"How much of the company will I still own by the time we reach Series D?"

Let's face it: this question constantly runs through every entrepreneur's mind. Even though you know what will transpire, the reality is shocking.

By the time your early-stage company hits Series D, you may own less than 12% of the company, according to Carta's 2025 Founder Ownership Report. This is how the story goes – founding teams experience steep dilution in their ownership across early funding rounds, particularly from Seed to Series B. While raising capital is essential for growth, understanding the cost of capital in terms of equity is critical for any entrepreneur, and increasingly important for angel investors who oversee the entrepreneur's performance incentives.

In this blog, we'll explore how equity dilution unfolds across fundraising stages, examine how it differs by sector (SaaS, Fintech, and Biotech), and share practical implications for innovators and investors.

The Big Picture: Dilution Across Rounds (2020–2024)

Let's start with the overall trend. According to data from early-stage companies that raised priced rounds between 2020 and 2024, entrepreneurs typically own:

- 56.2% after a Seed round

- 36.1% after Series A

- 23.0% after Series B

- 15.7% after Series C

- 11.4% after Series D

The most significant decline in ownership happens between Seed and Series B, where business leaders often trade large equity portions for capital needed to validate their product, gain early traction, and build a team. This period is where leaders typically give up the most control.

By the time a company reaches Series D, it's not unusual for entrepreneurs to hold less than 12% collectively — a figure that can be even lower in capital-intensive sectors. This has real consequences, from weakened control to diluted motivation. But as we'll see, the journey isn't uniform across industries.

SaaS: Moderate Capital Needs, Higher Equity Retention

Dilution is relatively gentler in SaaS than in other sectors. Entrepreneurs in SaaS businesses begin with a median of 57.8% equity post-Seed, which declines to 38.2% after Series A, and 26.5% at Series B. By Series D, the median founding team still retains about 14.1% — slightly above the overall cross-sector median.

Why does SaaS preserve equity better? Two words: Capital efficiency. SaaS businesses typically scale with leaner teams, digital-first products, and recurring revenue models. These characteristics mean that early milestones (like product-market fit and revenue traction) can be achieved with smaller funding rounds, resulting in less dilution per stage.

Moreover, strong unit economics in SaaS attract competitive investor interest, often allowing founding teams to negotiate higher valuations — another buffer against excessive dilution. The takeaway is that technopreneurs, with the proper growth trajectory, can preserve more ownership while still accessing capital.

