Investing in clean technology has never been more important.

With wildfires spreading in one part of the world and flooding in another, the steady rise in sea levels and global temperatures is telling us one thing: the reality of climate change is upon us! As investors, we need to think about the future of technology and understand how a simple shift in focus to investing in more sustainable and cleaner technology solutions can impact the lives of everyone on the planet.

Our theme for the month of July was ‘Investing in Clean Technology,’ Keiretsu Forum has been a pioneer in investing in cleantech solutions and is always on the lookout for emerging companies in this space. During our July Forums, we were joined by an exciting lineup of keynote speakers from the cleantech sector to educate investors on the steps they can take to properly navigate the industry. Joining our chapter meeting in Vancouver as a keynote speaker was Max Mankin, co-founder, and CTO of sustainable technology company Modern Electron.

In his address, he broadly discussed developments in the U.S. energy sector over the past 100 years. He spoke about the vastness of energy, why it is difficult to change, and the timeframe that investors should consider when investing.

Firstly, as an investor dabbling in cleantech, here are the 4 most important things you should know about energy:

1. Energy is really big

2. Access to energy makes our modern standard of living possible

3. Energy transformation takes decades

4. Always look for energy startups that have competitive unit economics and rely on today’s infrastructure

All in all, investing in the energy industry is definitely for the long-term as it is impossible to scale up quickly and achieve an ROI in 3, 5, or 10 years. Here’s why!

Factors That Make It Hard to Change Energy

Here are a few of the factors outlined by Max:

- Energy is cheap, big, and heterogeneous.

- A large demand for energy is coming from the developing world.

- The economics of the energy sector requires technologies with greater durability.

- ‘New’ is expensive and slow compared to other industries.

- Most energy is used by industries and not individuals.

Most importantly we need to accept that energy is extremely hard to change for several reasons:

