Starting a business can be a tumultuous experience for an entrepreneur. Every entrepreneur wants to build a business that will attract funding, scale their operations and make profits. Likewise, investors are looking for companies that promise attractive returns on their investments. So, what connects entrepreneurs and investors? Both are looking for a recipe for a start-up’s success. Is there a recipe for success? If not, what are the factors that can accurately predict a successful future for a start-up? Is it the business model? The idea? The team? Kevin Turner tells you how!

He is a long-time angel investor and Keiretsu Forum member who recently delivered a keynote speech at the Keiretsu Forum Northwest & Rockies April Roadshow. Under the theme, "Due Diligence – to write a check", he explained what investors are looking for in a company and what factors give them the confidence to invest.

So, what are the factors that make a start-up a success?

The answer to this question goes back to a 2015 Ted Talk. In a study, American businessman and Idea Lab founder Bill Gross identified the most important factors for a start-up’s success.

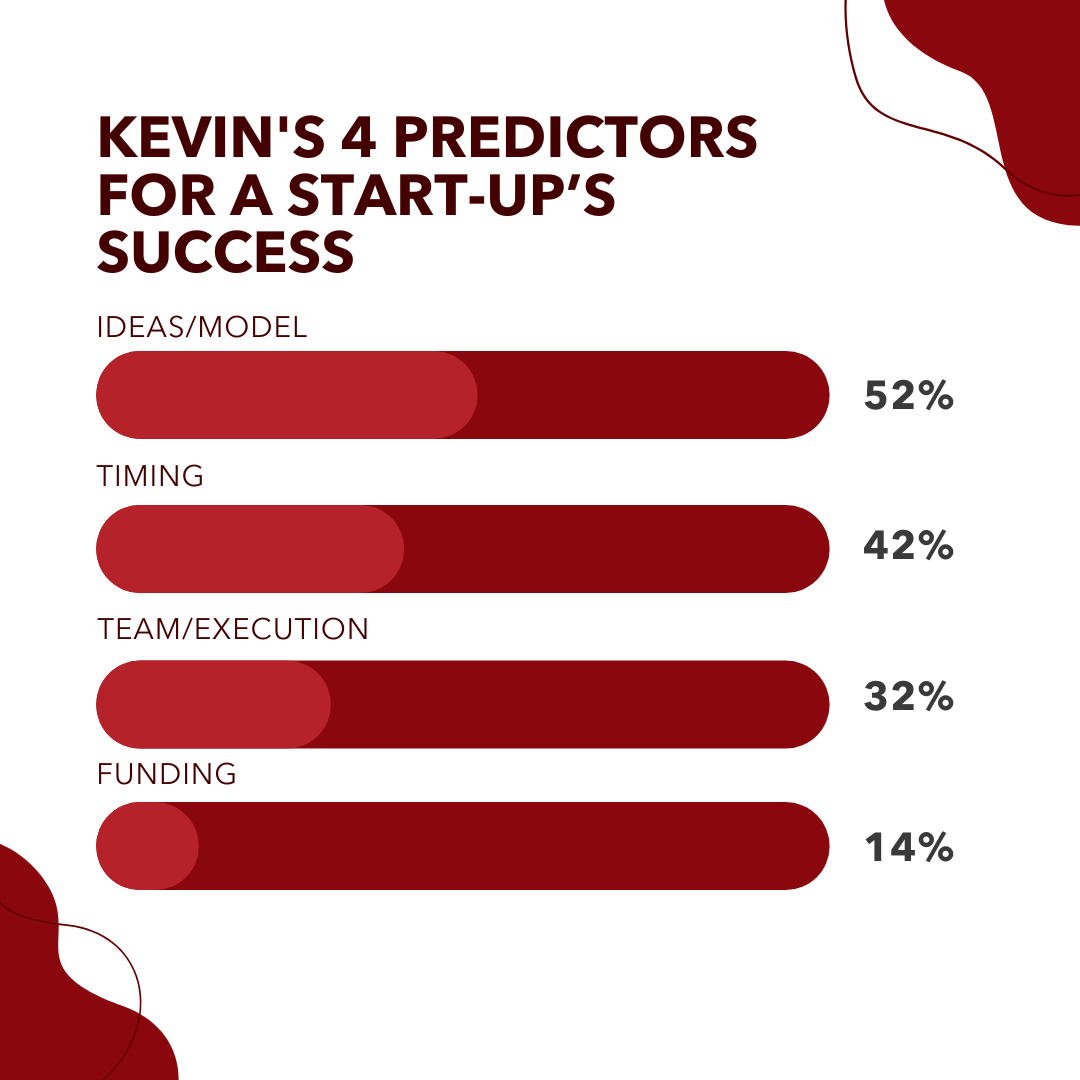

How do you predict which start-ups will be successful? Does funding rank as the most important factor? Or does the business model win? Bill Gross gave his prediction in order of importance:

- Timing (42%)

- Team/Execution (32%)

- Idea (28%)

- Business Model (24%)

- Funding (14%)

Timing

We all know that being in the right place at the right time is critical. When new technologies become part of the innovation landscape, their success depends on how well they help ensure that these technologies are understood by a wider audience.

