As an angel investor, your portfolio is like a classroom - you nurture startups, hoping they thrive. But in reality, only a few truly excel. The odds of a startup becoming a unicorn are just 0.00006%. A more likely scenario? Getting stuck in a business that’s neither a breakout success nor a failure, just generating enough revenue to sustain its stakeholders. While it may seem stable, it offers little to no exit opportunity. In this blog, we will first explore how to navigate these situations, then introduce a flexible model that could help unlock returns over a certain period from such “lifestyle businesses.”

Understanding ROI vs IRR

Before we dive into the topic, let’s take a closer look at the two metrics: ROI (Return on Investment) and IRR (Internal Rate of Return). While ROI measures the overall return on an investment, IRR factors in the time it takes to achieve that return. Time is crucial in angel investing because the faster you see your money back, the better the opportunity to reinvest and compound your returns.

For example, investing $50,000 and receiving $150,000 in three years offers a strong IRR of 44%. If the same return takes five years, the IRR drops to 25%. ROI remains the same because it doesn’t account for time, but IRR reveals the actual efficiency of your investment.

This distinction is vital because, in the startup world, the majority of investments fall into three broad categories: home runs, bankruptcies, and lifestyle businesses. 90% of startups fail in the first year. Among the remaining 10%, a few may deliver exponential returns, some will yield modest gains, others may fail later, and some will stabilize as lifestyle businesses. These lifestyle businesses are great for founders but a dead end for investors in terms of IRR.

Why a dead end? Think about it – a bankrupt business gets you a tax write-off, and a successful one gets you excellent returns. But a stabilized one, a company that hasn’t broken a ceiling but is just earning revenue and has a limited possibility of breaking into a unique space? It only gets you taxes and no decent returns, the worst of both worlds. So, your ROI may be good, but the IRR is hampered and will reflect in your portfolio. Essentially, your investment went sideways. These are the deals we need to address.

Let's look at some sobering statistics. Carta's Q1 2024 report highlights that only 13% of companies that raised seed funding in the first half of 2022 advanced to Series A. The path to acquisition or IPO becomes more challenging with each stage, which means it is tougher for you, as an investor, to find successful exit opportunities. This reality check begs the question: How can you improve your odds of success?

