Consider Snapchat, a pioneer in limited-time photo-sharing with 414 million daily active users. It must be the only app that does this, right? No. Instagram Stories replicated its core feature, leveraging Meta’s ecosystem to outcompete Snapchat with more than 500 million daily active users. Juicero, the high-profile startup backed by $120M in funding, failed partly because it lacked IP that differentiated it from competitors, leading to a rapid market collapse. Meanwhile, Qualcomm has built a multi-billion-dollar empire by aggressively patenting its technology and licensing it out, generating billions in royalties.

The point here is that we live in an era where it is very easy to replicate your business if you do not have the moat of Intellectual Property (IP) protection. Whether it’s Tesla’s open-source patent strategy, Apple’s aggressive trademark enforcement, or Google’s vast patent portfolio, companies that treat IP strategically have a lasting edge.

Let’s deep dive into the impact of IP on your growth prospects and a few things you should know before drafting an IP strategy.

The Cost of Neglecting IP Strategy

Businesses start with enthusiasm and a strong vision, but the harsh reality is that 90% of them fail. Many struggle to scale, plateau, or get pushed out by well-established competitors. What separates the survivors from those who fade away? One key factor is intellectual property protection or the lack of it. Without a well-defined IP strategy, you may face significant challenges that can lead to irreversible setbacks.

