Heading

En

Goal

At Keiretsu Forum Northwest & Rockies, we take pride in our thorough due diligence process, designed to support both investors and entrepreneurs in achieving their goals. Our objective is to evaluate the full potential of each company, providing investors with a structured approach to make informed decisions.

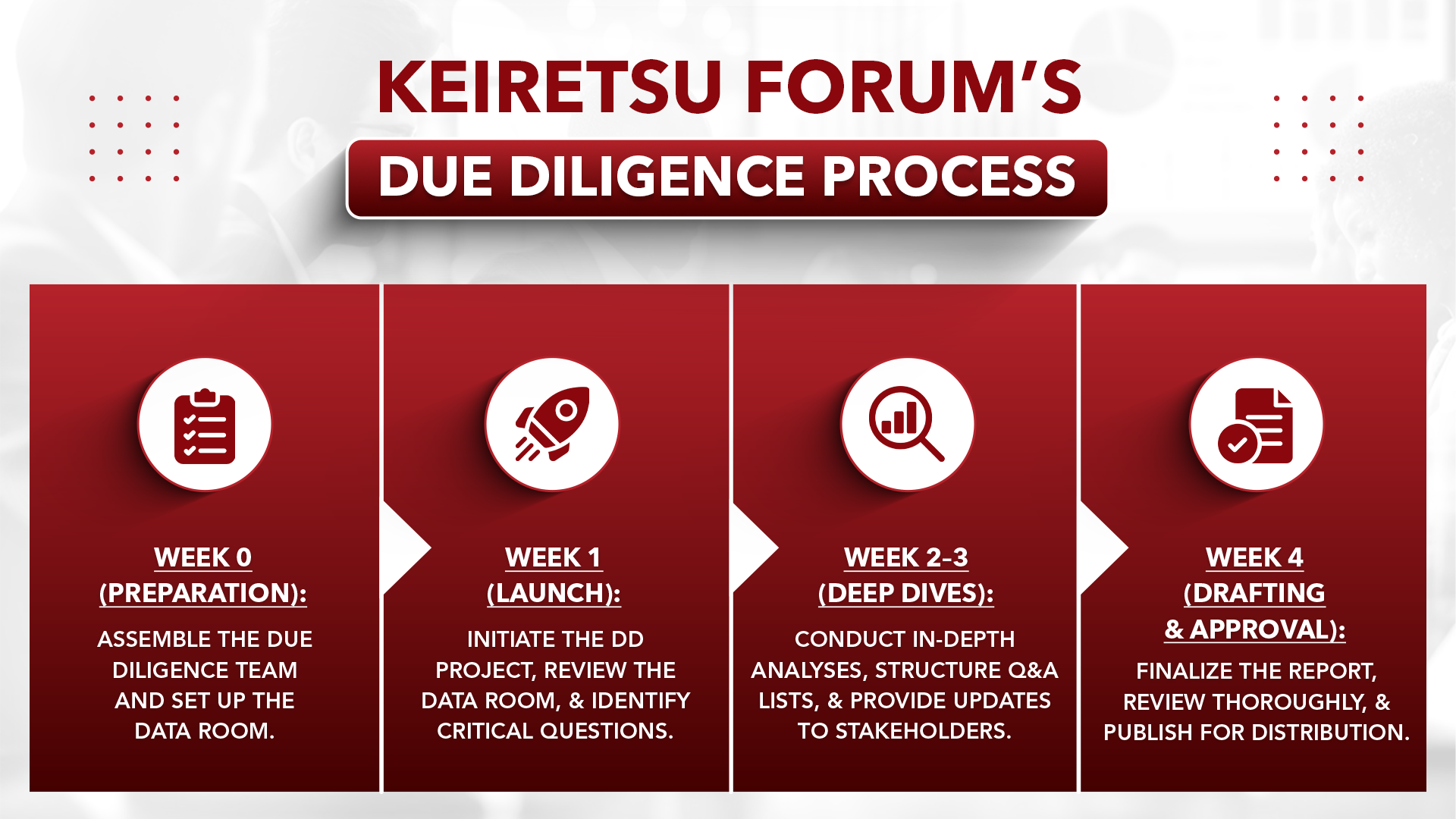

The typical due diligence process lasts between 4 to 12 weeks, with the timeline influenced by factors such as industry of the company, the DD team recruitment, and entrepreneur participation.

Our Due Diligence Values

At Keiretsu Forum, we believe in maintaining transparency, respect, and professionalism throughout the due diligence (DD) process. We aim to create a fair and balanced evaluation that benefits investors and entrepreneurs, ensuring productive discussions and sound decision-making. Below are the key principles that guide our approach to DD.

Open Process

The due diligence process is conducted in an open, democratic, and professional manner. Management access and all relevant documents and information will be shared transparently, with confidentiality respected where necessary.

Due Care with Public Forum

Discussions in public forums, whether online, in conference calls, or meetings, should be thoughtful, as careless remarks can influence investment decisions. Opinions shared should be based on facts, derived from the process, or supported by expert consultation.

Healthy, Respectful Assessment

Angel investing involves high risk, and it's important to acknowledge potential challenges while recognizing that they may be mitigated. The diligence process will evaluate these challenges constructively, focusing on their likelihood, impact, and mitigations. Discussions must be objective and respectful, avoiding personal charges or overreactions. When negative views are expressed, the company must be allowed to respond before including them in the report.

Full Disclosure of Relationships

Investors involved in the diligence team who have past engagements with the company or its management—whether through previous investments, services, or any other form of relationship—must fully disclose any potential bias in the due diligence report.

Contributing Members of the Team

Active participants in the due diligence process should have a genuine interest in investing or possess relevant domain expertise. DD leaders may invite experts to contribute when appropriate to enhance the process.

Opportunities for Review

The DD team will share findings, drafts, and final reports with the management team before sharing them with potential investors. This ensures that the company can correct errors, address tone issues, and respond if needed, ensuring no surprises in the process.

Respect for Entrepreneur’s Time and Money

Keiretsu Forum acknowledges the challenges of launching a business and raising angel funding. We understand the costs of courting investors and aim to scale the due diligence and fundraising activities to deliver a valuable return on the entrepreneur's investment.

Certain red flags may arise during the due diligence process that could potentially halt the process. It becomes the entrepreneur's responsibility to address these concerns and move forward as they see fit. Below are some common red flags:

- Insufficient or waning interest in the company

- Unidentified Due Diligence Leader

- Investment risks are considered too high

In such cases, the Team Lead or Due Diligence Director will notify the company and review the process to ensure closure.