Most angels diversify by sector, check size, and stage. Very few diversify by tax efficiency, and that’s been an expensive blind spot. The return of immediate R&D expensing under Section 174A reintroduces a powerful cash-flow lever for innovation-driven businesses, one that directly impacts burn rate, dilution risk, and survival odds.

When combined with existing R&D credits, this change alters how portfolios absorb risk and how capital compounds over time. Investors who incorporate these dynamics into portfolio construction will see clearer signals and fewer unpleasant surprises.

In this blog, we’ll unpack what Section 174A really does, why it’s a game-changer for early-stage R&D companies, and how you should factor R&D tax credits into portfolio construction, risk management, and follow-on capital planning.

What’s Changed: Amortization to Immediate Expensing

Under the 2017 Tax Cuts and Jobs Act (TCJA), U.S. businesses had to capitalize all domestic R&D costs and amortize them over 5 years, with foreign R&D amortized over 15 years. That meant innovation expenses contributed to taxable income in the short term, even when companies weren’t profitable, inflating tax bills and draining runway.

But the One Big Beautiful Bill Act (OBBBA) of 2025 reversed that treatment. It introduced Section 174A, which restores immediate expensing of domestic research and experimental (R&E) expenditures for tax years beginning after December 31, 2024. This means qualified R&D costs can be deducted in the year they are incurred, unlocking real cash tax savings and enhancing short-term liquidity.

For eligible small businesses (with average gross receipts under ~$31 million), the law even allows retroactive application to R&D costs from 2022 through 2024, presenting opportunities for amended returns and potential refunds.

