Thank you for your interest in Keiretsu Forum - Apply Online Here

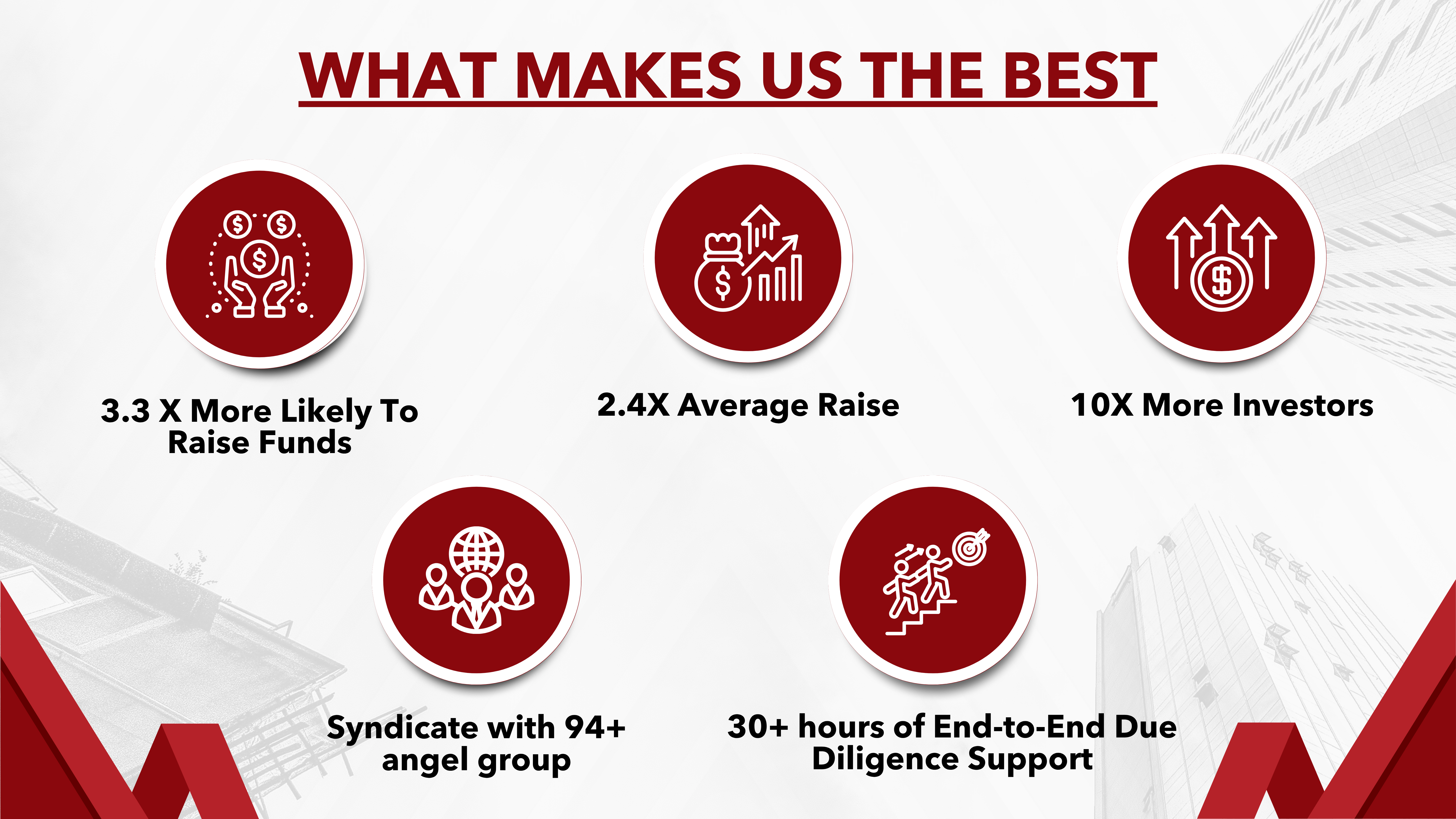

Keiretsu Forum Northwest & Rockies is a premier, accredited investor network with 393 members across the Pacific Northwest, Colorado, and Utah. We specialize in providing go-to-market funding support for startups, helping them secure the capital they need to grow.

In 2024, our investor network, along with referrals, funded 129 presenting companies (77%), investing a total of $76.1 million, with an average investment of $590K per company. Since 2007, we have been dedicated to fostering innovation by connecting promising startups with experienced investors.