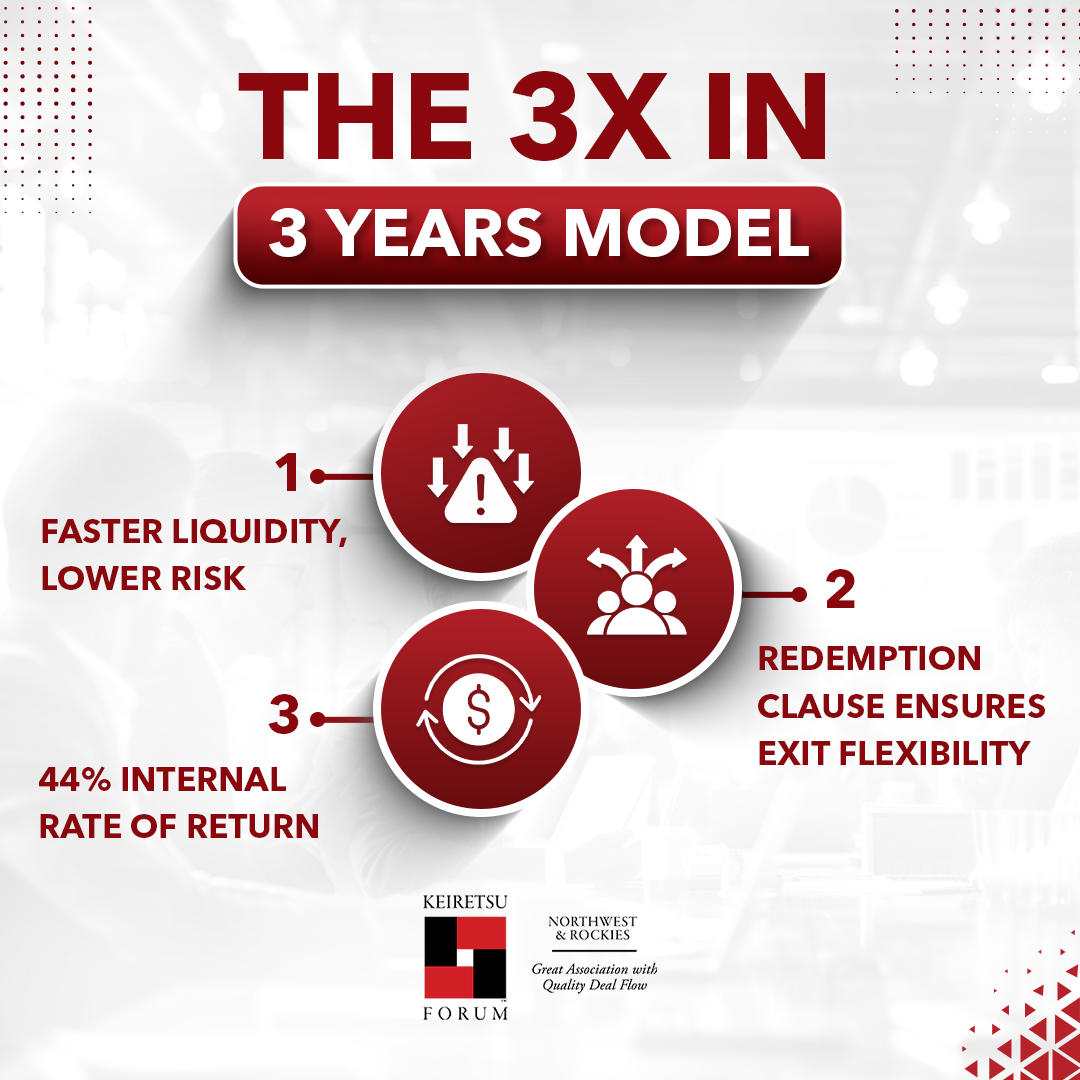

Redefining the Exit: The 3X in 3 Model

Here's a strategy to consider: Instead of solely chasing that elusive 40X return, what if you could structure deals to win in 9 out of 10 investments? Enter the “3X in 3 years” model. Here’s how it works:

- Include a redemption clause in the convertible note at the three-year mark.

- You can choose to either:

a) Redeem their original investment for 3X the amount, or

b) Forego the redemption and convert to equity.

Why three years? By this point, the startup's trajectory becomes clearer. Are they on track for Series A or B funding? Or are they settling into a lifestyle business model? If the startup is truly on a rocket ship trajectory, investors can easily opt to stay in for the long haul. But if signs point to a sideways scenario, there's now an exit ramp.

The convertible note includes the redemption clause and gives you discretion over your choice. If a company can’t pay the full amount immediately, the payout can be spread over six to twelve months, potentially linked to a revenue-sharing agreement. Importantly, this ensures that you are included in the financial equation if founders draw market-rate salaries.

A 3X return in three years translates to a 44% IRR – squarely in the sweet spot for angel investors. Compare this to the alternative: a 10X return over 10 years yields a similar IRR but with significantly more risk and time invested.

Will Everyone Agree?

Naturally, this approach raises eyebrows. You can expect objections in the form of:

"It's against the rules. Everything should be on an equity track."

While swinging for the fences is great, having a fallback option allows investors to salvage some capital, which they can reinvest in other opportunities. This approach isn’t about wishing for a company to fail but planning for the possibility that it might.

"No startup will accept these terms."

This is not a lose-lose scenario for early-stage companies but rather a level playing field where the interests of both entrepreneurs and investors are taken into account. Some people may see it as a way to buy back equity and potentially reduce dilution. Others hope investors will stay in for the long haul.

"Startups can't afford to pay this back."

If a company can pay market-rate salaries to its team, it can include investors in that equation. This clause ensures that investors aren't left behind if the startup shifts from an equity-focused path to a salary-focused path.

The Bigger Picture

Ultimately, the 3X in 3 years model is about creating better outcomes in an uncertain game. By proposing a structured option for early exits, you can improve IRR while allowing companies to pursue their growth journeys. It’s not about abandoning the equity track but ensuring that even sideways deals provide a path to returns.

Angel investors constantly think about structuring deals and managing portfolios to support innovation while avoiding losses. This motivation is the core of the 3x in 3 years model. You can further restructure it at your convenience or in partnership terms. It is a step toward mitigating risks and maximizing returns in a landscape where only a few startups truly breakthrough. You can build a more sustainable and rewarding investment ecosystem by redefining the game.

References:

https://www.datadriveninvestor.com/2024/07/19/the-steeper-climb-from-seed-to-series-a/

https://www.embroker.com/blog/unicorn-startup-checklist/