When gold was discovered in California in 1848, thousands rushed in with picks and shovels, hoping to strike it rich. Today, we’re witnessing its modern equivalent. But instead of rivers and hills, the treasure is buried in data, algorithms, and computing power.

Artificial Intelligence (AI) is that gold. It’s not confined to one industry or use case; it’s a foundational technology reshaping how businesses operate, how consumers interact, and how economies grow. From drug discovery to creative content generation, from fraud detection to climate modeling, AI is weaving itself into the fabric of everyday life.

AI’s versatility makes it the epicenter of smart capital. Unlike past waves of innovation where opportunity was concentrated in specific niches, AI represents a horizontal revolution—one with the potential to create enduring value across almost every industry. Just as the early adopters of the internet or mobile revolutions did, angels who position themselves now stand to benefit disproportionately as the ecosystem matures.

Why AI & Angels Are a Perfect Match

Angel investors have always been the first movers, the risk-takers who spot potential before institutions pile in. Over the last decade, no sector has captured this spirit of early conviction quite like AI, and here’s why:

1. Transformative Potential Across Industries

Unlike many innovations limited to a niche, AI can impact every corner of the economy, including healthcare, finance, logistics, retail, cybersecurity, education, and many other sectors. From automating drug discovery to predicting supply chain disruptions, AI-powered startups are solving problems at scale. This cross-industry applicability means wider exit opportunities and less dependency on any single vertical.

2. High Scalability with Lean Operations

AI businesses often thrive on intellectual capital more than physical infrastructure. A small, talented team with the right algorithms and data access can scale quickly, keeping costs lean in the early days. This efficiency appeals to angels who want their capital to stretch further without requiring massive follow-on funding in the seed stage.

3. Early Adoption Advantage

Just as those who backed early SaaS or fintech companies reaped outsized returns, AI can be a generational opportunity for angel investors. By entering at the ground level, you can position yourself for exponential upside as technologies mature and mainstream adoption accelerates.

4. Investor Sentiment & Momentum

AI is a cultural and economic revolution. The launch of tools like ChatGPT, Claude, and Gemini has democratized AI, sparking global conversations and capturing the imagination of investors. This momentum fuels valuations, attracts co-investors, and provides angel investors with fertile ground for syndicate participation.

