The world looks back at 2020 as the year of the pandemic that disrupted human lives, forcing us to learn from losses, adapt to new circumstances, and be prepared for everything. Private investors also have a similar outlook for 2020 but in a different context. A record number of companies went public during the year, but many ended their first day of trading in the red (McAfee Corp, Palantir Technologies, Root Inc., etc.). Early-stage investors had to endure a loss of $29.66 billion, just shy of the $37 billion lost during the dot-com bubble of the 1990s.

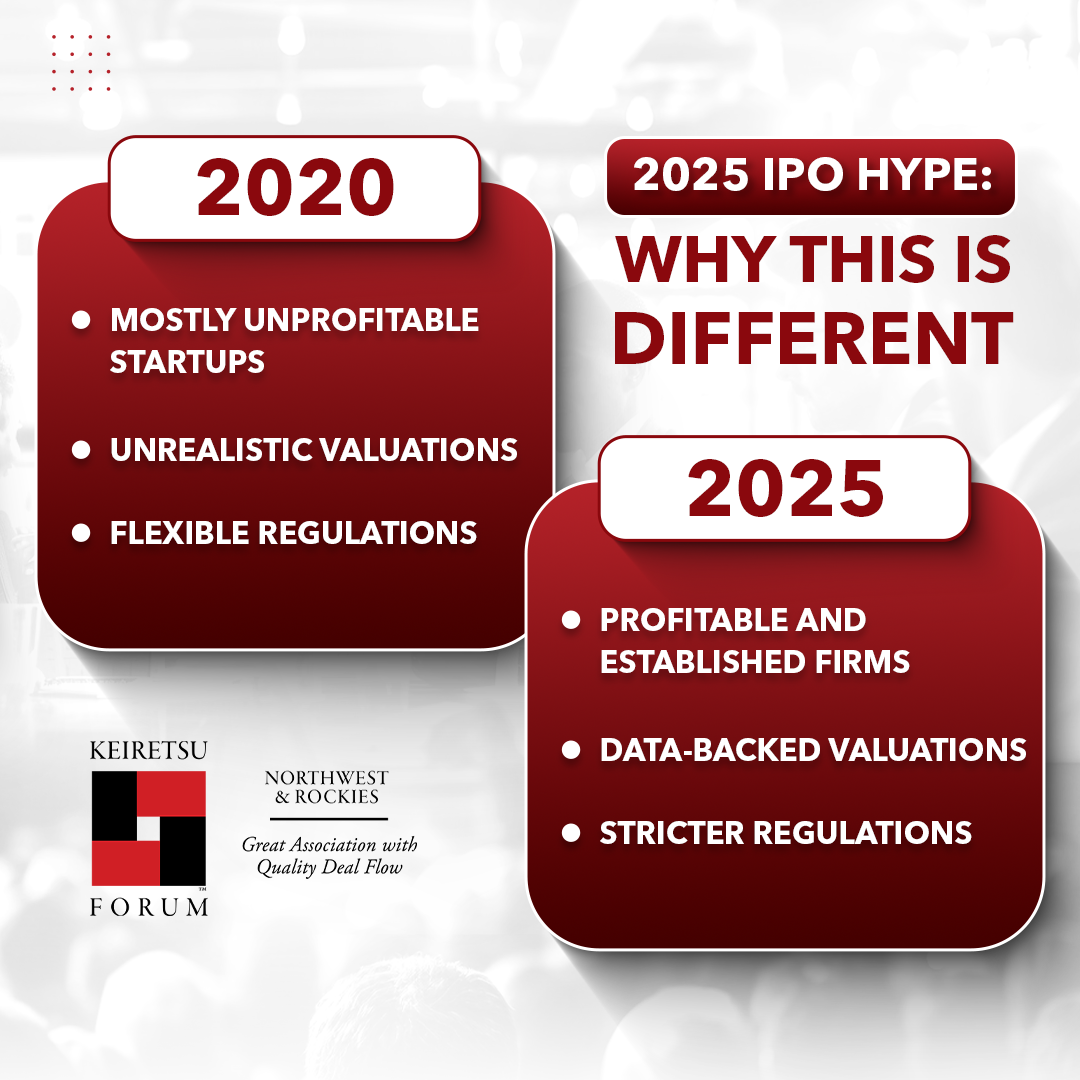

Now, in 2025, we are witnessing a similar resurgence. The last two years have stabilized the public market quite a bit, and once again, companies are thinking of going public. So, is investor confidence in IPOs back? Is it the right time for your portfolio company to go public? Or is it just another bubble waiting to burst? Let’s investigate.

Looking back at 2020 and 2021

The story begins in March 2020, when the global stock markets declined sharply due to the COVID-19 pandemic. In response, the US government announced cuts of 1-1.25% for federal funds to support the market during uncertain times. Naturally, the markets began to rebound. As remote work and online calls became the new normal, investors shifted their focus to tech companies developing remote work solutions. Medical companies also came under the spotlight as the race for developing the vaccine, face masks, and other medical equipment intensified.