Example: The apple pilot debuted in the 1990s. it was the first personal digital assistant to be produced. It was a failure, and Apple had to abandon it, not because it was a bad product, but because it was ahead of its time. In the future, the iPod and all other Apple products follow Apple's pilot. This shows that timing plays the most important role in the success of a product.

Team/Execution

A good team that can thoroughly implement the idea is the second most important factor. Every business needs a quality team and a good execution plan, otherwise, the business will not move forward. Some people only invest based on the team, especially if they have a track record of entrepreneurial success and multiple successful exits. A good team includes not only a group of highly qualified professionals but also their ability to respect each other's opinions and collaborate effectively to implement ideas and push the company vision forward.

Idea

A good idea is the third most important factor after timing and a good team. According to Bill Gross, the success rate of the idea is 28%. If you have a great idea, you can get the team, you can get funding, and you can get a lot of recognition in the market - but a great idea by itself doesn't give you huge success.

Business Model

A good business model is a very important strategic tool for entrepreneurship. It's not enough to have a good idea - even a good business idea can be useless if it cannot be developed, executed, and implemented. A good business model not only helps you focus on the steps needed to make your idea successful but also helps you achieve your short- and long-term goals.

Funding

To Kevin's surprise, funding was considered the least important factor out of the five for a start-up's success. He explained that while start-ups need funding, they don’t need it initially. A start-up needs to organize launch times, business strategy, ideas, and teams into a cohesive model that ultimately drives funding. As an entrepreneur, you might have a great product at the right time, run by a great team, and your chances of getting good funding might be high, and that's what it's all about!

Kevin follows the KISS (Keep it Simple Stupid) approach to investing

and these are his 4 predictors for a start-up’s success

Kevin’s mantra to finding the perfect company to invest in, with examples!

Kevin shared his experience as a member of multiple due diligence teams and the core of the investment philosophy that led him to invest in multiple companies. His investment philosophy? Invest in companies that have a positive impact on humanity. Kevin has always been passionate about investing in companies that work to create positive change in the real world, and now he has decided to go a step further and invest in companies and services that can do just that! Here are some examples of companies he invested in and what aspects of the companies led him to ultimately decide to invest.

Oisin Biotechnologies – Gene Therapy Startup

Oisin Biotechnologies wanted to be the FedEx of gene therapy. It wasn't until he became part of the due diligence team that he began to appreciate the simplicity of gene therapy. The company had a highly skilled and experienced team who together developed an elegant solution. They have yet to identify any bottlenecks for the future of gene therapy, and based on their progress so far, Kevin thinks the future of medicine is very bright.

Oscilla Power – Wave Energy Start-up

Oscilla Power was focused on being the lowest-cost provider. They achieved this by creating an IP focused on the design of floats and reaction vehicles. They used off-the-shelf electronics to make the product as cheap as possible, saving on installation and maintenance costs compared to their competitors who used more expensive electronics. Kevin said he knew all of this because he was part of the due diligence team.

Pattern Computer – Explainable Artificial Intelligence

Kevin was introduced to Pattern Computer through a member of the due diligence team. It took him several months to understand the quality of the team and the people in the company. Since then, his initial investment in the company has seen a 20x return, and he attributes his investment decision to the time he spent on due diligence.

Kevin’s advice for investors

Over the next decade, we will see tremendous advances in knowledge and technology as growth in both fields accelerates. Kevin pointed out that it is currently difficult for investors to learn and keep up with technology within their area of expertise, let alone outside of it. He noted that if investors can overcome this hurdle, they can become excellent integrators, bringing together the latest technologies. He believes that every investor should develop an investment philosophy, and save money for investments. As an investor, you can choose the best start-up based on an idea you think will be successful, then join a due diligence team that will help you make key decisions and eventually write that check.

ABOUT THE SPEAKER

Dr. Kevin Turner has accumulated more than three decades of experience and expertise in the practice and business of medicine. An awarded and Board Certified, Obstetrician/Gynaecologist, Dr. Turner is an expert in navigating complex regulatory frameworks and compliance. His wide breadth of experience and expertise include the following: business management; robotics, human resources; public health; software development and integration; curriculum development; strategic planning; product development and manufacturing; and marketing. With a background in macroeconomics and technology, Dr. Turner has carefully monitored the rise of cryptocurrencies, blockchain, and artificial intelligence (AI). He is an accepted thought leader in the convergence of these technologies. Click here to watch his keynote address.