Investing in life sciences is a different ball game from other sectors. The conversations during fundraising go beyond the revenue and product, focusing on dissecting the business and determining whether the solution will be viable in the long run. It is common to see a healthcare business acquired years before generating its first revenue. However, it isn't easy to pick a winner in life sciences. The product may not be scalable for a large market, its importance may wane over time, and several other reasons can change the course of a company’s destiny.

This blog covers Dr. Christian Apfel's thoughts about using due diligence to discover high-growth potential early-stage companies in life sciences.

The Role of Due Diligence in Finding Winners

According to the latest Angel Funders Report, angel investors are seeing a gradual increase in their return on investment, from 0.72x in 2019 to 1.55x in 2022. One of the main reasons behind this increase is the growing emphasis on due diligence (DD). A study by 4Degrees reveals that angel investors who dedicate less than 20 hours to DD activities yield a return of 1.1x in 3.4 years, whereas those who devote more than 20 hours enjoy 5.9x returns over 4.1 years. Clearly, the investors who deep dive into the business model, finances, addressable market, and other factors have a better view of the company’s growth potential to succeed.

Dr. Apfel suggests that the growth factors of the portfolio companies can be represented in a formula to anticipate the returns:

Expected Return on Investment ≈ P * ROI

Here, P is the Probability of Success, and ROI is the Return on Investment in Terms of Multiples.

