In angel investing, bigger hasn’t always meant better. Some of the savviest investors aren’t writing six-figure checks. They’re writing smaller ones, often $5,000 to $25,000, and doing so alongside dozens of peers in syndicates.

What looks like a modest investment on paper can create an outsized influence when combined with others. Syndication is allowing angels to participate in bigger deals, access better diligence, and build more diversified portfolios, proving that in today’s landscape, micro-checks can drive macro returns.

The Rise of Smaller Checks

According to the Angel Capital Association (ACA), nearly 70% of angel investors now invest via syndicates, pooling resources with peers to access higher-quality deal flow and reduce individual risk exposure.

This doesn’t mean angels are less committed to startups. On the contrary, smaller check sizes allow for greater portfolio diversification. Instead of making two or three concentrated bets per year, you can participate in 10 or more deals, spreading risk while still supporting innovation.

The impact is equally profound for entrepreneurs. Rather than relying on a handful of large checks, entrepreneurs can close rounds more quickly by tapping into syndicates that aggregate capital from dozens of investors. This accelerates fundraising while giving early-stage companies access to a network of engaged supporters.

Why Syndication Matters Now

The dynamics of early-stage investing are evolving. In 2024 alone, U.S. angel groups deployed over $4.8 billion into startups, according to ACA data. But deal structures have shifted - rounds are often larger, valuations higher, and competition for allocation more intense. Syndication has become the bridge that connects individual investors to these larger opportunities.

