Many forecasted a slowdown in venture capital flowing into AI at the start of the year. Crunchbase says January saw less than $2.2 billion invested in AI startups, in contrast to the $50 billion-plus poured into the sector throughout 2023. February painted a different picture with a few major deals announced.

The AI investment landscape is dynamic, to say the least. While temporary fluctuations and corrections are inevitable, the potential of AI continues to captivate investors, driving a sustained influx of capital into the sector. However, jumping on the AI bandwagon is still a risk – investors need a nuanced understanding and a strategic approach to capitalize on its full potential.

In this guide, we'll unveil expert insights on the AI investment outlook from our panel discussion at the Investor Capital Expo 2023, explore niche opportunities, and equip you with a few insights to separate hype from reality. So buckle up as we analyze investing in AI!

The AI Paradigm Shift: A Historical Perspective

From the integration of AI in cars, social media, and finance to the personalized product recommendations that shape our retail experiences, the impact of AI is becoming pervasive by the day. A vital part of the revolution is machine learning, a powerful subfield that imbues systems with the ability to learn, adapt, and improve autonomously.

Consider Netflix recommendations. The streaming company leverages AI to deliver personalized content. By ingesting vast troves of user data in quick time, algorithms can identify patterns and extract insights that enable predictions. But we're just scratching the surface of AI's potential. A survey of over 350 AI researchers projects that by 2060, AI capabilities will surpass human performance across numerous tasks (like writing a bestseller and performing surgeries).

The numbers are staggering: Global AI revenue could swell to $900 billion by 2026. The BofA Securities report with this data point goes on to note:

"Technologies such as AI, chatbots, robot process automation (RPA) in white-collar roles, and industrial robots in blue-collar jobs – all of which we estimate could displace 2 billion jobs by 2030. Up to 47% of U.S. jobs could impacted by computerization as less time is spent on routine and manual tasks that require time in training and education."

As AI makes its home within our lives, navigating this rapidly evolving technological terrain demands a keen appreciation for fundamental drivers and market forces.

Amid the frenzy, a balanced perspective remains crucial.

New technologies often experience gradual adoption curves, with economic impacts unfolding slowly. As such, investors must view the projections through a wider market lens to guide informed decision-making, not blind speculation. To truly grasp the investment landscape, we must first understand the pivotal shift that propelled AI into the mainstream. At our Investor Capital Expo 2023, we invited guests working at the frontlines of AI to discuss their outlook. Here are some extracts:

Paradigm Shifts

Panelist Armando Viteri CEO of Neubloc, kicked the panel discussion off, providing historical context to the AI boom. According to him, the paradigm shift occurred around 2017 when the groundbreaking "Attention is All You Need" paper was published. This seminal work introduced a fundamentally different approach to AI, paving the way for the emergence of foundational models like ChatGPT.

While tech giants and industry incumbents are heavily investing in AI infrastructure, Armando says that the true opportunities for startups might lie in niche markets and specialized services. He emphasized the limitations of commoditized infrastructure plays around generative AI, suggesting that these opportunities are relatively scarce.

Instead, Armando identified other areas of potential for AI:

