In 2023, Sam Altman, CEO of OpenAI said - “Look, the way this works is we’re going to tell you it’s totally hopeless to compete with us on training foundation models you shouldn’t try, and it’s your job to, like, try anyway.”

In January 2025, DeepSeek, a relatively unknown Chinese AI startup, did try, and the tech world witnessed a seismic shift that would redefine the landscape of artificial intelligence. DeepSeek unveiled its R1 model, achieving performance parity with OpenAI's GPT-4 at a fraction of the cost. This watershed moment sent shockwaves through the industry, triggering a chain of events that would reshape global tech power dynamics.

The R1, trained for a mere $6 million, stood toe-to-toe with OpenAI's GPT-4, which had required over $100 million in research and development. This cost revolution wasn't just about numbers; it represented a fundamental shift in the AI paradigm. Suddenly, the barriers to entry in advanced AI development had been dramatically lowered, democratizing access to cutting-edge technology.

The repercussions were immediate and far-reaching. Nvidia, the titan of AI chips, saw its market value plummet by an unprecedented $589 billion in a single day. The U.S. government, caught off guard by this Chinese leap forward, scrambled to respond with new chip export bans. Meanwhile, entrepreneurs and investors worldwide began to recalibrate their strategies, sensing both danger and opportunity in this new AI landscape.

DeepSeek's Disruption: Rewriting AI Economics

At the heart of DeepSeek's breakthrough was its innovative use of the Mixture of Experts (MoE) architecture. This approach allowed for a more efficient distribution of computational resources, drastically reducing the cost and energy requirements for training large language models. The result was a model that could match GPT-4's performance on reasoning and mathematical tasks while being orders of magnitude cheaper to develop and deploy.

However, DeepSeek's true masterstroke was its decision to release R1 under an MIT license. Over 700 derivatives of the model had sprung up within weeks as developers worldwide began tinkering with and improving upon the base model. This open-source approach starkly contrasted the walled gardens of OpenAI and other Western AI giants, igniting a new era of collaborative AI development.

The impact on China's domestic AI market was equally profound. Tech giants like Alibaba and Baidu, caught flat-footed by DeepSeek's innovation, were forced to slash their AI service prices by up to 97%. The era of AI as a premium, high-cost service is probably ending.

Nvidia's Meltdown & Semiconductor Shockwaves

Nvidia's stock crash sent ripples through the entire tech ecosystem. The $589 billion wipeout wasn't just a record-breaking loss; it was a stark warning that the foundations of the AI industry were shifting. Investors feared DeepSeek's efficiency-focused approach would reduce demand for Nvidia's powerful but energy-hungry GPUs.

The supply chain implications were immediate. In India, electronics manufacturing services stocks like Kaynes and Dixon plummeted by 20%. Even ASML, the Dutch lithography giant, issued cautious guidance, signaling uncertainty in the semiconductor industry's future.

Nvidia, however, wasn't going down without a fight. The company doubled down on partnerships in the Middle East, seeking new markets for its high-end chips. In China, where new U.S. export controls loomed, Nvidia engaged in a frantic stockpiling of its H20 chips, hoping to maintain its foothold in the world's largest AI market.

Investor Landscape: Panic or Opportunity?

To understand the implications of DeepSeek’s disruption, let’s explore Jevons’ Paradox. This concept, named after economist William Jevons, shows that technological improvements in efficiency often lead to increased overall usage rather than reduced consumption.

Historically, when steam engines became more efficient, coal consumption didn’t decrease; it surged because steam power became cheaper and more accessible. Similarly, cheaper models like DeepSeek’s could spark widespread adoption of AI. As the cost of AI tools drops, more companies and industries will likely integrate AI into their operations, driving demand for AI infrastructure and applications.

