Angel investors and VCs are beacons of private capital. While angels are likely armed with personal funds and years of entrepreneurial experience, VCs boast massive war chests and an eye for companies that can scale into market behemoths. Both provide young companies with crucial rocket fuel in the form of an equity investment, but there are some key distinctions. And similarities.

So, what are the dynamics of angel investing in relation to venture capital? Where do they meet? What do the two seek? Suit up, founders and funders — it's time for a full breakdown of these two heavyweight investment classes. We'll examine their strengths, motivations, economics, incentives, and operational approaches. Ready? Let's go #BackToBasics!

Who are Angel Investors?

We'll start by taking a look at angels. As the name would imply, these are affluent individuals who directly invest their own money and personal wealth into promising startups. They take an equity stake in exchange for providing that crucial early dose of capital momentum and funding runway.

While angels were once considered more of a bridge between the friends/family round and institutional venture funding, the landscape has evolved.

Angels are increasingly forming coordinated groups that can cut larger checks and get involved at slightly later stages than the traditional solo angel approach.

Learn more about Keiretsu Forum membership here.

While the motivations of individual angels may vary, their typical due diligence may focus more on the strength of the idea itself and the caliber of the team behind it. Proven traction and compelling financials are always a plus, but angels have more flexibility to take bigger, earlier bets on companies they feel have truly visionary potential down the line.

Who are Venture Capitalists?

Venture capital funds are investment vehicles that pool capital from sources like pension funds, endowments, corporations, and high-net-worth individuals. They use these committed funds to buy equity stakes in high-growth-potential private companies, to enjoy massively lucrative returns via an IPO or acquisition. VCs don't invest their own money.

VCs may wait until a startup has an established product or service, a proven business model with traction, and a clear roadmap for immense growth and market domination. Simply having a brilliant idea is not enough. VCs swing for the fences and back companies with legitimate unicorn potential.