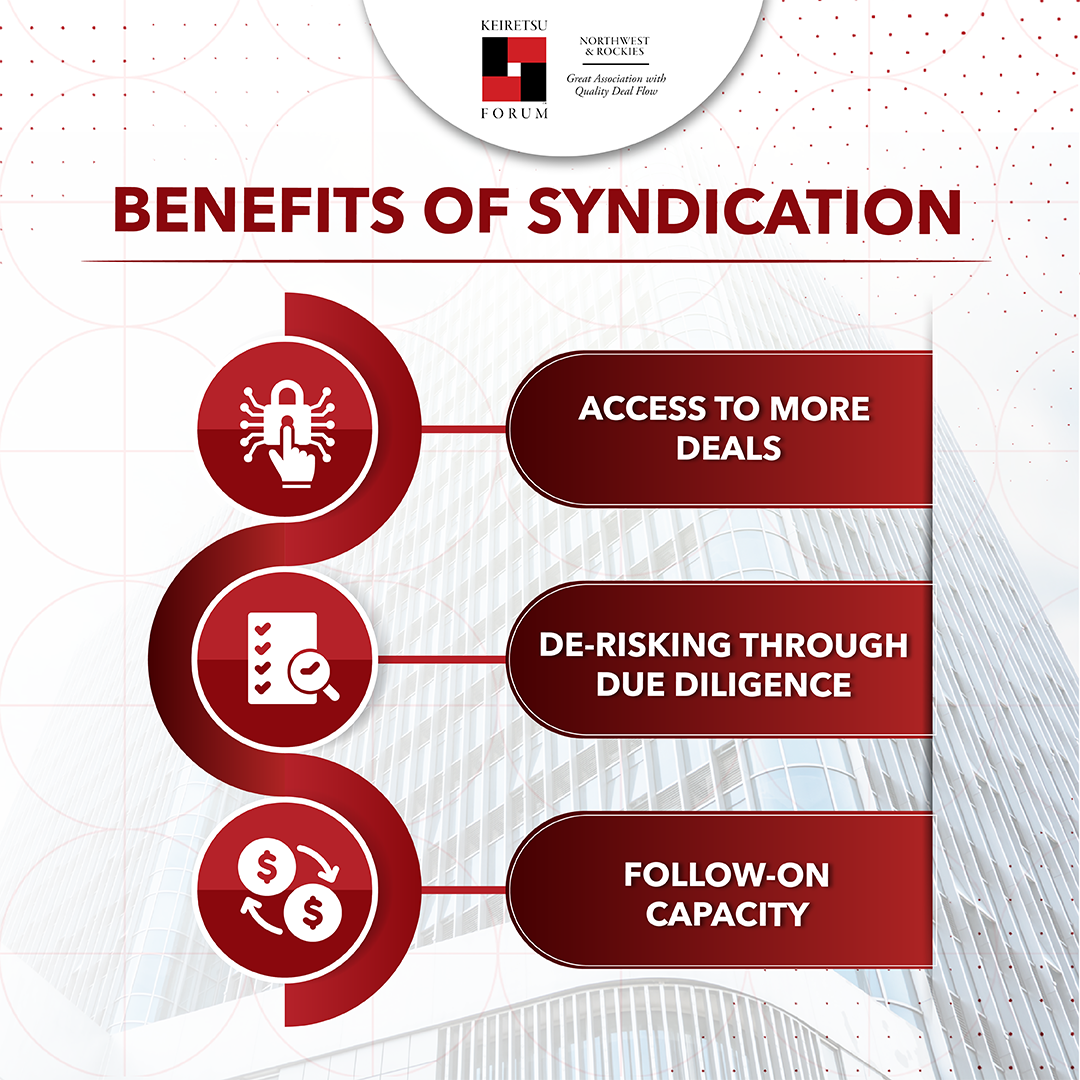

Syndication brings three key advantages:

- Access to More Deals – By pooling capital, you can gain entry into rounds that might otherwise be oversubscribed.

- De-risking Through Due Diligence – Syndicates leverage the collective expertise of members, reducing the burden on any one investor.

- Follow-on Capacity – With a syndicate structure, you can double down on winners through coordinated follow-on funding.

In short, syndication democratizes access to high-quality opportunities while preserving the discipline and rigor of angel investing.

The Investment Syndication Network (ISN): Setting the Standard

While syndication is becoming the norm, it is a challenge to find a network that delivers on the promise of quality deal flow and association. This is where the Investment Syndication Network (ISN) distinguishes itself.

Here’s how ISN makes syndication works for you:

- Follow-on Funding for Top Portfolio Companies – ISN helps members back their strongest performers with coordinated follow-on rounds.

- Syndication with 65 North American Angel Groups – Expanding reach and ensuring diverse deal flow.

- 209+ Virtual Events Per Year – Including deal flow sessions, training, and networking opportunities.

- Up to 49 Angel-Grade Deals Per Month – A large volume of pre-vetted opportunities.

- 50 Due Diligence Reports Per Year – Providing the rigor needed to invest with confidence.

- 2 Angel Syndication Network Live Summits Per Year – Bringing the community together for deeper engagement.

ISN brings together capital, knowledge, diligence, and community - all essential to making smarter investment decisions.

From Micro-Checks to Macro Impact

Think about this – if you write ten $10,000 checks through a syndicate-backed strategy, you are getting $100,000 worth of access across ten companies. Statistically, you now have a better chance to support a breakout company, compared to investing the entire amount in just one or two ventures.

Syndication allows you to think less about your check size and more about its strategic deployment. The collective power of smaller checks builds momentum, creates follow-on capacity, and ultimately improves the chances of generating “macro” returns.

The Future of Angel Investing

The future belongs to investors who recognize that the landscape has shifted. Large checks are no longer the sole gateway to meaningful participation. Instead, the real advantage lies in being part of a trusted syndicate that provides access, diversification, and discipline.

At ISN, we see this every day. Angels who once thought of themselves as “small players” now wield real influence in rounds, thanks to syndication. Entrepreneurs, in turn, benefit from communities of investors who bring capital, expertise, mentorship, and follow-on support.

Micro-checks are no longer marginal; they’re the building blocks of tomorrow’s unicorns. And with the Investment Syndication Network, you can confidently write smaller checks knowing they are part of a system designed for bigger outcomes.