Believe it or not, this entire development is good news for investors as it opens up investment opportunities:

1. Decentralized Computer Networks

DeepSeek’s proof that high-performance AI doesn’t require massive GPU clusters has accelerated the shift toward distributed computing. Startups like RenderToken and Aethir have seen 170% gains by creating “GPU Airbnb” models, enabling enterprises to monetize idle chips. This market grew 412% YoY to $7.8B, with J.P. Morgan predicting decentralized networks could reduce hyperscaler capex by 24% while broadening access

2. Energy-Efficient AI Infrastructure

With AI projected to consume 15% of global electricity by 2030, investors are backing technologies that address the energy trilemma. Liquid immersion cooling trials reduced Nvidia’s TDP by 40%, while neuromorphic chips from BrainChip and SynSense promise 100x efficiency gains. The EU’s AI Act is further driving demand for sustainable infrastructure, with ArcticAI’s phase-change cooling systems cutting data center costs by 70%

3. Vertical SaaS 2.0

DeepSeek’s open-source R1 model has democratized specialized AI development. Startups building industry-specific tools are attracting capital:

- MedLingua: FDA-cleared diagnostic AI trained on 2M patient records

- Fintegrate.ai: Raised $20M for SEC-compliant financial analysis tools

- CropProphet: Increased Nigerian farm yields by 40% using soil analysis LLMs

Entrepreneurial Avenues in the New AI Era

The DeepSeek R1 disruption has unleashed a gold rush for entrepreneurs, democratizing access to advanced AI while upending traditional barriers to innovation. By slashing AI development costs from $100M+ to under $6M and offering open-source licensing, DeepSeek has opened three transformative opportunities:

1. AI Wrappers

The collapse of entry costs enables hyper-specialized applications across industries. Now, you do not need to develop an AI model from scratch to build niche solutions. Simply access open-source AI models and build your product on top of them. Imagine the effort, time, and costs you can save with this approach.

Startups like MedLingua now offer FDA-cleared diagnostic tools trained on 2M patient records using DeepSeek derivatives, while Fintegrate.ai deploys SEC-compliant financial analysis at 90% lower API costs than legacy providers. Similar opportunities exist in education (personalized tutoring systems), agriculture (crop yield prediction models), and manufacturing (AI-driven quality control), where customized models can address niche pain points profitably.

2. Ethical AI Services

The open-source explosion has intensified the demand for trust infrastructure. Startups like FairLens now audit models for bias compliance with EU regulations, while TrueSource uses blockchain to verify training data provenance. With DeepSeek facing scrutiny over alleged censorship protocols, there’s a growing appetite for “AI alignment-as-a-service” platforms that ensure ethical deployment across cultural contexts.

3. Global-Local Hybrid Models

India’s Krutrim showcases how regional players can adapt AI models by hosting localized versions on domestic servers ($0.51/million tokens), addressing cost and data sovereignty concerns. Similar opportunities exist in Southeast Asia and Africa, where entrepreneurs can fine-tune models for local languages/regulations while leveraging the R1 backbone. This "glocal" approach is particularly viable given DeepSeek’s MIT license, which permits commercial derivatives without royalties.

The disruption has effectively turned AI development into a modular toolkit – entrepreneurs who combine cost efficiency with domain expertise and ethical guardrails are poised to redefine industries. As AWS, Microsoft, and NVIDIA rush to host R1 on their clouds, the stage is set for a Cambrian explosion of lean, high-impact ventures that treat AI not as a product but as raw material for solving real-world challenges.