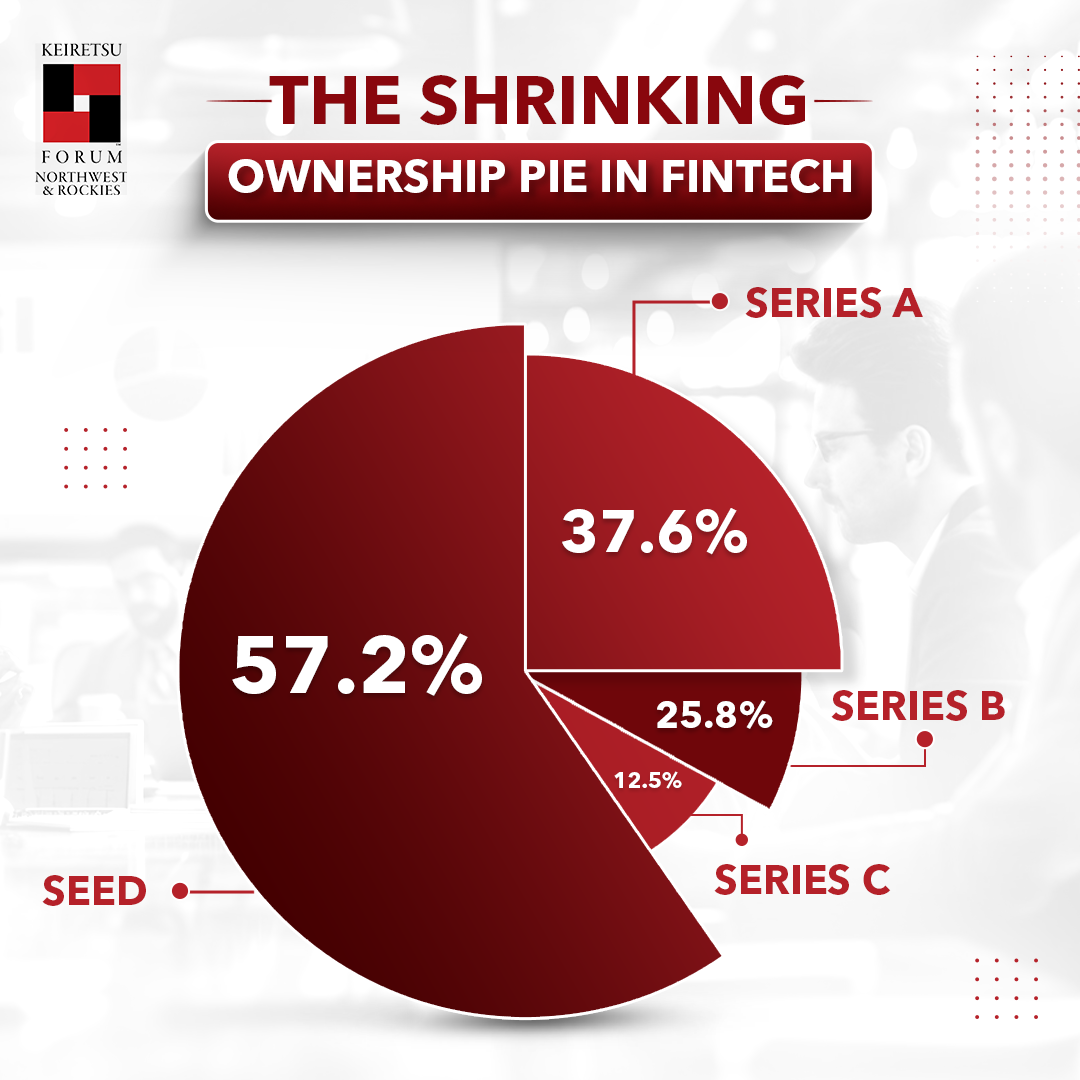

Fintech: Similar Path, Slightly Steeper Slopes

Fintech companies show a similar pattern to SaaS but with slightly heavier dilution, especially in later rounds. Entrepreneurs begin with a median of 57.2% at Seed (almost identical to SaaS), but by Series A and B, ownership drops to 37.6% and 25.8%, respectively. In Series D, the equity drops to just 12.5% of the company.

The difference often stems from regulatory overhead and infrastructure costs unique to fintech. Whether it's compliance teams, security architecture, or licensing, fintech companies usually need to raise more upfront to build trust and meet legal standards.

This leads to bigger early-stage rounds and, consequently, more dilution. Still, many fintech businesses remain relatively lean compared to Biotech or deep-tech ones, as they rely more on tech and less on manual efforts. This is why they have a healthier equity plan compared to capital-heavy sectors.

Biotech/Pharma: Early Capital, Early Dilution

Biotech and Pharma companies tell a very different story in the Carta study. Entrepreneurs already retain significantly less ownership at the Seed stage — a median of just 45.8%. After Series A, that number plunges to 25.2%; by Series B, founders typically own only 10.8%. In Series D, that figure dips to 8.1%, the lowest among the sectors studied.

This steep curve is a reflection of the industry's unique nature. Drug development, clinical trials, and regulatory approvals are expensive and time-consuming. Businesses in this space often raise large rounds early, not to scale, but to survive. There is typically no revenue for years, and investors fund long research timelines in exchange for significant equity stakes.

As a result, Biotech entrepreneurs face early and unavoidable dilution. In many cases, scientists or researchers who start these companies take on more minor roles over time, making way for professional CEOs or management teams who can handle commercialization and fundraising. This sector often relies on non-equity incentives like earnouts, milestones, or IP royalties to keep the leaders engaged even when their ownership drops below 10%.

Moral of The Story: Dilution is Inevitable, But Control is a Choice

Equity dilution isn't just an entrepreneur's concern or an investor's checklist item — it's the shared narrative of a company's growth, ambition, and strategy. Every line on a cap table reflects a decision: how much to raise, when to raise it, and what that capital was meant to achieve.

If you are an entrepreneur, dilution is difficult for you; we get it. It feels like giving away the ownership of something close to your heart. But it's not about how much you own today; it's about how you protect your influence, your motivation, and your ability to steer the ship in the long run. Every raise should be a strategic move, not a desperate one. Plan a few rounds ahead. Know your sector's benchmarks. And negotiate with the confidence that you're building something truly valuable — not just for investors, but for yourself and your team.

If you're an investor, take a moment to look at the cap table. It's not just numbers; it's a trail of decisions. A well-structured cap table means this leader knows how to manage resources, pace their growth, and protect long-term value. A messy one? That's a red flag. Of course, some sectors, like Biotech, come with their own rules, and high early dilution might be expected, but in most cases, alignment matters more than anything.

Ultimately, whether you’re writing checks or chasing product-market fit, we're all working toward the same thing: sustainable, meaningful growth. And that means building (or backing) companies where everyone around the table is motivated, empowered, and invested in the journey, not just the outcome.