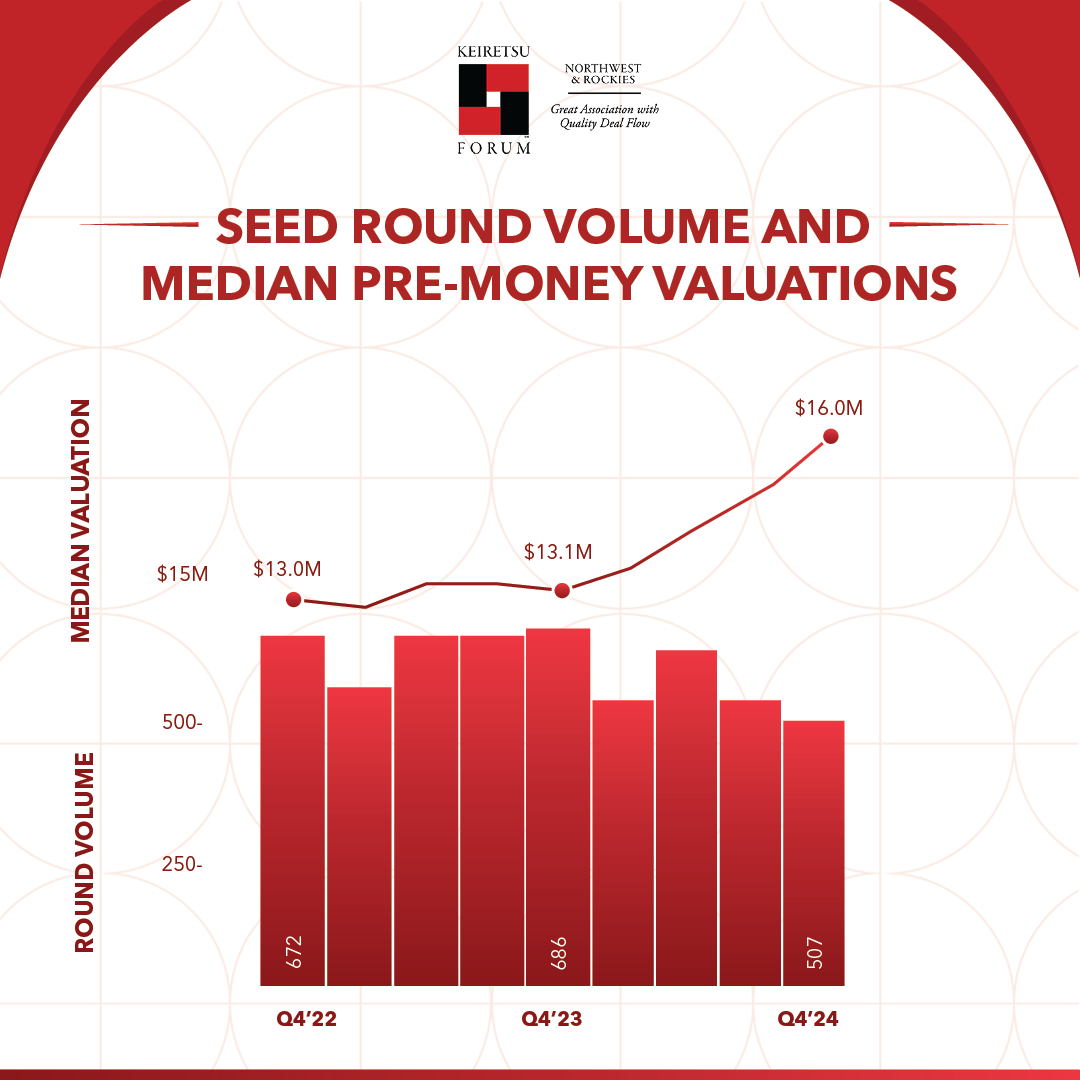

According to Carta’s State of Private Markets: Q4 and 2024, median pre-money valuations at the seed stage have hit an all-time high of $16 million in Q4 - the highest figure recorded since at least 2016. This includes both primary and bridge rounds. And no, you didn’t misread that. The startup market is heating up again, and seed rounds are starting to look a lot like Series A from just a few years ago.

But what’s driving this spike? And more importantly, how should you be thinking about this as an angel investor?

Let’s break it down.

The Rise of Seed-Stage Competition

Seed investments were scrappy just a few years ago. All entrepreneurs had was a slide deck, maybe a beta product, and a few angel checks to keep the lights on. But that image is evolving.

With venture firms moving earlier, micro-VCs multiplying, and syndicates swarming the best deals, competition at the seed stage has never been more intense. Everyone wants in before the price jumps, and that urgency is inflating valuations.

What used to be a $6–8M seed round is now commanding double that, especially if the founding team checks all the right boxes: prior exits, strong technical background, or early traction.

For angels, this trend presents both an opportunity and a dilemma.

The Double-Edged Sword of Higher Valuations

Let’s be honest, no one likes overpaying.

A $16M pre-money on companies still in early product development can feel steep. Your ownership gets diluted, and the pressure on future growth multiples increases. If the company ends up raising a flat or down round later, that entry point could sting.

But here’s the other side of the coin: higher valuations signal market confidence.

If top-tier entrepreneurs are raising at a premium and investors are still chasing the round, it’s worth asking why. Sometimes, valuation isn’t just about numbers. The company might be solving a critical problem, attracting elite talent, or operating in a sector with massive upside.

The key is knowing when it’s worth the premium and when it’s not.

So… Are We in a Bubble?

It’s tempting to draw comparisons to the circumstances of 2021, but this uptick feels more strategic than speculative.

Companies are being built faster, leaner, and with more technical sophistication than ever before. AI-native companies, for instance, can ship MVPs in weeks and attract enterprise interest just as fast. The bar has been raised, and the best businesses are delivering.

In many ways, investors are willing to pay more because the winners are pulling away from the pack earlier. The market is starting to distinguish between “cool idea” and “fundable company” much sooner.

So no, this isn’t all smoke and no show. This time, you may hit gold.

How You Can Navigate This Landscape

If you’re an angel investor, here’s how to stay smart in a high-valuation world:

- Double down on diligence – At higher valuations, risk tolerance needs to be matched with real signal. Is the team exceptional? Do they have unique insight into the problem? Are early customers begging for the product?

- Look for co-investor quality – Who else is in the round? Top-tier seed funds or experienced angels are often a good sign that the round’s pricing isn’t just hot air.

- Negotiate pro-rata rights – If the company takes off, you’ll want the chance to maintain or increase your stake. Protect your upside.

- Be sector-savvy – Some sectors warrant higher valuations than others. For instance, AI infrastructure or B2B SaaS with strong early metrics might justify a $16M pre-money valuation. A consumer app with no retention? Maybe not.

The Bottom Line

The seed stage isn’t cheap anymore. But that doesn’t mean it’s not worth it.

Yes, $16M pre-money valuations raise eyebrows. But in a world where speed, talent, and tech advantages compound early, missing out on the next breakout company could cost far more than a few extra points on the cap table.

As the early-stage game gets more competitive, your edge will come from being disciplined, not defensive.

So ask yourself: Is this team solving a problem that matters, and are they the best ones to do it?

If the answer’s yes, lean in. Because in today’s market, access is everything.