For more than a decade, low-cost capital shaped how early-stage businesses were built and funded. Under the Zero Interest Rate Policy (ZIRP) era, liquidity was abundant, risk tolerance was high, and growth-at-all-costs became the dominant playbook. Speed mattered more than efficiency. Market capture often took precedence over unit economics.

That era is now firmly behind us.

As interest rates normalized and capital tightened, the investment landscape shifted, forcing both entrepreneurs and investors to rethink what “good” looks like in early-stage companies. Today, capital efficiency is no longer a nice-to-have. It is a core signal of resilience, discipline, and long-term value creation.

For angel investors, this shift presents a significant correction and an opportunity.

Life After ZIRP: A Different Rulebook for Early-Stage Investing

Post-ZIRP markets have dramatically changed the cost of capital. When money was nearly free, inefficiency could be masked by successive rounds of funding. Companies could afford long runways without meaningful revenue, betting on future scale to justify present losses.

That cushion has disappeared.

Higher interest rates have increased investor selectivity. Follow-on capital is no longer guaranteed, valuation multiples have compressed, and capital-intensive growth strategies face more scrutiny. As a result, entrepreneurs are being pushed, sometimes reluctantly, sometimes intentionally, toward leaner operating models.

This shift has recalibrated the risk-reward equation for angel investors. Businesses that can generate meaningful progress with less capital now stand out in a crowded deal flow environment.

Why Capital Efficiency Has Become a Leading Indicator

Capital efficiency is about doing more with every dollar deployed. In today’s environment, capital-efficient companies tend to exhibit:

- Faster paths to revenue validation

- Lower dependency on external funding

- Stronger discipline around unit economics

- Operational focus over vanity metrics

For investors, these traits reduce downside risk while preserving upside optionality. A business that reaches meaningful milestones with less dilution also leaves more ownership intact for early backers, which is an essential consideration as exit timelines extend.

Importantly, efficiency is becoming a proxy for quality. Entrepreneurs who can prioritize, sequence, and allocate capital intelligently often demonstrate the strategic maturity angels look for in long-term partners.

The Rise of Scrappier Entrepreneurs

The new generation of entrepreneurs is building differently. With capital harder to raise and diligence more rigorous, many early-stage companies are starting lean with smaller teams, narrower product scopes, and sharper customer focus. Instead of chasing rapid expansion, they are aiming for product-market fit, early profitability, or at least a credible path toward it.

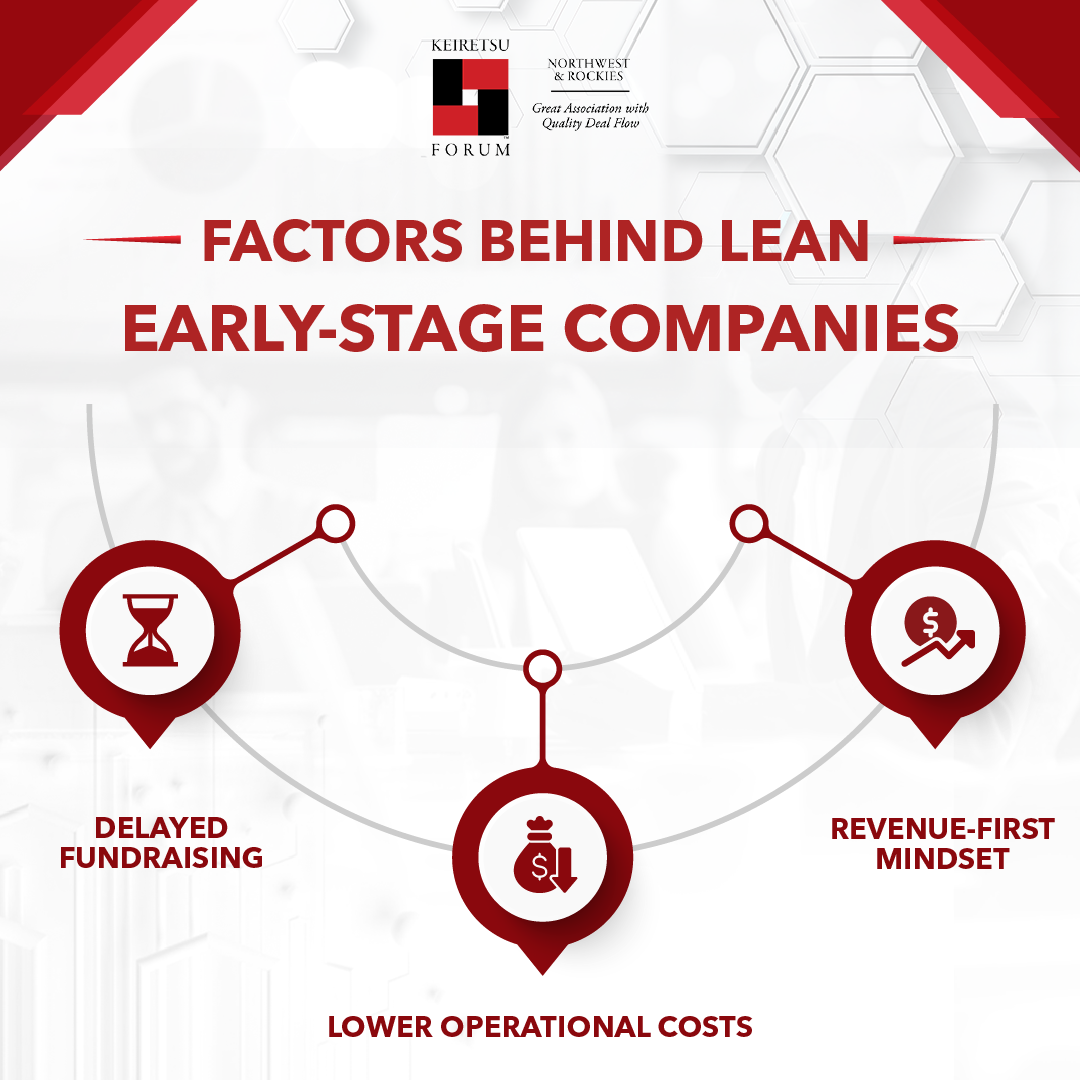

Several factors have accelerated this shift:

- Lower startup costs: Cloud infrastructure, no-code tools, and AI-driven workflows have reduced the capital needed to launch and iterate.

- Revenue-first mindsets: Entrepreneurs are prioritizing customers earlier, rather than depending solely on external capital.

- Delayed fundraising: Some companies are choosing to bootstrap longer, raising capital only after key risks have been mitigated.

For angel investors, this often translates into cleaner cap tables, more precise traction metrics, and fewer assumptions embedded into valuation.

A Healthier Long-Term Ecosystem

Stepping back, the rise of capital-efficient companies may ultimately strengthen the broader innovation ecosystem.

Entrepreneurs are being forced to build real businesses earlier. Investors are aligning more closely with long-term value creation rather than short-term multiple expansion. And capital is being allocated with greater intentionality.

For angel investors, this environment rewards patience, discernment, and hands-on engagement. The best opportunities may not be the loudest or fastest-growing, but the ones quietly compounding value with limited capital.