1. It is huge 2. Everyone uses it 3. It’s diverse 4. No one wants to use less of it

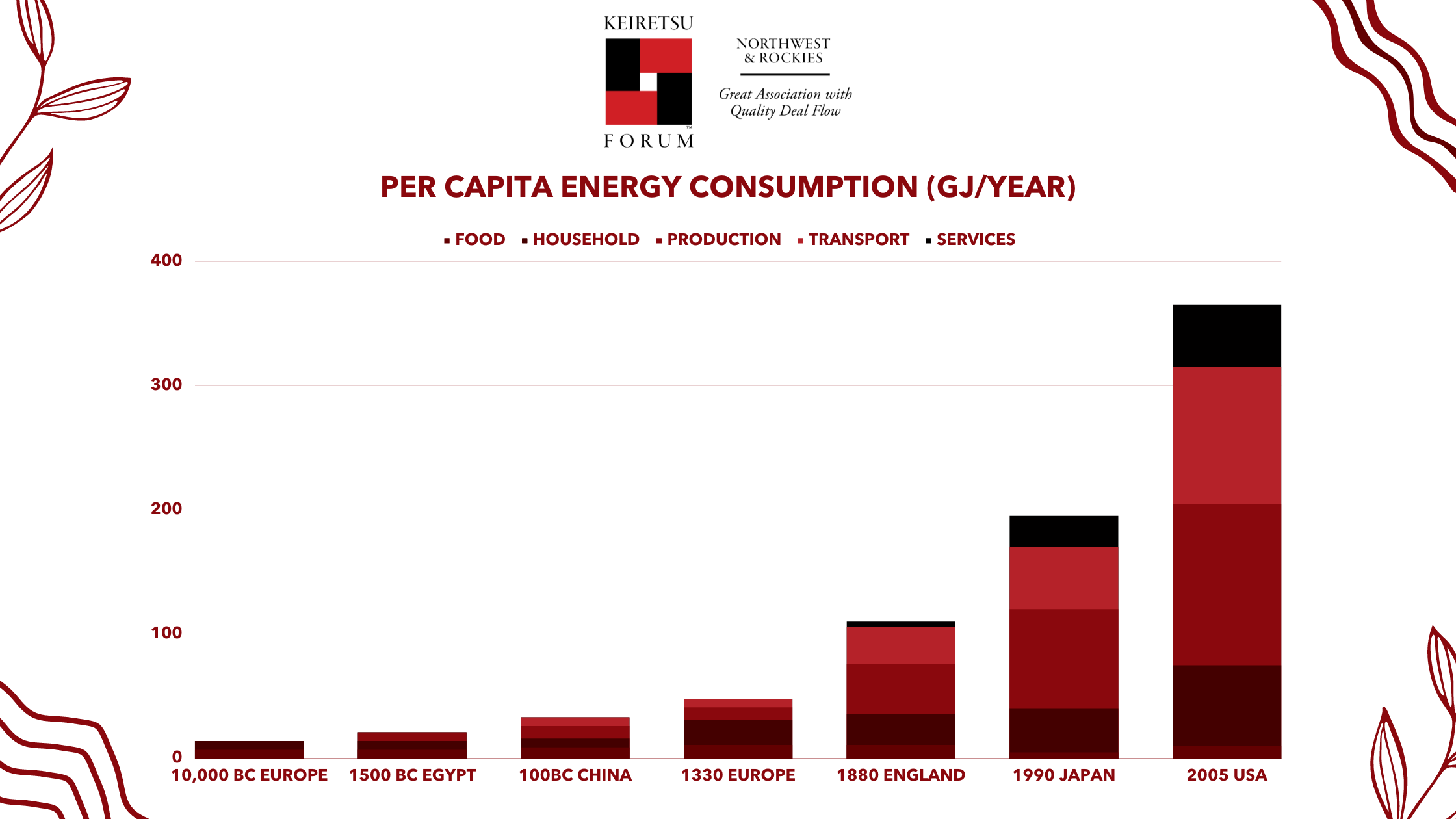

The graph above paints a picture of the annual gigajoule (GJ) energy usage per person for the last 10,000 years. The energy consumption was negligible 10,000 years ago, but today it is quite high.

There has been exponential growth that started in the late 1700s to the early 1800s. The Industrial Revolution which was gaining momentum during this period is what led to the increase in energy usage. More than technological innovation, it was the realization of how to transfer energy more easily that propelled the growth of consumption by the masses. This event was the catalyst for energy becoming cheaper and more accessible. Europeans, Americans & Canadians since then have been steadily increasing their energy usage.

So, over the past 100 years, this is how energy has impacted the world around us:

- In the late 1800s, the steam turbine was invented.

- In the 1900s, Thomas Edison worked with JPMorgan to build the electricity grid.

These inventions are the backbone of the modern era. Max points out that these inventions took place nearly 150 years ago and we are still using these technologies today.