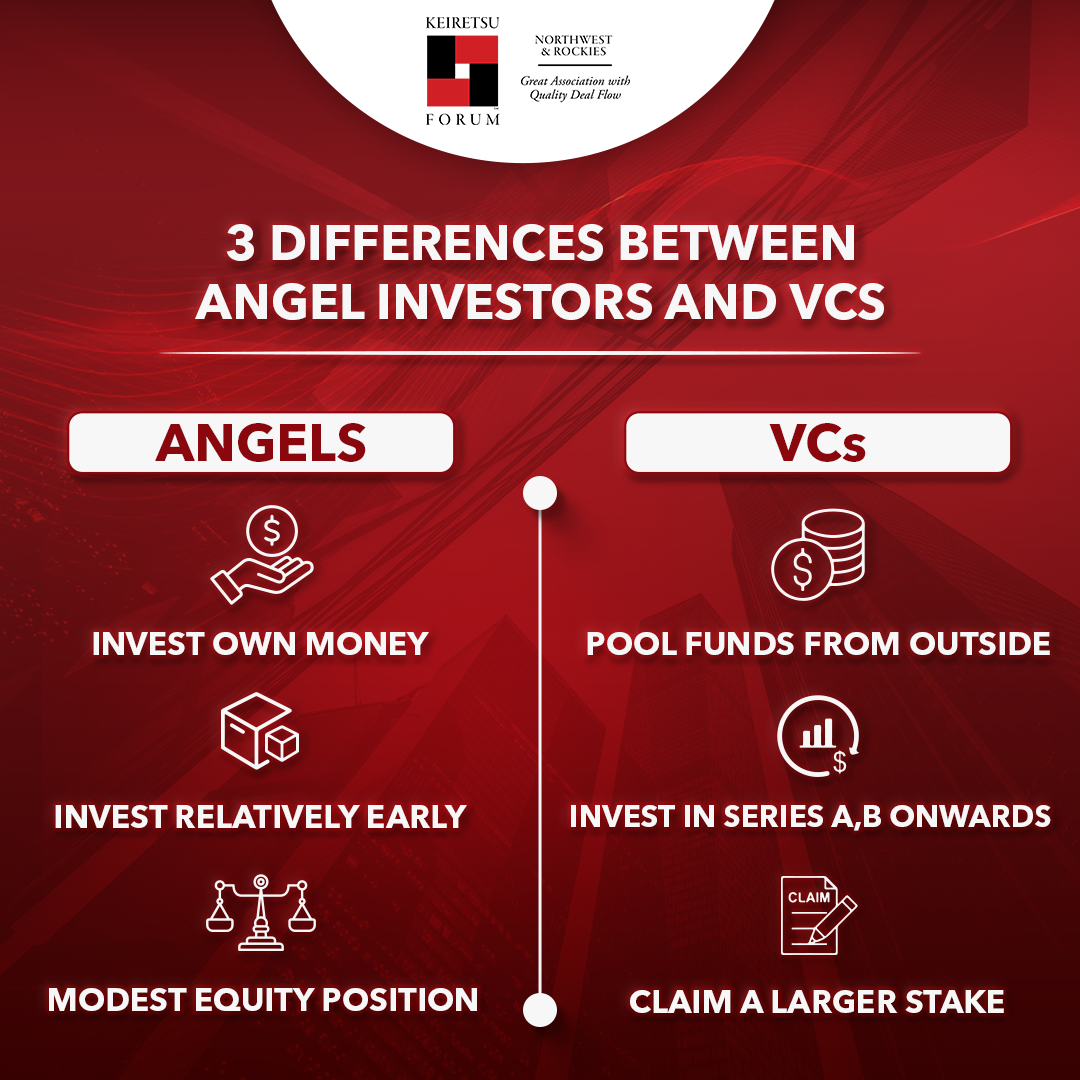

Angel vs VCs — The Main Differentiators

With the definitions of our key players established, let's break down some of their characteristics:

Investment Stage & Risk Profile

Early-stage angel investors are traditionally more eager to place bigger bets on companies with a disruptive vision and massive long-term upside potential. They have more flexibility to take on out-sized risk in exchange for ground-floor equity stakes in game-changing ideas.

VC firms, on the other hand, tend to come in at a bit later stage for an opportunity. They need to see compelling evidence of product-market fit, a clear path to scalability and signs the business can grow into a valuable entity. The risk profile is still high but hinges more on execution risk rather than the original concept itself.

Investment Amounts & Equity Stakes

Since angel investors use their wealth, individual investment amounts are naturally more constrained than a VC firm managing multi-million dollar investment funds. The SEC says typical angel deals may provide $200,000 to $400,000 per company, while, the ACA puts the median individual angel check around $25,000 based on a study.

VC firms have significantly larger funding sizes available. According to Crunchbase, the median Series A deal size stands at $12 million, while the average approached $18 million.

On the flip side, while angels take smaller equity percentages, VCs demand much larger ownership stakes (up to 50%), while individual angels may own quite a minor stake in a company.

Operational Control & Decision Making

With angels, the expectation is typically for a more passive investment role. They may advise or mentor founders but may be content with "paying to play" and letting management maintain more strategic and operational control. As angels consolidate their energies and take more active steps, this approach may tilt towards the VC way. Which is?

Well, venture capitalists demand an extremely active voice and tight control over major initiatives and long-term direction. Board seats, veto rights for key decisions, replacement provisions for founders/executives if needed these are all standard protections that VCs require as part of their deal terms.

Risk & Investment Incentives

Angels are investing their wealth and can be more patient with growth trajectories and return timelines. VC firms, however, are investing committed capital on behalf of large institutional investors like pensions and endowments. These investors have aggressive annual return targets that the VC needs to meet. Angels can let investments season for longer and don't face the same pressures for rapid exit events. Though of course, early outsized returns are always the goal if possible.

Because of this, VCs inherently need to take a more aggressive, accelerated approach geared towards prepping a portfolio company for an exit and liquidation event. The investment firm's partners also earn a piece of any profits realized (carried interest), so they are motivated to swing for the fences.