R&D Credits vs. R&D Expensing: A Strategic Distinction

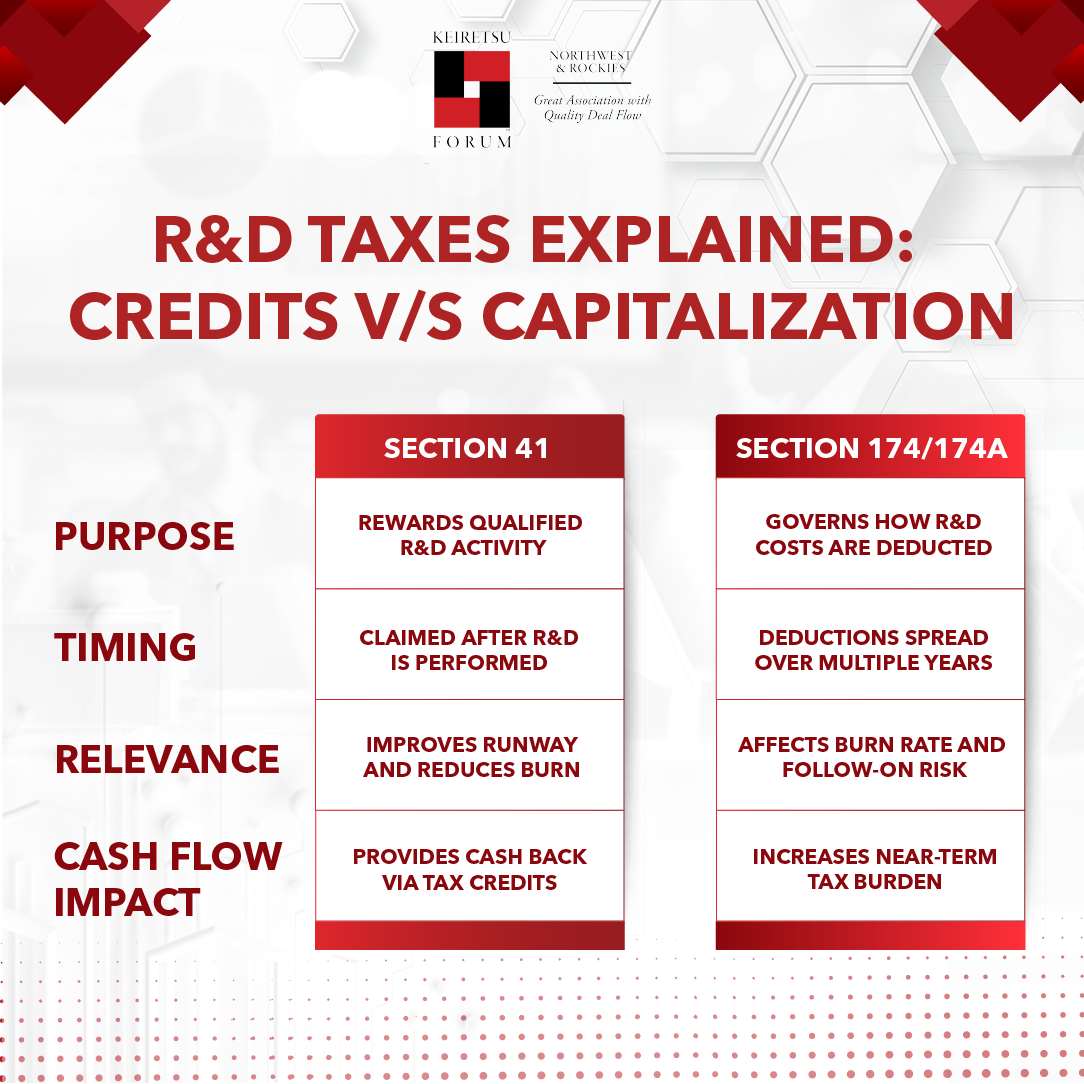

Two separate provisions matter: Section 41 (the R&D tax credit) and Section 174/174A (how R&D expenses are treated). The Section 41 credit has existed since 1981 and provides a direct tax credit, often up to ~10% of qualifying R&D expenses, that reduces tax liability dollar-for-dollar.

But R&D credits are narrower in scope and require specific qualifying criteria. On the other hand, Section 174 governs the timing of deductions for R&D outlays across a broader set of costs (including overhead and software development). Under the restored expensing rules, businesses can still claim Section 41 credits and immediately deduct Section 174A expenses, expanding the net tax benefit.

. For firms that historically capitalized R&D costs under old rules, the combination of Section 41 credits and immediate expensing can dramatically improve cash flow and valuation dynamics, which can be crucial if you are gearing up for follow-on rounds.

Why This Matters for Angel Investors?

There are four big reasons why you must lean in on this new development:

Portfolio Valuation and Cash Flow Forecasting

Before Section 174A’s return, many R&D-heavy businesses showed inflated taxable income because their R&D deductions were spread out — even when they weren’t generating revenue. That led to higher effective tax rates and worse cash flows in the early years.

Immediate expensing flips the script. R&D spend now reduces taxable income in real time, lowering cash tax outlays in the same year expenses were incurred. For investors, this means:

- Higher near-term free cash flow

- More conservative cash runway models

Forecasting models and valuation multiples should be updated to reflect a lower tax drag and smoother interim cash burn.

Better Risk Management in Innovation-Driven Companies

Failure is common in innovation and experiments. Entrepreneurs can reduce the capital risk by structuring tax savings to maximize runway. By enabling immediate expensing, Section 174A improves the capital buffer for R&D pursuits:

- Reduces cash dependency on fundraising cycles

- Lowers dilution pressure by extending runway with internal tax-driven cash

- Supports more aggressive experimentation without immediate tax penalties

You can now evaluate R&D investment profiles holistically, including tax strategy as a source of competitive advantage.

Follow-On Capital Planning

Follow-on investing becomes highly selective in a down market. R&D tax incentives can influence these decisions by accelerating:

- Break-even timelines

- Liquidity events

- Bridge financing requirements

Businesses with substantial R&D credits and immediate deductions may require less external capital than their peers. For angels, this means reallocating follow-on capital to opportunities that genuinely need it, or renegotiating terms when tax-benefit-enhanced valuations improve fundamentals.

Here’s What You Need To Do Now

You can now proactively integrate R&D tax benefits into portfolio playbooks:

- Ensure companies characterize R&D costs correctly — differentiate between Section 41 credit expenses and Section 174A deductions. Both earn benefits, but documentation matters.

- Update financial models to reflect immediate expensing benefits, and test sensitivity under various R&D intensity scenarios.

- Coach businesses to consider amended returns when eligible, especially if they deferred R&D deductions under prior rules.

- Coordinate with tax advisors early — compliance nuances, transfer pricing, and foreign R&D treatment still pose challenges.

Turn Incentives into Strategy

The restoration of R&D expensing under Section 174A is a strategic lever for value creation. This means new tools to assess cash flow resilience, optimize capital allocation, and manage downside risk in innovation portfolios. As you identify your next tranche of winners, don’t simply analyze product roadmaps and market traction. You must weigh how R&D incentives could extend runway, buffer risk, and accelerate returns across your portfolio.