Energy for Human Development

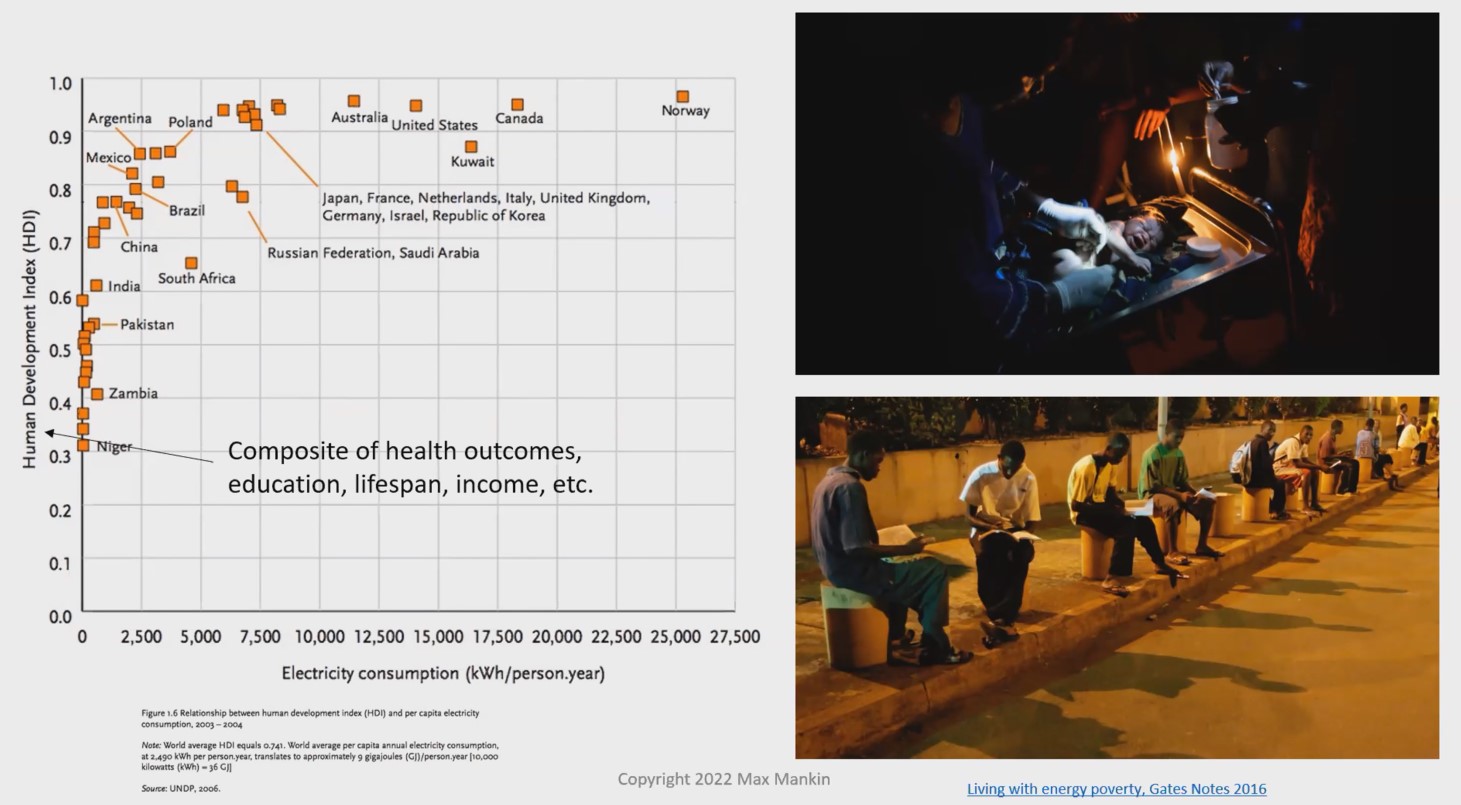

The graphic above represents the Human Development Index of developing countries against developed ones with the main comparison being electricity consumption per capita.

The index peaks for countries like the US, Canada & Australia. On the other hand, the sub-Saharan countries and the Middle East are on the other end of the spectrum. Max states that energy usage determines the quality of life.

Here’s an example: If a person is born in a country with low energy usage, there are chances that their entire life trajectory is highly shaped by it. Since they don’t have electricity, they don’t have access to amenities like heaters, and lamps. Without adequate power, they cannot study efficiently, which might affect their performance in school, which in turn will impact their future job prospects. Usage of energy also impacts their nutrition, health, sanitation and overall development. Thus, proving that energy is linked to the quality of life.

