Once, America’s industrial might was unparalleled. The country kept churning out over half of the world’s manufactured goods and setting the global standard for production. But times have changed. Today, US manufacturing accounts for just 12% of the worldwide pie. Yet, in this decline lies a remarkable evolution. America hasn’t lost its edge; it has become more tangible and future-proof. The nation has transformed from the world’s factory floor into an intellectual powerhouse, leading in innovation, technology, and market-defining ideas.

This isn't just economic data; it’s a seismic shift in value creation. It’s about entrepreneurs building billion-dollar ideas from kitchen tables, about a nation no longer forging steel but forging patents, algorithms, and transformative solutions. It's about how the American dream has morphed into creating intellectual property that shapes the global landscape. An important partner in this evolution is the investors who back entrepreneurs in taking risks and building something valuable. And we are not talking only about angel investors, we have another group of investors, one that traditionally stayed on the sidelines of venture-backed startups now stepping into the spotlight: family offices.

Often seen as conservative, long-term stewards of wealth, multi-family offices have historically been more aligned with real estate, blue-chip stocks, and legacy businesses. They rarely sit at the same table as private equity firms when discussing high-growth investments. But, as we pointed out before, times are changing. Family offices are now playing a more active role in shaping private equity.

Let’s deep dive into the dedication of US entrepreneurs, especially post-COVID, and the pivotal role of family offices in the big American growth story.

Entrepreneurs: The New Economic Vanguard

The entrepreneurial spirit is not just alive; it's thriving. Pre-COVID, between 2016 and 2019, newly established companies (less than a year old) contributed significantly to job creation, with around 1.7 million jobs in 2019 alone. While employing a larger share of the workforce, older companies experienced fluctuations in job creation. Post-COVID, startups have continued to create jobs, with over 3.7 million jobs in 2023. In contrast, older firms continue to face challenges in employment creation. They are shedding hundreds and thousands of people in their workforce. This dramatic shift positions new-gen entrepreneurs as the primary engine of job creation in the modern economy.

To understand the scale of this entrepreneurial boom, consider the "Cambrian explosion" metaphor. In geological history, life on Earth remained relatively stagnant for billions of years until a sudden burst of diversification 500 million years ago. Similarly, The US experienced a rise in new business applications from an average of about 2.5 to 3 million annually from 2005 to 2016. During the COVID-19 pandemic, applications surged to historic highs, with significant increases continuing post-pandemic. In 2023, a record 5.5 million new business applications were filed, signaling a strong entrepreneurial environment.

Despite this boom, entrepreneurship remains a high-stakes endeavor. Approximately 90% of startups fail, with about 70% failing within their first decade. Venture capitalists often view a success rate of around 5-7% as significant, as most of their returns come from a small number of highly private equity investments. 86% of small business owners earn less than $100,000 annually, and about 30% do not pay themselves a salary.

One of the most astounding revelations is that many entrepreneurs finance their ventures by tapping into their 401(k) retirement accounts. This willingness to sacrifice future security underscores the depth of their commitment and belief in their business visions.