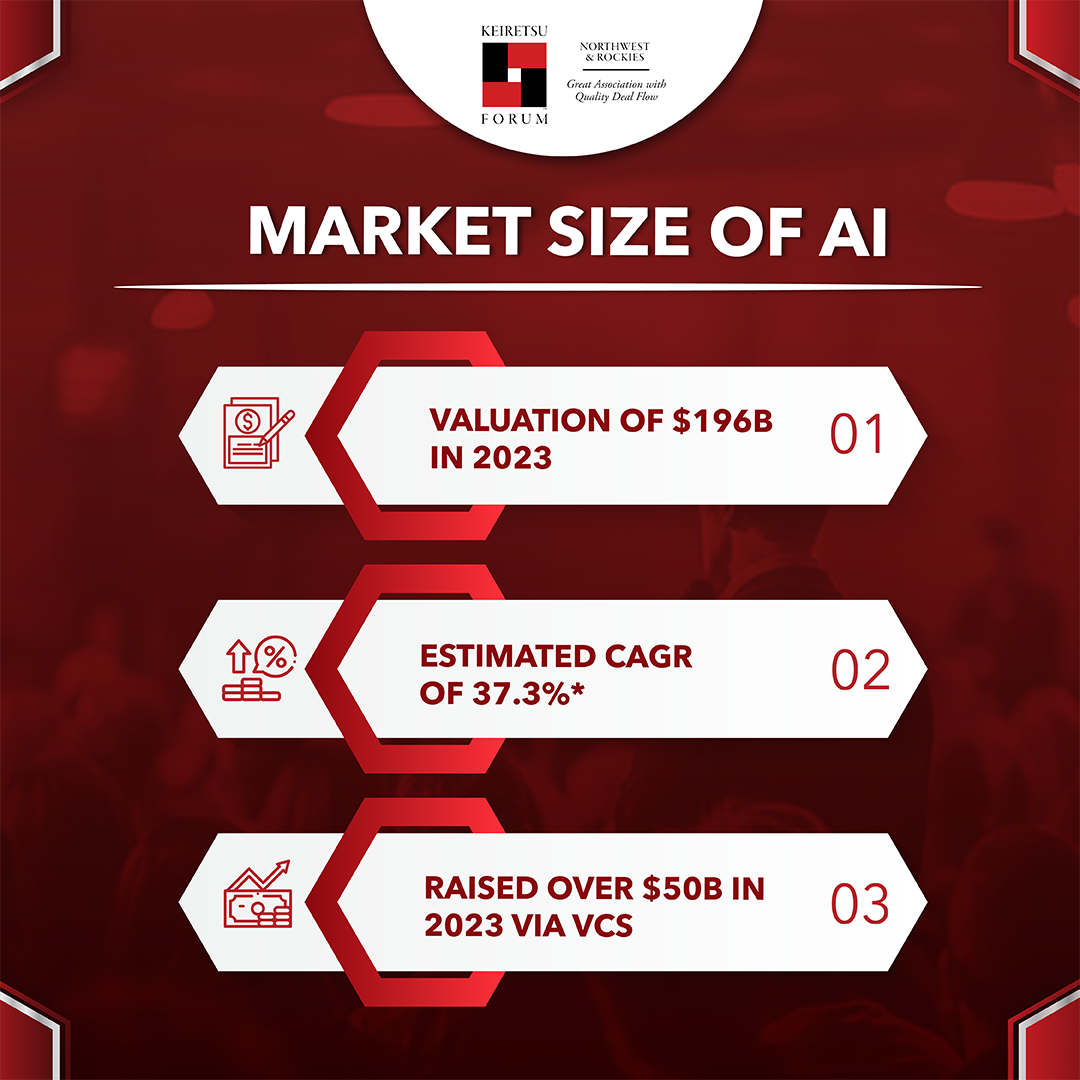

The Numbers Don’t Lie: AI’s Market Boom

To understand why angels are so bullish, one only needs to look at the numbers.

- According to Grand View Research, the global AI market was valued at around $196 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 37.3% from 2024 to 2030, reaching over $1.8 trillion by 2030.

- In the US, AI investment is already outpacing other tech verticals. PitchBook reports that US-based AI startups raised over $50 billion in venture funding in 2023 alone, despite a slowdown in overall venture activity.

- Sub-sectors such as Generative AI are showing explosive growth—estimated to create $4.4 trillion in annual economic value, according to McKinsey, across industries like customer service, software development, and marketing.

For angels, this is a roadmap to outsized returns. The expanding market size ensures a growing pie, while strong growth rates offer multiple entry points and exit options across industries.

Where the Next AI Fortunes Will Be Made

So where exactly are angel investors placing their bets? The AI landscape is vast, but a few sectors stand out:

1. Healthcare & Biotech

AI is transforming diagnostics, drug discovery, and personalized medicine. Startups using AI to predict disease risk or accelerate clinical trials are already drawing strong interest from angel investors. With healthcare spending in the US topping $4 trillion annually, the upside here is staggering.

2. Generative AI & Creative Industries

From text and image generation to code writing and video creation, generative AI is transforming how businesses and creators operate. Angels see this not just as a software play but as the foundation for new industries, such as personalized content platforms and AI-driven design tools.

3. Cybersecurity

Cyber threats are a perpetual menace in a digital world. Companies developing AI-based threat detection, fraud prevention, and data protection systems are attracting investors who recognize that digital security has become a boardroom priority.

4. AI Infrastructure & Tools

Not every investor needs to back the “application layer.” You can build a strong portfolio by betting on companies that provide the picks and shovels of this gold rush: data labeling, AI hardware optimization, model training platforms, and cloud-native AI tools.

5. Sustainability & Climate Tech

The role of AI in optimizing energy usage, predicting climate patterns, and managing resources is becoming increasingly relevant. Several companies are addressing the energy crisis with the help of AI and data centers, and most have achieved significant traction.

From Hype to History: The AI Investment Moment

The AI boom is often compared to the dot-com era, but there’s a crucial difference: AI is already producing tangible results across various industries. What once felt futuristic is now embedded in our daily tools and workflows. For US-based angel investors, this is the moment to act.

The gold rush metaphor fits perfectly. The tools may differ, but the opportunity remains the same: transformative wealth creation at the edge of a new frontier. Angels who move decisively today may well hit gold.