Navigating the Post-DeepSeek World

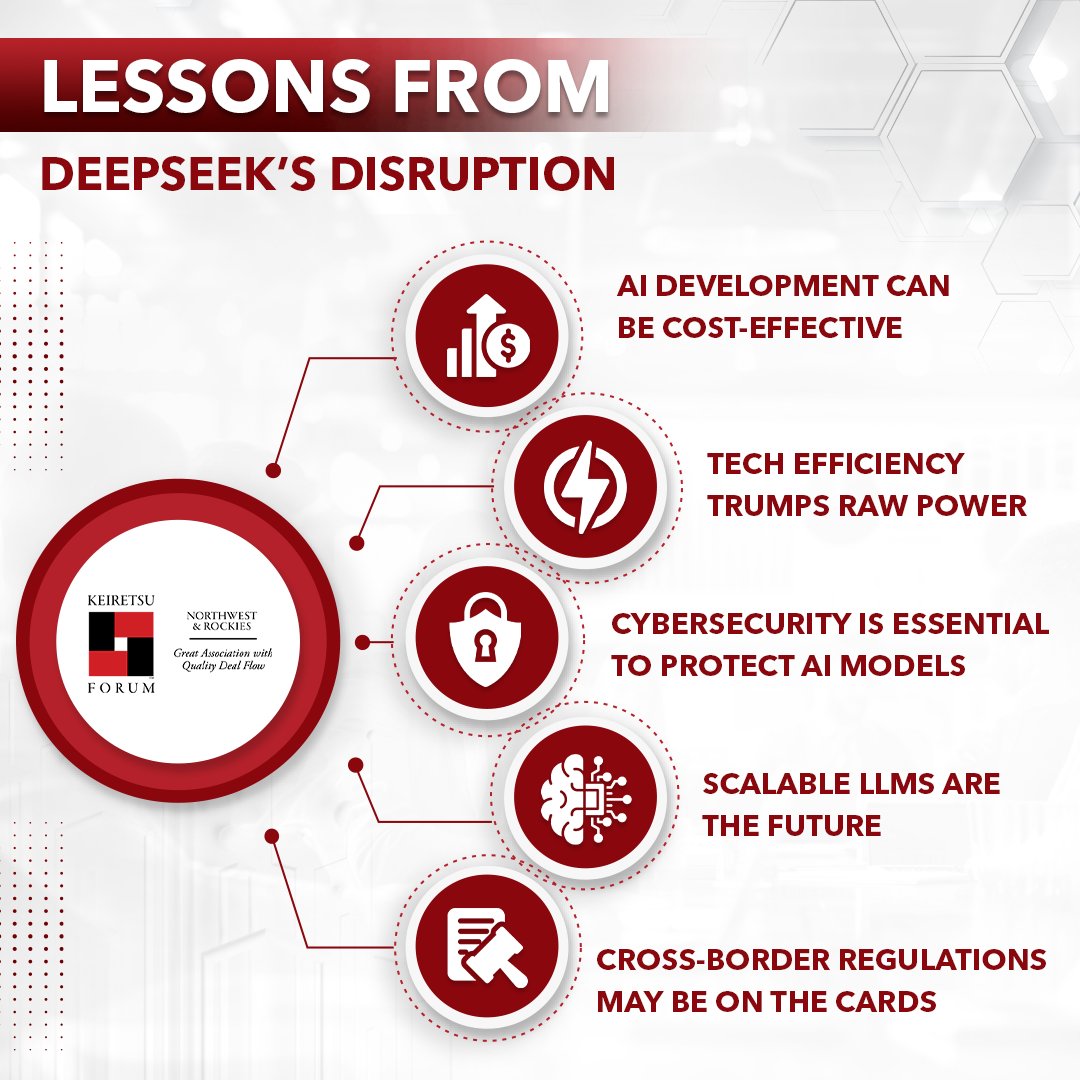

The AI landscape has been irrevocably altered. DeepSeek's breakthrough has shown that AI supremacy is not just about raw compute power but about cost-efficiency and accessibility. Geopolitical considerations now play an outsized role in shaping AI technology and talent flow.

The message is clear for investors: diversification into inference optimization and AI efficiency technologies is crucial. Entrepreneurs should focus on building upon open-source foundations, creating moats through specialized applications and ethical AI practices.

As we navigate this new era, one thing is certain, the AI revolution is no longer a distant future. It's here, it's democratized, and it's reshaping our world in real time. Those who adapt quickly to this new reality will be best positioned to thrive in the post-DeepSeek world.

References:

https://sourceability.com/post/deepseek-redefines-the-rules-of-ai-and-semiconductors

https://yourstory.com/2025/01/deepseek-ai-revolution-global-impact

https://builtin.com/artificial-intelligence/deepseek-r1

https://www.techsciresearch.com/report/gpu-as-a-service-market/21737.html

https://techhq.com/2023/06/airbnb-for-gpus-chip-rental-model-for-generative-ai/

https://oasisprotocol.org/blog/what-is-decentralized-ai