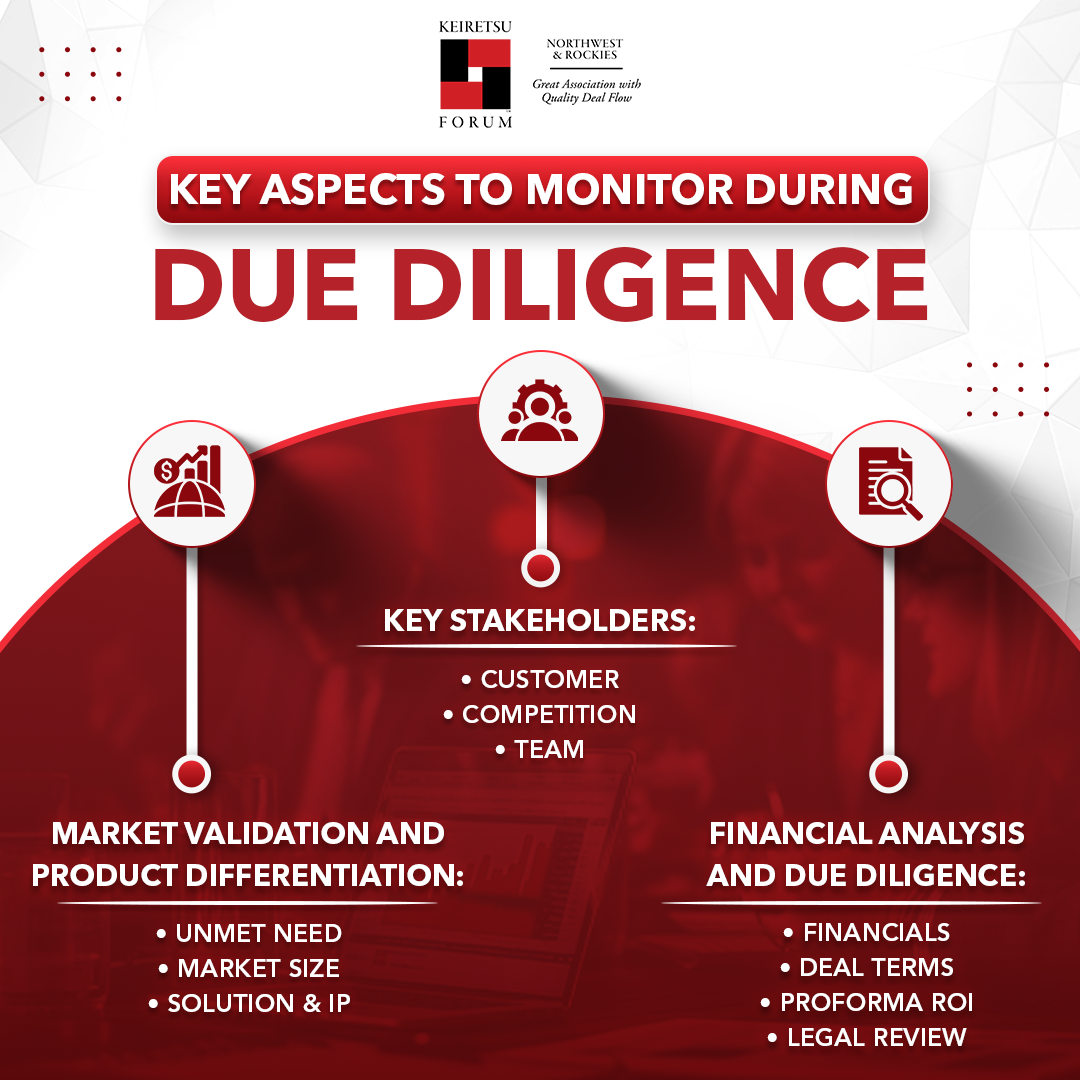

The Probability of Success is defined by the solution, its need, the team, and the competition. On the other hand, ROI is determined by market size, profit margins, exit value, and dilution. Let us examine these factors and how they impact the Return on Investment.

Addressing a Large Market With a Unique Solution

Any product entering a large market needs to have a few aces up its sleeve. The first ace is a unique solution that fulfills an unmet need. The stronger the unmet need, the higher the customer demand. If the customer demand is already high, there is a significant market size to capture. A large addressable market translates to substantial revenue potential. The unique solution must have sufficient patents and trademarks to prevent competitors from replicating the idea.

Dr. Apfel gives an example of an interesting company that invented a pill to change gut flora and curb obesity. The product was targeting an unmet need, as obesity is a huge health and economic burden in the West. The solution was inexpensive and possibly highly effective, with minimal side effects. The company also had an excellent Intellectual Property (IP) in their hands, as the formulation was unique. The pill’s demand, uniqueness, and IP all contribute to a higher probability of success, which means it is a potential winner.

Market, Customers, and Barriers to Entry

In the above point, we discussed the importance of market size and unmet needs. In addition to these points, it is important to study customer habits and purchasing power. Any product that does not directly reach the customer will find it difficult to enter the market, no matter how unique it is.

A brand had reinvented face masks for patients under anesthesia. Their IP was around an apparatus that fit into the mask and allowed the patient to breathe comfortably under sedation. The product was clinically useful, especially for pediatric cases, but Dr. Apfel identified a key challenge—marketing. The purchase decision for these masks lies in the hands of the surgeons, who bring the maximum revenue into the hospital. Hence, the purchasing decision was disconnected from the user, making the product difficult to sell.

Dr. Apfel advises analyzing a business's addressable market and customers to understand its growth potential. In the above case, the market was vast, but the product did not take off because its customer was disconnected from the purchasing power. This example sheds light on the customer’s ability to tilt the probability of success.

No Competition – A Blessing in Disguise?

The number of competing businesses and their grip on the market are significant entry barriers for new players. But what if there was no competition? While it seems like an ideal scenario, having zero competition means driving customers away from a well-accepted tradition or method. Hence, the absence of another player does not necessarily imply zero competition, as you are up against the general standards.

Currently, there are 300,000 emergency C-sections for suspected fetal distress. C-sections are also associated with a significantly increased risk of maternal deaths. To overcome this challenge, a brand came up with a method to measure the oxygen concentration of the unborn child and predict the necessity for a C-section. Their product solves a massive problem with smart and non-invasive fetal reflectance pulse oximetry.

The product does not compete with anything except fetal heart rate monitoring, a procedure riddled with 89% false positive and 50% false negative results. Despite no other business competing in the market, the brand faces an uphill task of solving a major challenge – replacing the inconclusive procedure. Since most of the world relies on the procedure, the company faces stiff competition to enter the market. If they crack the code to enter the market and convince the customers, their chances of success will skyrocket. Hence, standards can be your biggest rivals, too.

Investing in life sciences is a high-risk, high-reward endeavor. The best way to identify a winner is to investigate the company’s potential using DD reports. Remember that life science companies can change the future, so you are investing for the long run. Feel free to use the above equation to assess companies and make informed decisions.

About the Speaker

Dr. Chris Apfel, founder and CEO of SageMedic Corp., is an expert in clinical trials with over 100 publications. Formerly a UCSF Professor, he developed the widely-used "Apfel Score." With 20+ years of clinical experience, Dr. Apfel teaches clinical trial design at UCSF and chairs the Life Science Committee at Keiretsu Angel Investment Forum. His expertise spans anesthesiology, critical care, and emergency medicine, complemented by an MD, PhD equivalent, and MBA from Wharton.

Watch his full keynote at Keiretsu Forum Investment Summit here.

References:

https://publuu.com/flip-book/37288/751879/page/56