Imagine you are an entrepreneur finding your feet. You've got a killer idea, a rockstar team, and a burning drive to disrupt your industry. In a dog-eat-dog world, however, promise and theory alone won't cut it: you need capital to turn your dream into reality.

So you take those necessary steps and power through never-ending meetings. You pitch your idea to the right investors and generate interest. All goes well and soon... you receive an unassuming document that might just kickstart your fundraising journey. The document is what is called a term sheet.

What is a term sheet and why is it important? We'll answer that question in today's #BackToBasics blog. Later, we will also look at how to structure a deal and how much percentage to give an angel investor. So without delay, let's find out –– what is a term sheet?

In the Beginning: Term Sheet Definition and Purpose

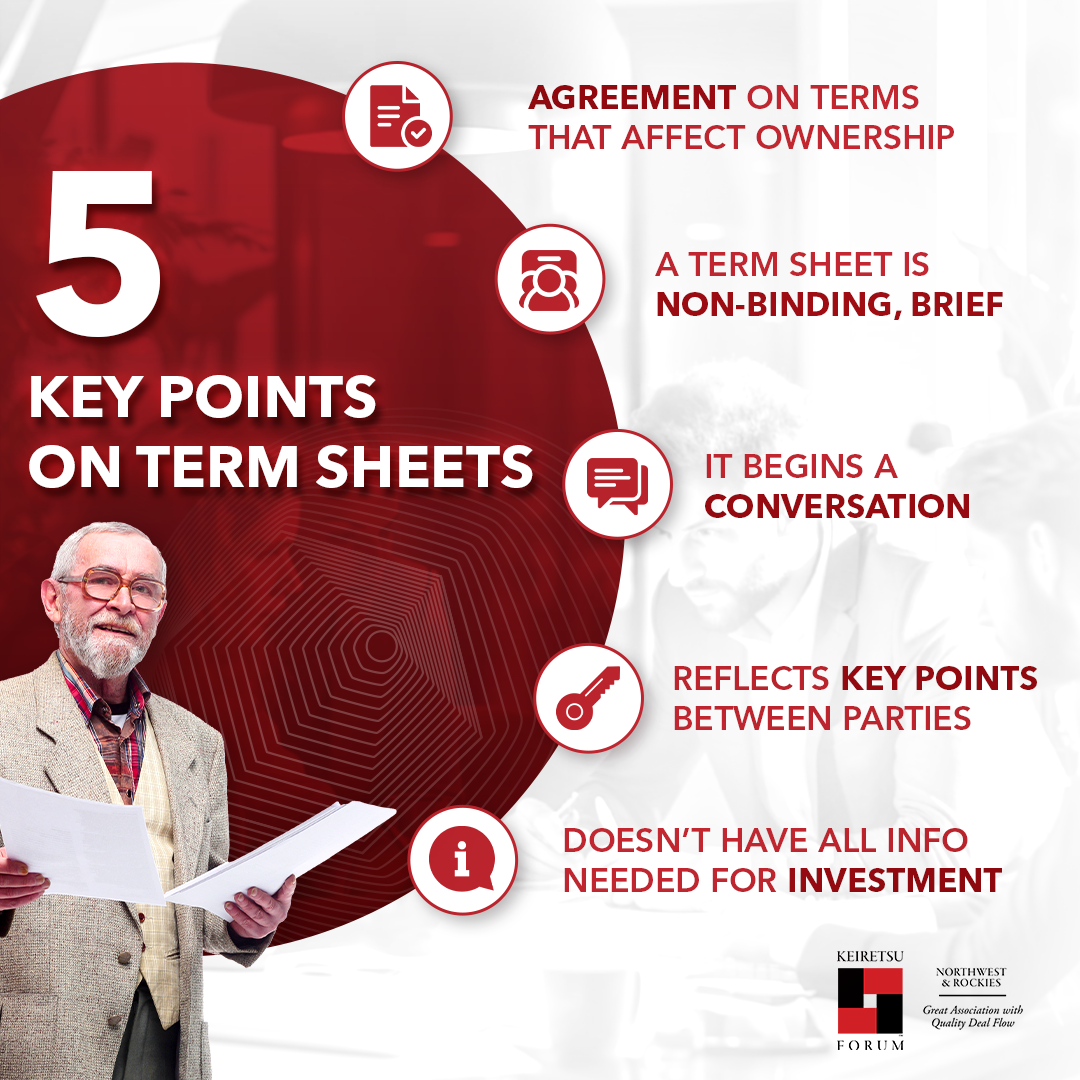

Mark Girouard, CEO and Founder at Stage Right Ventures, spoke to Keiretsu Forum about the science of term sheets. He said, "A term sheet is someone's idea of a potential agreement of terms that affect the ownership claims. It begins a negotiation and hides many potential points that an investor and a company will eventually agree upon implicitly or explicitly. It is a beginning, that's all!"