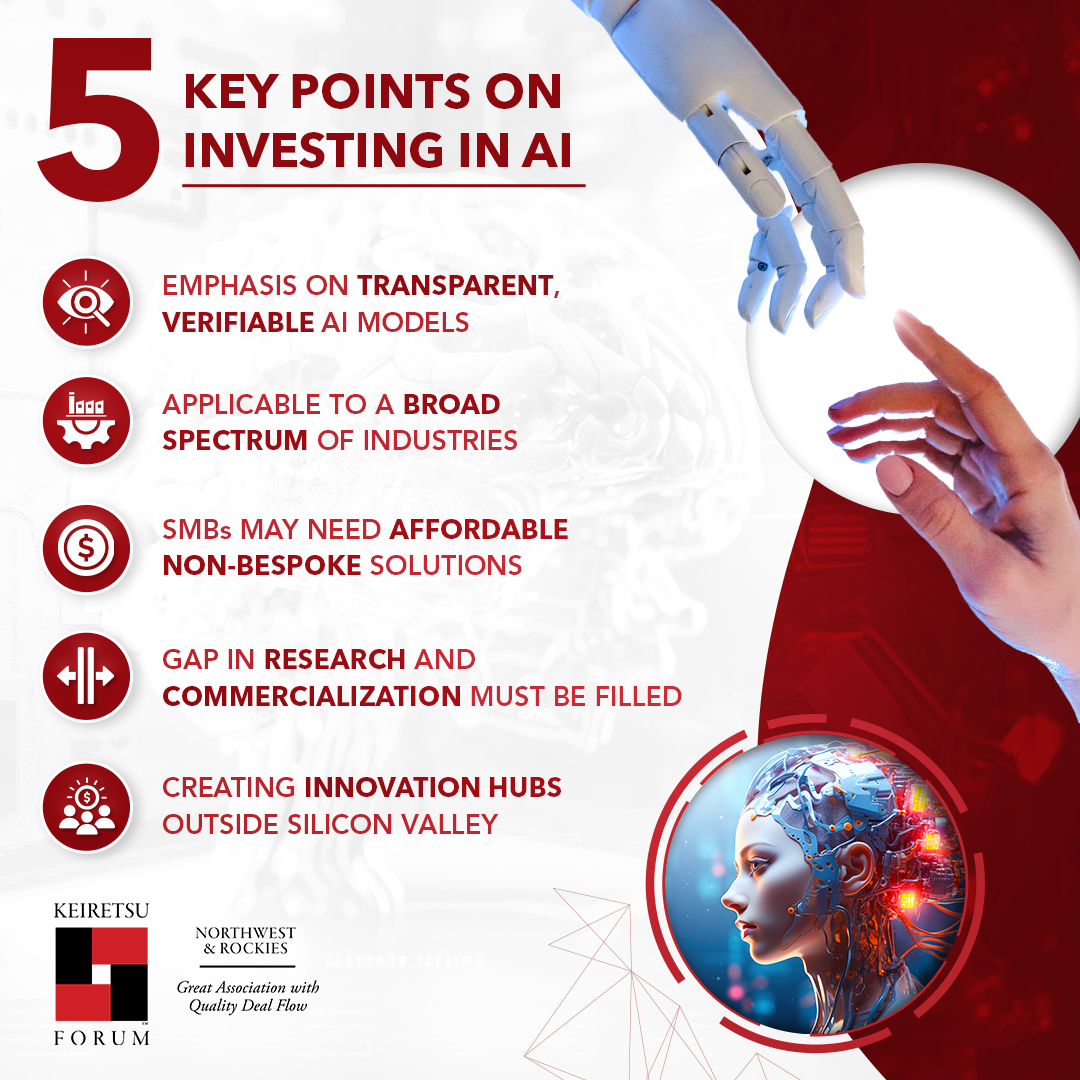

1. Small and Medium-sized Businesses (SMBs): SMBs often lack the resources to develop bespoke AI solutions. Vertical market AI suppliers can seize this opportunity by offering tailored solutions through Software as a Service (SaaS) models. By amortizing the cost across a broad customer base, these suppliers can provide AI capabilities that would otherwise be unattainable for SMBs, creating a win-win scenario for both parties.

2. Point Solutions in Specific Industries: Investing in point solutions tailored to address niche challenges within particular sectors, such as biology or healthcare, presents viable opportunities. These focused AI applications can deliver significant impact by addressing industry-specific pain points, creating value for stakeholders, and generating attractive returns for investors.

Our panel discussion then moved on to opportunities and areas of concern in the sciences.

Bridging the Gap: From Commercializing to Inclusivity

Melanie Salvador, Executive Board Member of Singularity Ecosystem Venture Fund, then shed light on a critical challenge: the disconnect between brilliant scientists and the commercialization of their innovations, adding,

“The issue is some of the greatest scientists in the world are creating products [and] we have no idea what they're building. They're building something spectacular – way larger than ChatGPT. And they have no idea how to commercialize the product.”

In other words, while groundbreaking AI products are being developed, many scientists lack the expertise to bring these innovations to the global market. This strategic approach acknowledges that scientific brilliance alone is not enough; it must be paired with business acumen and capital to thrive in the competitive AI landscape.