The Family Office Advantage For Private Equity

The Silent Powerhouses: Family Offices and High Net-Worth Individuals

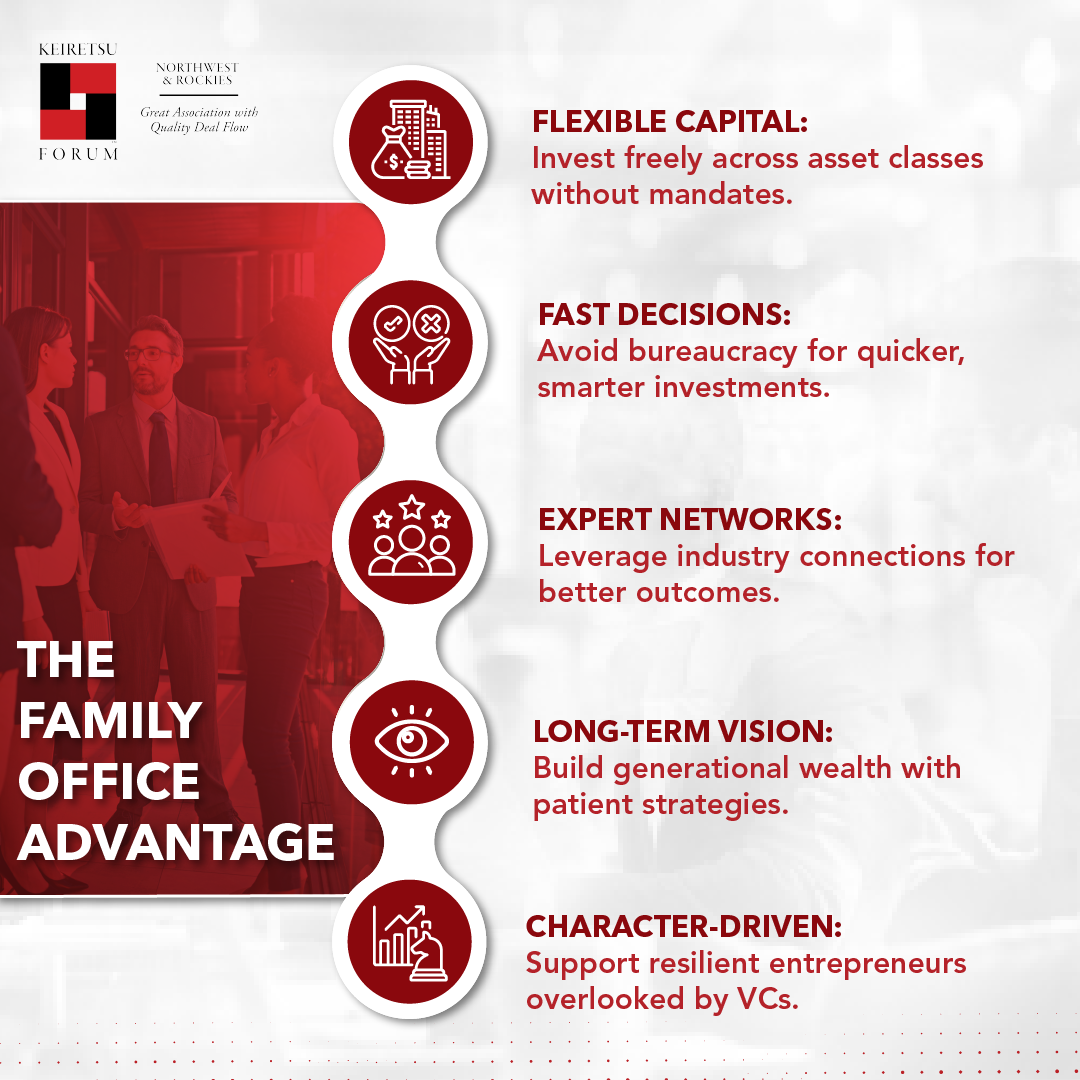

Entrepreneurs typically seek investment from venture capital (VC) and private equity (PE). Still, there is a significant force that stays silent under the shadows but commands immense transformative capabilities – family offices. With over $55 trillion under management, multi-family offices surpass VC and private equity combined. Unlike VC firms constrained by rigid investment mandates, family offices have several strategic advantages that make them a good investor prospect:

- Flexible Capital: Ability to invest in private companies across diverse asset classes without restrictive mandates.

- Speedy Decision-Making: Freedom from bureaucratic delays enables quicker, more decisive investments.

- Expert Networks: Deep domain expertise and industry connections enhance investment success.

- Long-Term Vision: A focus on generational wealth allows for patient capital strategies.

- Character-Driven Investments: The capacity to back resilient, visionary entrepreneurs often overlooked by traditional VC models.

If you are a family office investor in the US, this is your time to reinvigorate private equity. As a matter of fact, many FO investors are entering the PE arena. Private equity now accounts for approximately 30% of the average family office portfolio, up from 22% in 2021, surpassing public equities, which account for about 25%. Nearly half of US family offices plan to engage in direct deals over the next two years, bypassing traditional private equity funds to gain greater control and transparency.

As a family office investor, you can lead by fostering an ecosystem of mutual support. You can catalyze significant economic growth and secure your legacy by sharing insights, co-investing, and leveraging your unique advantages. After all, collaboration isn't just a strategic move; it's necessary to ensure long-lasting impact and wealth preservation.

Embracing America's New Identity With Family Offices

America's transformation from a manufacturing giant to an intellectual property powerhouse is a testament to its entrepreneurial spirit. The nation's strength now lies in its ability to innovate, adapt, and create intellectual value. Entrepreneurs, multi-family offices , and high-net-worth individuals play pivotal roles in this narrative.

You can shape America's economic future by embracing collaboration, leveraging unique strengths, and fostering resilience. The path forward isn't without challenges, but the potential rewards, both personal and national, are immense. The next chapter of American prosperity depends on recognizing and unlocking this collective power.

References

Excerpts taken from Michael Loeb’s keynote Igniting the Ecosystem

https://www.cnbc.com/2024/11/12/family-offices-invest-private-company-deals.html

https://www.empaxis.com/blog/family-office-trends

https://cepr.org/voxeu/columns/china-worlds-sole-manufacturing-superpower-line-sketch-rise

https://www.bls.gov/spotlight/2022/business-employment-dynamics-by-age-and-size/

https://eig.org/2023-business-formation/

https://54collective.vc/insight/startup-businesses-fail-in-the-first-year-survival-tips/

https://altline.sobanco.com/small-business-revenue-statistics/