The Slow Growth of Energy

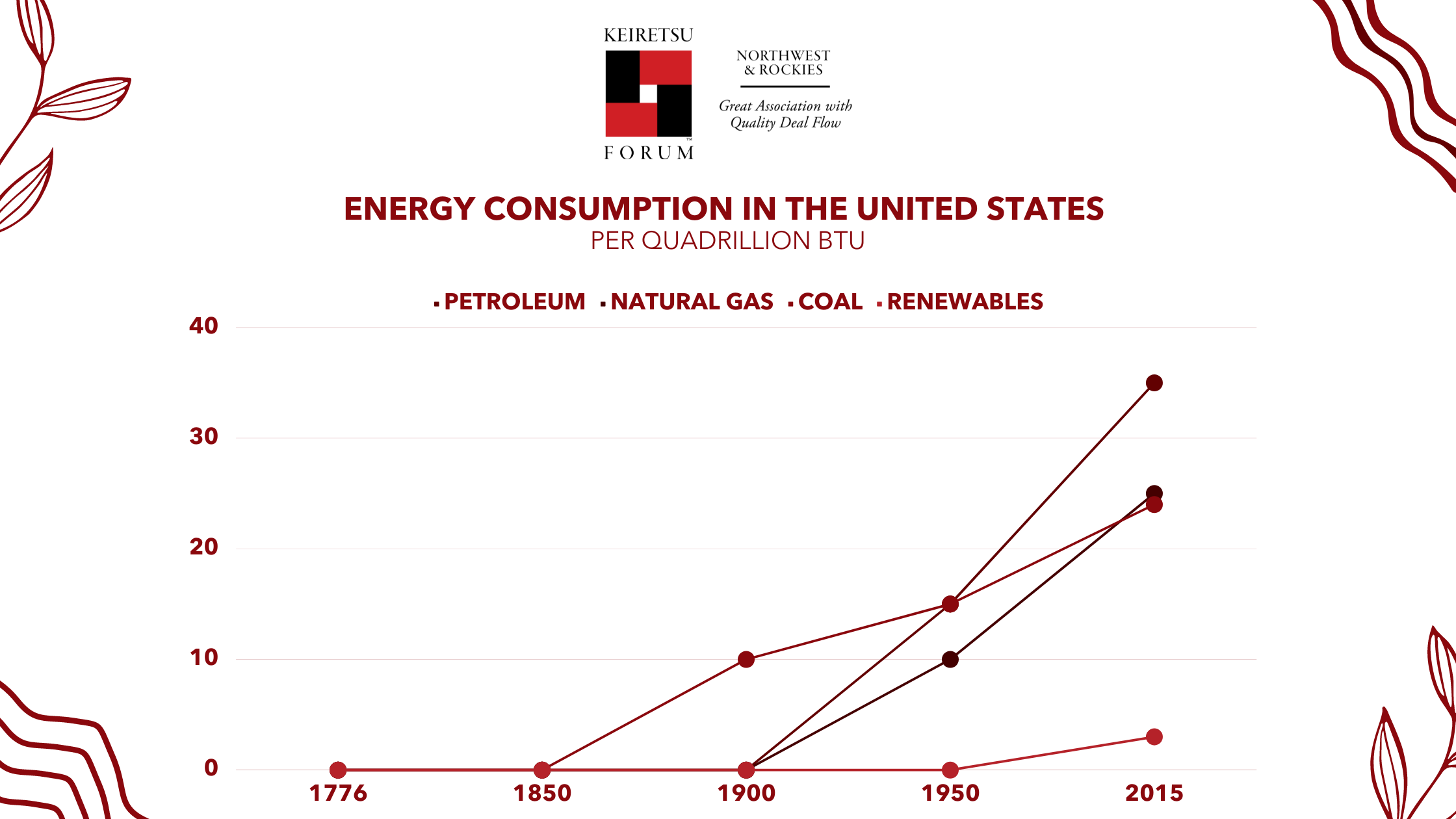

As Max stated, energy is really big, but also very slow to change. The graph above shows year-on-year energy consumption in the U.S. The timeline factors the transition, from using less energy in the 1700s to the present day,

- Before 1850, people used biomass such as firewood for heating homes

- After the invention of the steam turbine in the late 1800s, companies burnt coal to generate electricity

- The 1900s saw the invention of cars & the installation of oil and gas pipelines

- The early 2000s saw the small but steady growth in the use of solar power

This chart clearly illustrates the changes in the energy market over the past couple of hundred years. The growth and adoption of new sources of energy in order of magnitude take decades if not months, investors should consider this factor when investing in cleantech.

This chart clearly illustrates the changes in the energy market over the past couple of hundred years. The growth and adoption of new sources of energy in order of magnitude take decades if not months, investors should consider this factor when investing in cleantech.