Valuation & Investment Decision Making

While both sides have rigorous diligence protocols, the specific priorities and focus tend to differ between angels and VCs when assessing potential opportunities.

For angels, a lot more weight may be placed on the strength of the idea, the founder's passion and vision, and the overall entrepreneurial makeup of the team behind the business plan. Intricate financial modelling, scalable growth frameworks, and concrete exit strategies are less of an immediate priority.

VCs take a much more institutionalized approach to evaluating opportunities, diving deep into records, revenue projections, total addressable market opportunities, and the realistic ability for the company to scale into a market juggernaut quickly.

Size and Scale

Venture capital firms are typically funded by major institutional investors like pension funds, endowments, and financial firms that have a lower appetite for extremely high-risk bets. As a result, while a portion of these institution's capital is allocated to venture investments, it's a relatively small percentage of their overall portfolio.

In contrast, angel investors put up their personal capital without that institutional backing.

It makes them more able and willing to take risks on disruptive ideas and visionary founders, even if near-term financials or product-market fit aren't fully proven out yet. Angels have more flexibility to prioritize team strength and a bold vision over established metrics.

Speed of Investment and Growth Expectations

Another key difference relates to contrasting timelines and growth expectations. Angel investors can move much more nimbly and rapidly when deciding to back an opportunity. Since they deploy their personal funds without bureaucratic red tape, angels can often make investment commitments on extremely short timelines.

This enables startups to secure crucial early-stage funding promptly when speed is paramount. Venture capitalists have a more extended outlook on investments maturing, given the longer fund lifecycle structure they operate under.

Well, now that we have gone through some of the differences, there is much in common between VCs and angels. Let's see...

Where Angels & VCs Converge

Both angels and VCs fuel innovation and risk-taking in markets where other conventional sources of capital don't tread. Early-stage startups pioneering new technologies, business models, and product categories face major hurdles in securing financing from anywhere else. Yet angel and venture investors are not only willing to take on that risk but represent vital lifelines for any startup aspiring for major growth and disruption.

The ultimate motivation is also aligned — to supercharge a company's upward trajectory and generate massive financial returns in exchange for taking an early ownership stake in the venture.

Yes, the specific economics and incentive structures differ, but both sides have clear expectations of earning premium rates of 20%-35% annually over the lifetime of the investment.

Both hinge on a rigorous evaluation to identify companies with elite founding teams, innovative products poised to reshape industries, and proven ability to rapidly gain meaningful market traction. They need to become supremely confident in the startup's vision and execution roadmap to take the calculated risk.

Perhaps most notably, both angel investors and VC funds frequently provide value-add services well beyond their pure capital infusion. This can span anything from strategic business guidance and mentorship to leveraging their professional networks for talent recruitment, customer acquisition, strategic partner intros, and more.

Key Takeaways: Angel Investors vs Venture Capitalists

- Angel investors typically provide smaller early-stage funding from personal wealth, while VCs invest larger amounts at later stages using pooled institutional funds.

- Angels can be more patient with growth trajectories, whereas VCs need companies to rapidly scale for an exit that meets their institutional investors' return targets

- The diligence process differs, with angels weighing ideas/vision more heavily and VCs scrutinizing business fundamentals, revenue models, and scalability roadmaps

- Yet both serve as crucial sources of risk capital for innovative startups, expect premium 20%+ annual returns, and offer value-additive services beyond just funding

In summary, while angels and VCs may seem similar on the surface as startup investors, there are numerous key distinctions. Picking the optimal funding path and partners will shape the entire future trajectory of a startup out to seek funding.

Sources

https://hbr.org/1998/11/how-venture-capital-works

https://www.sec.gov/education/capitalraising/building-blocks/investor-types

https://news.crunchbase.com/venture/funding-rounds-average-mean-startups-charts/

https://www.geekwire.com/2017/u-s-angel-investors-study-shows-78-male-87-white-17-california/

https://about.crunchbase.com/blog/venture-capitalist-percentage-ownership/