Researcher and AI expert S. Chakra Chennubhotla shed light on the unique considerations and requirements for AI solutions in areas like clinical trial optimization, drug discovery, and companion diagnostics. Chakra emphasized transparency and verifiability in AI models within the life sciences industry. Stakeholders in this field are rightfully wary of "black box" approaches, as the implications of AI decisions can have far-reaching consequences for human health and wellbeing.

Ensuring that AI models can verify known biological truths and contribute to improving entire workflows, rather than isolated components, is crucial for gaining acceptance and adoption. Furthermore, Chakra underscored the significance of scientific review, peer validation, and funding from reputable institutions like the National Institutes of Health for AI innovations to gain credibility in the life sciences arena. Well, while market-ready innovation and niche opportunities matter, so does inclusivity.

Our next panelist, Adrian Mendoza, an entrepreneur-turned-investor, shared insights into initiatives aimed at fostering a diverse and inclusive AI ecosystem. Adrian focuses on supporting diverse-led early-stage startups in fintech, AI, and cybersecurity. By providing access to tools, mentorship, and domain expertise, these initiatives strive to democratize innovation and create new hubs of entrepreneurship beyond traditional tech hotspots.

He went on to emphasize the necessity of encouraging innovation across various communities, recognizing that the next generation of AI companies may emerge from unexpected pockets of talent. By embracing diversity and promoting inclusive investing, investors can tap into a broader pool of innovative ideas and perspectives, driving the growth of the AI ecosystem and unlocking untapped potential.

Moving on, we come to the final part of the blog. Due diligence for AI!

Diligence in AI Investments

As the AI hype cycle continues to gain momentum, our expert panelists offered valuable insights on due diligence strategies to separate genuine opportunities from mere hype. Armando cautioned that many of these early AI companies focused on productivity tools might not survive market dynamics. He emphasized the importance of real-world impact and sustainable business models, suggesting that investors should seek out AI solutions that address tangible problems and create value across diverse sectors, rather than chasing fleeting trends or hype-driven ventures.

Armando spoke about the limited number of knowledgeable AI developers globally, which can lead software companies to overstate their internal AI capabilities. Thorough diligence regarding a company's true AI expertise is essential to avoid falling prey to exaggerated claims.

Finally, Adrian lamented the "garbage in, garbage out," phenomenon — stressing the fundamental importance of data quality and quantity for AI algorithms to function effectively. As he put it bluntly, “If you have no data, your algorithms are worthless. Remember, in order to create statistical significance, you need to have 10,000 data points for every signal.”

He emphasized the need for substantial data points to achieve statistical significance, citing the example of ChatGPT's limitations in generating accurate citations due to insufficient data. By aligning investments with AI solutions that demonstrate measurable impact and long-term viability, investors can mitigate risks and position themselves for enduring success in a rapidly evolving market.

In summary, here are our key takeaways from the blog:

1. Embrace Niche Opportunities: While AI infrastructure plays might be dominated by tech giants, niche markets and specialized solutions present lucrative opportunities for startups and savvy investors alike. Tailored offerings for SMBs and point solutions addressing industry-specific challenges can unlock substantial value.

2. Prioritize Transparency and Verifiability: In sensitive sectors like life sciences, transparency and the ability to verify the rationale behind AI models' decisions are crucial for gaining trust and adoption. Investments in AI innovations that prioritize these principles are better positioned for long-term success.

3. Foster Diversity and Inclusive Investing: By supporting diverse-led startups and promoting inclusivity, investors can tap into a broader pool of innovative ideas and perspectives, driving the growth of the AI ecosystem and unlocking untapped potential.

4. Conduct Rigorous Due Diligence: Separate hype from reality by assessing fundamental business metrics, true AI expertise, data quality and quantity, and alignment with established investment theses. Avoid falling prey to exaggerated claims and focus on real-world impact and sustainable business models.

Sources:

AI Investment Outlook Panel Discussion, Investor Capital Expo 2023

https://business.bofa.com/en-us/content/ai-trends-impact-report.html

https://arxiv.org/pdf/1705.08807.pdf

https://news.crunchbase.com/ai/startup-venture-funding-february-2024-moonshot/

https://www.linqto.com/blog/how-to-invest-in-artificial-intelligence/