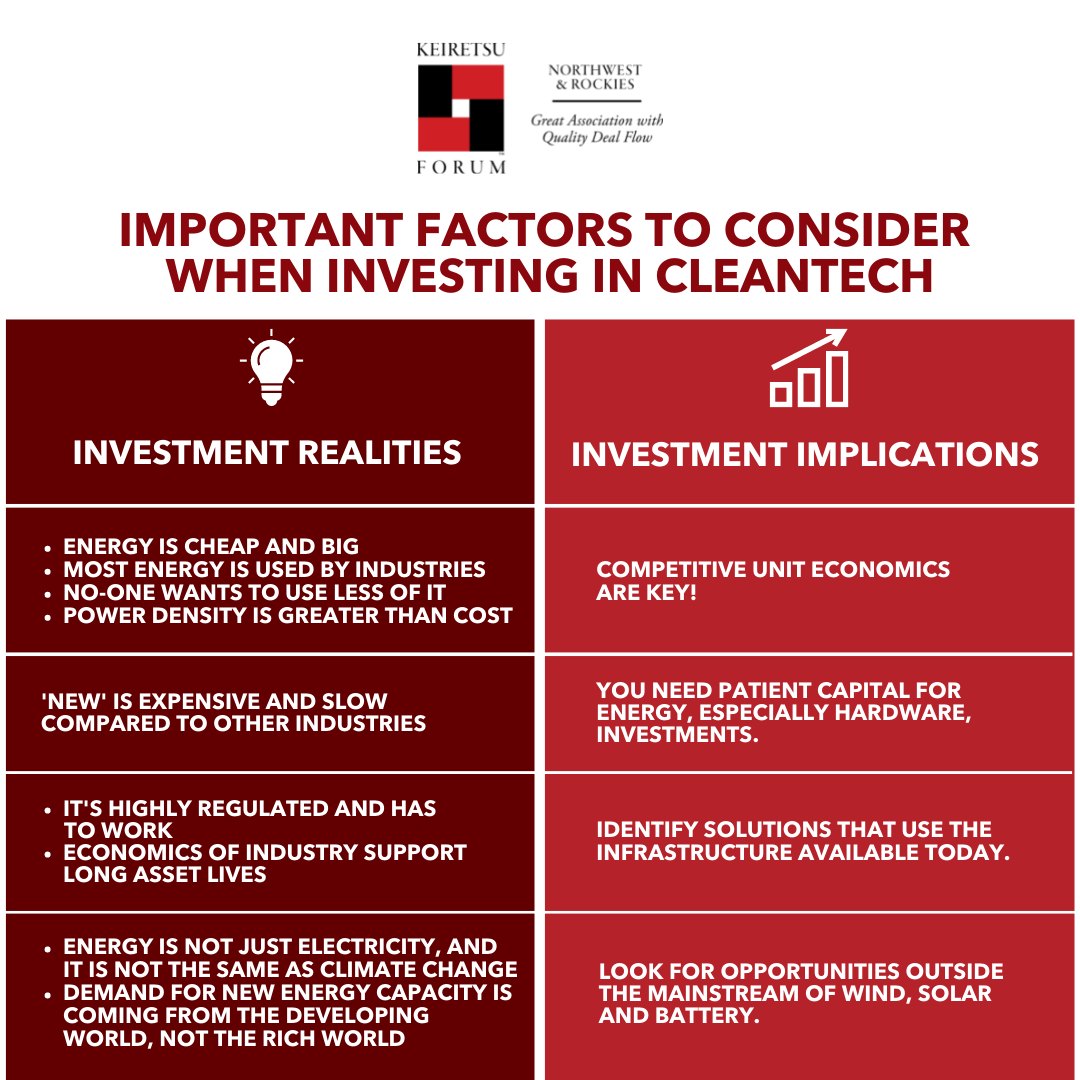

So how can investors make better cleantech decisions?

Here are 4 main lessons for investors:

Competitive Unit Economics: Because energy is cheap, you need to be competitive. If your clean technology solution costs more than the current market rate, you cannot succeed.

Identify solutions using today’s infrastructure: Always be cautious of cleantech companies talking about cleantech solutions based on the technology of the future. Any kind of transformation in this sector will not happen in 3,5 or 10 years, it will minimum take at least 30 to 50 years.

Patient Capital: You need patient capital, also known as long-term capital, especially if it is a hardware investment.

Look for Opportunities: While solar, wind, and batteries get a lot of attention in the media, as an investor, look beyond these areas for deal flow opportunities, especially in energy sources that get very little attention.

About the Speaker:

Max Mankin is the co-founder and CTO of Modern Electron, a sustainable energy technology company with the mission of affordably and practically decarbonizing heat and power. He has a decade of experience building and leading teams, as well as designing, fabricating, and characterizing energy systems and functional materials. At Modern Electron, he leads a team of45 scientists, engineers, and technicians; rectifies product and market requirements with technology; and sets company market and technology strategy. You can watch his keynote here.