Think of a term sheet as the pregame to signing the official investment contract. It outlines all the key terms and conditions proposed by the investor. While not legally binding, it sets the basic framework and allows both parties to weigh their interest before diving into lengthy legal paperwork. It's the first real conversation about making that deal happen.

A term sheet serves as a preliminary roadmap for the deal, summarizing the crucial points before detailed legal agreements come into the picture. In most cases, it may be offered by the company raising money, but the investor could table it first. A term sheet allows parties to talk about something rather than send a huge investment agreement to start the conversation.

By laying out the core elements upfront, the term sheet helps streamline the negotiation process and minimize potential roadblocks later. But wait, before we figure out what is in a term sheet, let's find out...

What a Term Sheet Is Not

While the term sheet serves as a crucial starting point, it's essential to remember that it's not an all-encompassing document. It doesn't capture every intricate detail of the agreement. It is like the tip of the iceberg – it serves as a starting point. A term sheet does NOT include:

- Informal discussions: Coffee shop chats or casual meetings aren't on the term sheet's pages.

- Prior agreements: Existing term sheets or agreements with other investors.

- Side letters: Any separate agreements between the parties, addressing specific details not covered in the term sheet, are not in the term sheet.

- The full agreement and understanding of all related parties: The term sheet cannot capture the complete understanding and nuances of the relationship between the startup and all its investors. Due diligence, clear communication and transparency are essential throughout the process.

As Mark says, "Term Sheets are non-binding, brief, general, limiting, and shouldn't be agreed without deeper introspection, meditation, and assessing the love capacity of all parties."

Term sheets are the star players during priced funding rounds, where the startup's valuation takes center stage. This is often the case in Series A rounds and beyond, where startups have gained some traction and are seeking larger investments to fuel their growth ambitions.

What Does a Term Sheet Include?

Within a term sheet, you'll find provisions that lay the groundwork for the entire deal. Here are some components you may find in a term sheet:

- Investment amount: This outlines the specific amount of money the investor is willing to invest in the startup.

- Valuation: The all-important number that acts as a crux of the investment and defines your startup's worth. The term sheet will have the pre-money valuation (the company's worth before the investment) and the post-money valuation (the company's value after the investment).

- Type of investment: This specifies the nature of the investment, whether it's equity (ownership stake in the company), debt (a loan that needs to be repaid with interest), or a convertible note (converts to equity at a later date).

- Liquidation preference: This clause determines how investor exits are prioritized in case of company liquidation or bankruptcy. It defines the order and amount in which they will receive their investment back, ensuring their interests are protected.

- Board Representation: In this section, who gets the board seats is laid out. It mentions if and how investors get voting seats to weigh in on big decisions.

- Rights and Protections: A right of first refusal gives existing investors the option to purchase any shares a founder wants to sell before they can be offered to outsiders. This helps investors maintain their ownership percentage. Pro rata rights give investors the ability to participate in subsequent fundraising rounds to maintain their proportional ownership.

- Stock option pool: This section sets aside a specific number of shares for employee stock options, which may be used to incentivize and attract top talent

- Tag-along clause: Allows minority shareholders to sell their shares at the same price as majority shareholders,

- Drag-along clause: Requires all shareholders to sell their shares if a specified percentage of shareholders (say 80%) agree to an acquisition offer.

Now that we have a fair overview of a term sheet's essence, let's look at a vital zone of the investment process associated with deal terms –– structuring the deal and negotiating it.

How to Structure and Negotiate the Deal

Structuring the deal is laying the foundation of your investment agreement. It involves defining the ownership and other key aspects of the investment, ensuring a solid base for your startup's growth.

When it comes to equity ownership structures, angels may be offered the following in return for their funds:

- Common stock: Represents the ownership rights, with voting rights and the potential for dividends.