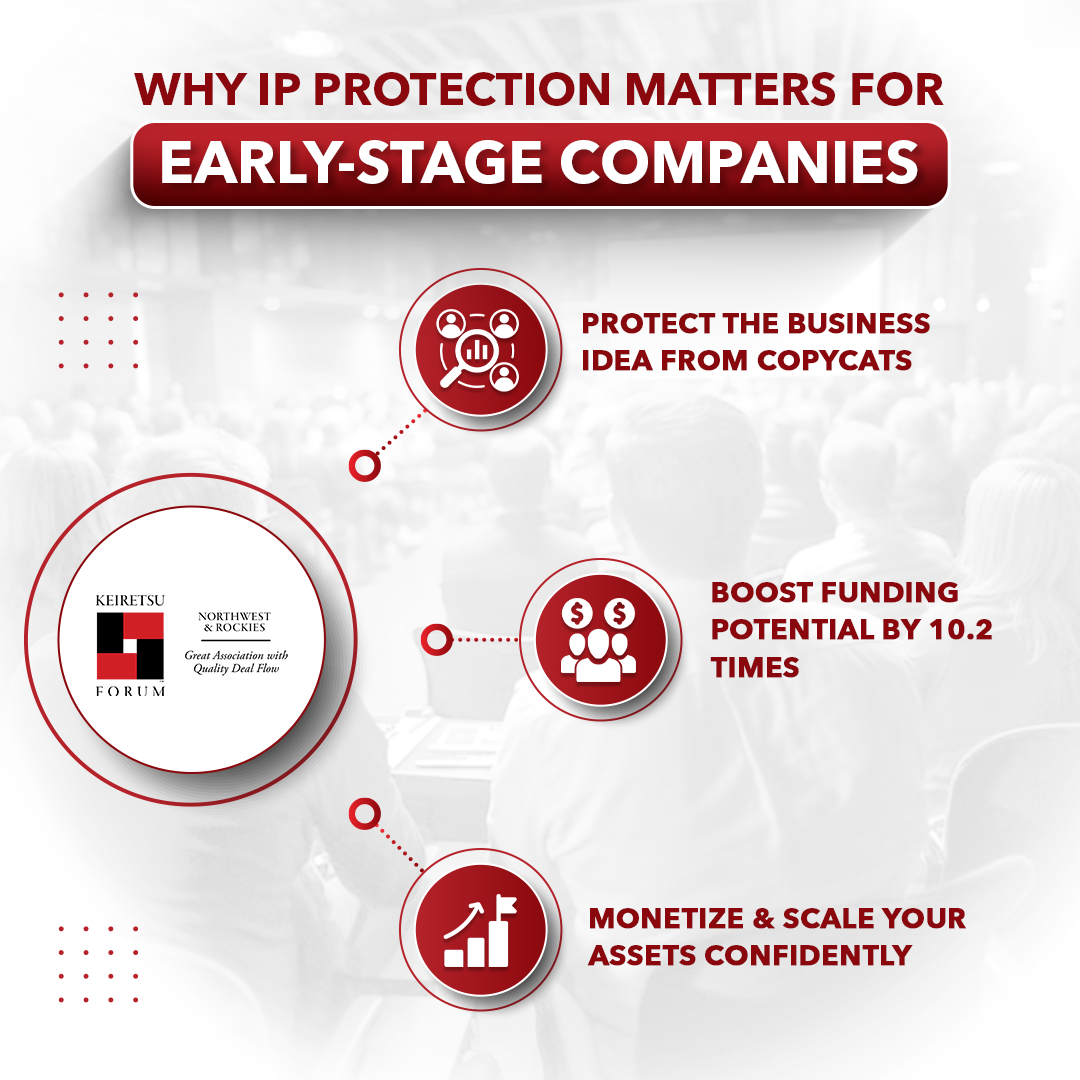

First, lacking IP protection leaves you vulnerable to copycats and industry giants. Larger corporations have the resources to monitor emerging innovations and, without legal barriers, can replicate ideas, outpace the original innovator, and dominate the market. Businesses without patents, trademarks, or copyrights often find themselves in legal battles they cannot afford or, worse, shut out of the market entirely.

Second, investors are wary of startups without a strong IP foundation because they are a risky bet. Even if the product is innovative, investors need assurance that you can protect your market position. Patents and trademarks improve your odds of raising funds by 10.2 times versus your peers without IP protection.

Additionally, IP protections can help you monetize your services. Successful companies generate revenue through licensing agreements, strategic partnerships, and brand equity. Without trademarks, you are running the risk of brand dilution; without patents, you can miss licensing opportunities; and without copyrights, you lack control over original content.

Since the America Invents Act (2011), the patent landscape has shifted, making it harder for smaller companies to compete. Large corporations leverage their vast patent portfolios to create legal roadblocks for smaller players. In this environment, startups that only secure one or two patents may find the investment insufficient. Instead, leveraging trade secrets with copyrights and strong internal security measures can be a more practical approach.

Without an IP strategy, you’re not just at risk of failure, you risk being erased from the market entirely. On the other hand, those who invest in a solid IP foundation early on gain a competitive edge, attract investors and secure long-term sustainability.

The Three-Legged Stool of IP Strategy

A successful IP strategy is more than simply filing patents. It’s a balancing act between three pillars:

- Finance – Many startups underestimate the financial aspect of IP protection. Securing patents, trademarks, and copyrights requires a well-planned budget, but entrepreneurs often only recognize this necessity when it’s too late. Without financial planning, companies may be unable to protect their innovations effectively or enforce their rights in legal disputes.

- Legal/IP Law – This is typically the first stop for businesses, as they seek legal counsel on patents, trademarks, and copyrights. However, legal protection alone does not ensure business success. Many companies focus too much on acquiring IP but fail to integrate it strategically into their business model. Poorly structured IP portfolios can lead to costly legal battles or patents that provide a slight competitive advantage.

- Technology & Market Strategy – The actual value of IP emerges when it aligns with the company’s broader market and product strategy. You may have strong patents, but you are underutilizing your IP assets if they do not align with product development, branding, and commercialization.

Neglecting these three pillars can result in weak IP protection, limited monetization opportunities, or exposure to legal risks. Successful startups treat IP strategy as an ongoing, dynamic process rather than a one-time legal task. By ensuring a balanced approach between finance, legal protection, and market strategy, companies can position themselves for long-term success while mitigating risks associated with inadequate IP management.

The Four Shades of IP Strategy

Your IP strategy should be centered around four elements, each representing different levels of business maturity:

- Freedom to Operate – Ensuring your business won’t get sued for infringement. This is the most basic level of IP protection that many startups focus on.

- Cost Advantage – Using IP to lower costs, increase margins, and improve market share. This can involve proprietary technology, branding, or process improvements.

- Differentiation – Developing foundational IP that sets your company apart. If your technology is groundbreaking (especially in hardware), it may be worth patenting. However, in software, trade secrets and copyrights are often a better approach to avoiding copycats.

- Monetization – Building an IP portfolio that generates revenue through licensing. This is the Qualcomm or Disney model, where companies own vast IP portfolios that become their primary business asset.

Think Long-Term About IP

Most early-stage companies don’t think deeply about IP until a triggering event forces them to. You must avoid this mistake and leverage your IP assets right from the beginning of the company’s journey. Whether securing a trademark for branding, filing for a key patent, or keeping proprietary technology as a trade secret, the right strategy can make a difference in long-term valuation. IP is about creating tangible business value, and in today’s competitive market, that’s something no startup can afford to overlook.

References

Excerpts from Matt Moyer’s keynote Intellectual Property Strategies for Early-Stage Companies