You must meet the following criteria to present at one of our Forums:

- Headquartered in the US or Canada

- Demonstrated Traction: $750K+ in revenue (or approaching clinical trials for Life Sciences / TRL 6-7 for technology companies)

- Experience Raising Capital: Prior fundraising from angel investors

Capital Raise Strategy: A defined budget allocated for fundraising

If your company meets these criteria, we’d love to support your fundraising journey.

Keiretsu Presenting Process

Our quality deal flow often comes from our community of Members, Sponsors, and Community Partners including universities, government institutions, and entrepreneur groups. If you are interested in presenting to Keiretsu Forum, there is a simple, highly structured process to go through to ensure that the best companies have the best opportunities to raise capital.

Step 1 Prescreening (Free):

After you Apply for Funding, you will receive a “Prescreening” email outlining the next steps. During this stage, we assess whether your company aligns with our fundraising process. To ensure a smooth experience, please review the criteria above and confirm that our model meets your fundraising goals and budget.

Step 2 Deal Screening (Free):

If you meet our Prescreening criteria, we will contact you via email to setup a follow-up call and invite you to our next available Deal Screening meeting. Deal Screening is held on the first and third Wednesdays of each month at 9:00 AM – 12:00 PM PT. The last session of the month is exclusive to cleantech companies. In this meeting, you will pitch to 40+ active Keiretsu Forum members, who will review your presentation, discuss your potential, and vote anonymously on inviting you to the Keiretsu Forum Roadshows the following month.

We provide detailed feedback for each presenting company, offering guidance on connecting with interested investors from the event and discussing the next steps. If you find value in our process and decide to move forward, we will send an agreement to take things forward. Once payment for our funding facilitation services is confirmed, you will be scheduled to present to the full forum, typically within 1-2 weeks from the date of Deal Screening, depending on availability.

NOTE: Accept Invitation to "Investor Forums" & Pay Administrative Fee

To move forward to the next step, you will need to be invited by our Deal Screening Committee and you will need to determine that our value proposition is a good fit for your company. We will send you a overview package and an agreement to sign. Once the agreement is signed and the administrative fee is paid you will be able to proceed to Step 4.

Step 03 Professional Coaching (Inclusive):

Once the Administrative Fee is paid, we will provide one-on-one professional coaching, process coaching and due diligence coaching on how to attract maximum interest during our investor forums, guidance on our Due Diligence Process, and advice on how to make your Term Sheet even more appealing to investors. We are committed to helping you raise substantial capital and our coaching guarantees that your messaging will be well received by professional investors.

Step 04 Monthly Virtual Roadshow (Inclusive):

Throughout the Forums, six companies will be featured in front of on average 270 unique potential investors with 15-minute presentations (10-min presentation, 5-min Q&A). We have found that most companies are able to attract at least 40 investor sign-ups, with the most successful companies garnering up to 100+ sign-ups.

Step 05 Due Diligence Facilitation (Inclusive):

Keiretsu Forum NW & Rockies is dedicated to delivering timely ROI for your funding facilitation fee. We support you by managing a thorough due diligence process, which often generates strong investor interest, or "soft circles," around your company.

During this process, companies engage with potential investors to assemble a group of 5-6 highly qualified team members with confidence in securing investment. Once the team is set, a 3-5 week due diligence process is initiated. Our proprietary Due Diligence Process focuses on answering the critical questions investors need to evaluate before making their investment decisions. Last year, our due diligence process helped secure $74M+ in investment from investors across the network.

Recommended: Update Presentations (Administrative Fees Vary)

Upon completing the Due Diligence report, companies can opt to present again to investors via a second virtual roadshow. This “Update” presentation is the most efficient way to reconnect with investors who expressed interest but did not participate in the initial due diligence process.

Step 06 Reconnect and Syndicate:

Once due diligence is completed, it's time to reconnect with the potential investors who have expressed initial interest. To further support your fundraising efforts, Keiretsu NW & Rockies offers comprehensive guidance on best practices and strategies employed by highly successful entrepreneurs. This coaching covers over 90 proven tactics that can be shared with companies that have completed the process.

We also offer 90+ proven strategies and best practices employed by highly successful entrepreneurs, which you can use to fuel your fundraising efforts. After gaining some traction, you can also gain a unique opportunity to pitch to other Keiretsu Chapters, both nationally and globally. Additionally, you can connect with angel groups within the Keiretsu Investment Syndication Network and other affiliated angel networks.