- Preferred stock: Offers various privileges like liquidation preference (priority in receiving investment back during liquidation) and cumulative dividends (unpaid dividends accumulate and are paid before common stockholders receive any distributions).

- Participating preferred stock: It combines features of preferred and common stock, offering liquidation preference, dividends, and the ability to share in remaining assets like common stockholders during liquidation.

- Convertible notes: Short-term debt instruments that convert to equity at a later date.

Choosing the appropriate ownership structure depends on the specific needs of your company and the investors' preferences. Consult with legal and financial advisors to determine the most suitable structure for your situation – they'll be your trusted architects in designing the blueprint for your investment agreement. Moving on, here's how a founder may approach negotiations.

How to Negotiate a Term Sheet

When negotiating the term sheet, founders must get a deep understanding of the document's content, legal counsel, and a clear vision of the company's goals. It's an opportunity to ensure the terms are fair, beneficial, and sustainable for both parties – and a test of your entrepreneurial prowess.

Before you hit the negotiation track, familiarize yourself with the terms and their implications. Consult a lawyer specializing in startup financing – they'll be your guide through the legal nuances, helping you identify potential pitfalls and ensuring your interests are protected. Identify the aspects of the deal that are most crucial to your company's success. Research market benchmarks for similar deals in your industry, and network with other founders who have navigated the fundraising maze to gain invaluable insights and advice.

Remember, the art of negotiation is all about creating value for both parties.

Aim for a win-win situation that benefits both the company and the investors. Demonstrate the potential for growth and ROI for the investor while advocating for terms that ensure your company retains sufficient control and flexibility for future growth.

Be prepared to discuss, revise, and compromise – negotiation is an iterative process, much like the journey of entrepreneurship itself. And if the terms don't align with your company's long-term vision, don't hesitate to walk away from a deal that could potentially derail your path to success.

Now, coming to a vital cog in the term sheet wheel, let's answer a question that many new entrepreneurs have.

What Percentage Should You Give an Angel Investor?

Ah, the age-old question that every founder grapples with – what percentage should you offer an angel investor? Well, there's no one-size-fits-all answer. Angel investors could claim anywhere between 10% to 50% ownership stake in early-stage companies, but this range is flexible.

The ownership is influenced by several factors, including the stage of the company, the size of the investment, and the valuation of the company. Earlier-stage companies with less traction may offer a higher percentage to attract investors, while later-stage companies with a proven track record may be able to negotiate a lower percentage.

So once the term sheet has performed its functions, where do we go from here? To wrap up the blog, let's look at...

What Happens After a Startup Signs a Term Sheet?

Signing the term sheet marks an important milestone, but the race has just begun. Brace yourself, for the following steps await after inking that term sheet:

- Due diligence: Investors conduct a thorough investigation of the company's financials, legal standing, and market potential. This process may involve reviewing financial statements, interviewing key personnel, and conducting market research – think of it as a full-body scan to ensure your startup is in good shape.

- Negotiation of legal documents: Based on the findings of due diligence and further discussions, the parties finalize the legal agreements that govern the investment. These agreements typically address details like reporting requirements, board representation, and exit strategies – the rulebook that defines the game.

- Closing: Once all legal documents are signed, and any conditions are met, the investment is finalized, and the funds are transferred to the company – the moment you've been waiting for, the fuel that propels your startup dreams forward.

The timeframe for completing the investment process after signing the term sheet can vary, typically taking four to eight weeks to close the deal. But fear not, for with patience and perseverance, your startup will emerge victorious, armed with the resources needed to conquer new frontiers.

In summary, what the term sheet is –– a crucial component of the startup financing journey, serving as:

- A preliminary roadmap for the investment agreement, setting the stage for negotiations.

- A platform to outline key terms like valuation, investment type, and ownership structure, shaping the foundation of the deal.

- A starting point for negotiating fair and beneficial terms for both parties, ensuring a win-win situation.

- A precursor to due diligence, legal document negotiations, and the closing process, guiding you through the intricate steps.

- A stepping stone towards securing the funding needed to bring your vision to life.

Sources:

Mark Girouard’s Keiretsu Forum keynote, “The Science of Term Sheets”: https://muse.ai/v/doMjeDV

https://www.svb.com/startup-insights/raising-capital/read-startup-term-sheet/

https://online.hbs.edu/blog/post/term-sheet-for-investors

https://carta.com/blog/term-sheets/

https://sifted.eu/articles/details-term-sheet-actually-mean