The companies also saw an opportunity. The positive investor sentiment and high liquidity from the government meant it was a good time to go public. In 2020, 183 traditional IPOs raised approximately $70 billion. A year later, 908 companies raised $282 billion, making 2021 one of the busiest years for IPOs since the dot-com bubble. Special Purpose Acquisition Companies (SPACs) also became a dominant force, as they provided quicker access to the public markets without the lengthy IPO process. The SPACs accounted for over half of the IPOs in 2020 and raised $82 billion. Sounds like a fairy tale, right? Sadly, it was not.

The companies that went public in those two years depended on investor sentiment and incredibly high valuations. By the end of 2021, concerns about rising inflation and potential interest rate hikes began to unsettle the market. The Federal Reserve's decision to raise interest rates to combat inflation directly impacted equity valuations. Approximately 80% of IPOs were trading 19% (median) below their initial offering prices, bringing down investor confidence in the public markets. The aftermath extended to 2022, when only 149 IPOs were launched, raising $20 billion, almost 10% of last year’s valuations. The bubble finally burst.

Is History Going To Repeat in 2025?

Like every comeback story, the public market grew over the last two years. In 2023 and 2024, 379 companies launched IPOs and raised $63 billion. The investor sentiment is high once again. So, are IPOs back? The evidence suggests that 2025 may not be as big of a deal as expected.

The biggest lesson for investors from the IPO bubble was to focus on profitability, not revenue. As a result, investors are more cautious before making major decisions, that includes the IPO. The last two years of IPO activity were mainly driven by the AI hype and the Fed’s support, and the Fed is not expected to introduce more cuts until midway through the year. In December 2024, the Fed stated that the frequency and magnitude of cuts over the next few years will be more muted than previously forecast. So, investor confidence may be rising, but companies are still vigilant before going public.

Speaking of vigilance, the Securities and Exchange Commission (SEC) has intensified its scrutiny of IPO processes, particularly regarding SPACs (Special Purpose Acquisition Companies). In March 2022, the SEC proposed new rules governing deSPAC transactions, requiring greater disclosure and due diligence from SPACs and target companies. Almost 40% of the IPOs in 2020-21 were SPACs, and the tightening regulations are expected to significantly lower their numbers going forward, which means the total IPOs won’t be as close to the bubble years.

Another point to note is the type of companies that are planning their IPOs this year. Klarna, Stripe, Databricks, Discord, Cerebras Systems, and Navan are expected to go public, presenting a mix of varied sectors and exceptional financial history. Who knows if SpaceX will announce its IPO? We know the skies it is touching (pun intended). So, there is interest in companies to go public, but there will be no rushed decision-making.

2025 will have a different story than 2020-21, but the expectations should be similar to 2024. We can look forward to 50-60 companies going public with the right preparation and focus on long-term profits.

Is Your Portfolio Company Going Public Soon? Remember To

Now that we know the situation is not the same as a few years ago, here are a few things to know before you consider IPOs for your portfolio companies:

Time the IPO to Perfection: We cannot overstate this enough—the timing of your IPO will dictate its results. Yes, the public markets are performing well, but waiting for one or two large-scale companies to go public to test the waters would be wise. After all, an IPO during a bullish market can yield better returns than a bearish environment. You should also consult experts and management before announcing a date.

Leverage The Lock-in Period: While the lock-in period depends on filing with the SEC, the optimistic public market scenario suggests you should consider locking in your shares for at least 90 days. You can consider a longer duration if there’s more profitability at stake. This will also help limit the influx of shares into the market and stabilize stock prices.

Explore Secondary Market Opportunities: The secondary market achieved a remarkable transaction volume of approximately $115 billion in 2023, making it the second-highest year. 2024 was no different, as the market generated $70 billion only in the first half of the year. Clearly, there is a lot of value in exploring partnerships with secondary market platforms.

Prepare For Potential Buybacks: There is a growing trend of companies performing well financially buying back their stocks. Corteva, AECOM, and EOG Resources have announced substantial buybacks, which could drive value in 2025. Similarly, it is wise to keep buyback as an option for the near future if your company does well after the IPO.

In conclusion, the IPO landscape for 2025 appears similar to the past few years, with no significant changes. As an angel investor, assessing market volatility and the performance of recently listed companies is crucial before advising your portfolio company to go public. To maximize returns, consult experts, identify the right timing for an IPO, explore secondary markets, and prepare for buybacks.

Reference:

https://www.nasdaq.com/articles/how-the-ipo-bubble-burst-and-where-do-we-go-from-here

https://news.crunchbase.com/public/biggest-ipos-2021-current-value-didi-rivn/

https://www.cfo.com/news/valuations-of-2020-2021-software-ipos-sink/654953/

https://site.warrington.ufl.edu/ritter/files/IPO-Statistics.pdf