Angel investor Mike Markkula gave away $250,000 of his fortune in 1977 to fund an unknown company run out of a garage by two college dropouts. Many would have passed on the deal. Mike didn't. Today, that company is worth nearly $3 trillion. Moral of the story: if you're looking to ask angel investors for money, you could use the vision and confidence of a young Steve Jobs.

But if you're not one of the greatest entrepreneurs in history yet, hang on! There are other ways to persuade angels to fund your dream. It's hard to believe that despite the piercing questions, intense glares, and loop-hole finding, investors are looking for reasons to invest in your startup! So what do you say to an angel before asking them for money? How do you get the proposition and timing right? Worry not. We will look at ways to boost your funding chances with angel investors. Let's also examine how much money you could ask an angel for and what not to say to them! Ready?

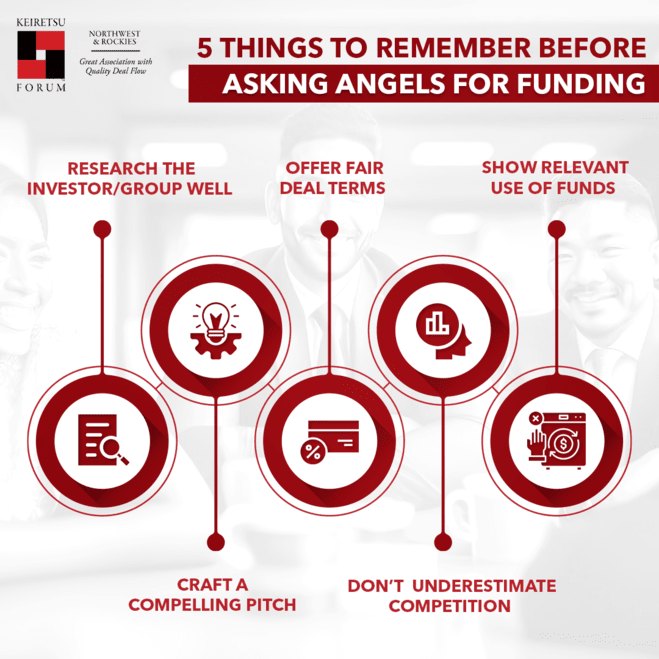

A Step-by-Step Guide to Ask Angels for Funding

Research: Before meeting with individual investors or angel groups, soak up knowledge and make research your best friend. Understanding your investors and what excites them will help you create a persuasive narrative tailored to them. Go through the investor or angel group's background and past investments. Analyse their industry preferences.

Pitch: If the alignment fits, craft a compelling pitch for the investor. It needs to convey the essence and potential of your business. Talk about the problems your company solves in the marketplace. Provide a detailed picture of your revenue model and how your business will make money. Show them a demo!

Your pitch is the golden key to your fundraising efforts.

You should also show evidence of your growth potential and any expected milestones. Angels will ask you how your product or service has a unique value proposition and how safe it is from duplication. Answer these and any other tough questions confidently, without exaggeration.

Numbers: Before angels agree with your valuation, investors want to see financial projections that map out the path to an exit. You must know your financials, including cash flow and revenue streams inside out. Next, offer investors a realistic valuation and the right deal terms. These must align with your finances, the product, industry standards, and future rounds.

Network: Angel groups pre-screen investors so you don't have to worry about their ability to write you a check. The process of screening, presenting Q&As, funding and follow-ups is more streamlined and orderly at an angel network. Things can get messy without such a structure! If you want to ask an angel investor for money, you could start by researching local or national angel networks.

Angel groups give you the chance to target scores of investors in one go!

Connections: Trust and mutual respect are crucial before any cash can change hands! Establish ties with potential investors or angel groups before you approach them. The larger your network, the higher your chances are of stumbling upon the right investor. You can connect and engage with investors by boosting your network. Participate in industry events frequented by target investors and keep your social profiles updated.

Strategies to foster new relationships include

- Engaging in conversations at industry events and through mutual connections.

- Sharing updates about your business to keep potential investors in the loop.

- Being genuine in your interactions and showing interest in their work and insights.

When to Ask Angel Investors for Money?

Pre-revenue startups may not be eligible for bank or VC funding. Angel investing fills the gap and places risky bets on a company not yet in the big league. If you're a startup unqualified to approach VCs or banks, angels could help you. Timing is crucial. Identifying the optimal stage for investment can significantly influence an investor's decision. A lot depends on an angel network's funding criteria. Are you at a point where you're primed to scale operations or reach a pivotal milestone? You could approach angel groups who fund Seed or Series A companies.

Other signs include:

- Positive feedback and interest from your target market or industry experts.

- Demonstrated traction, such as user acquisition or partnership agreements.

- A clearly defined future milestone that will significantly enhance company valuation.

Leverage phases of market optimism to highlight the upsides of your business proposition. Positive sentiment can bolster the case for your startup's sky-high potential.

Before seeking an angel investment, ensure your company is structured for growth. Do you have a scalable operational process that can handle increased demand? What about strategic plans for hiring and expanding your team? Proof of concept with a product or service that demands expansion to reach its potential.

How Much Money to Ask from Angel Investors?

Angels hand out smaller checks than VCs. While there are no strict rules, think funding in the range of $50,000 to $500,000. However, your request will depend on the stage of your company and the deal terms you offer.

More restrictive terms will reduce the investment amount. Valuation is also important. How have you valued your company? Do the angels agree with the rationale? For instance, let's say you want a $250,000 check from an angel investor. You could claim such an amount if you offer 25% ownership in return and your (accepted) valuation is in the region of $1M. Lastly, the use of the funds matters as well. If you wish to expand your team or add a new dimension to production, the appropriate funds may be granted.

What Not to Say to Angel Investors

A conversation with potential investors can go south pretty quickly! It may be a lot about what you don't say as it is about what you say. Here are some key phrases and attitudes to avoid.

-

Avoid implying unrealistic valuations without evidence. Projecting inflated worth without substantial proof can discredit your business sense and turn savvy investors away.

- Avoid asserting value propositions without supporting data or estimations based on unsubstantiated future success. Do not be overconfident in the size and reach of your market without relevant market analysis.

- Next, don't dismiss the importance of your competition. Underestimating competitors is a common mistake that can make you appear naive and inadequately prepared.

- Don't say to an investor that they will get X% of ROI. There are few ways to be certain about returns and investors have their own forecasts too! If you are talking about ROI, present data in a range rather than talking about an exact number.

When you're asking angel investors for money, you must strike the right balance between optimism and realism. Investors know how to reject deals. They reject most of the deals they are offered. So when you lay out your business plans and financial projections, they should be grounded in solid, quantifiable data. Present your growth strategy with clear, achievable milestones, and remember that credibility is key to winning trust. Investors need to feel confident that you have a firm grasp on the numbers. The more you can demonstrate a comprehensive understanding of your enterprise and its potential, the more likely you are to secure the investment you're seeking!

Sources:

https://www.lightercapital.com/blog/five-steps-to-raise-capital-from-angel-investors

https://fastercapital.com/questions/How-to-Ask-for-Money-from-Investors.html

https://gust.com/blog/8-tips-on-how-much-money-to-ask-for-from-investors/

https://hbr.org/1986/05/how-much-money-does-your-new-venture-need