For decades, accreditation has been the gatekeeper of private market investing in the United States. It has determined who can participate in angel rounds, private placements, and other high-growth opportunities, often with rigid thresholds tied more to wealth than to knowledge or experience.

But in 2026, that definition is no longer as static as it once was.

As capital markets evolve, entrepreneurs build businesses earlier and leaner, and private capital plays an ever-larger role in economic growth, regulators are facing mounting pressure to reassess an old question: Who should be allowed to invest in private companies and why?

The SEC’s shifting stance on accreditation suggests that a broader, more nuanced framework may be taking shape, one that could expand access while still maintaining investor protections. For angel investors, this evolution has implications not only for deal access but also for market dynamics, valuations, and the future composition of the private capital ecosystem.

Pat Gouhin spoke about this topic at the August Investor Capital Expo. You can watch his keynote here.

A Brief Look Back: Why Accreditation Exists at All

The accredited investor framework was designed with a clear objective: to protect individuals from complex, illiquid investments that carry elevated risk.

Historically, the SEC relied on income and net worth thresholds as proxies for financial sophistication. If investors had sufficient wealth or a consistent high income, they were presumed capable of absorbing losses and understanding risks. This approach prioritized simplicity and enforceability, but it also created a blunt instrument.

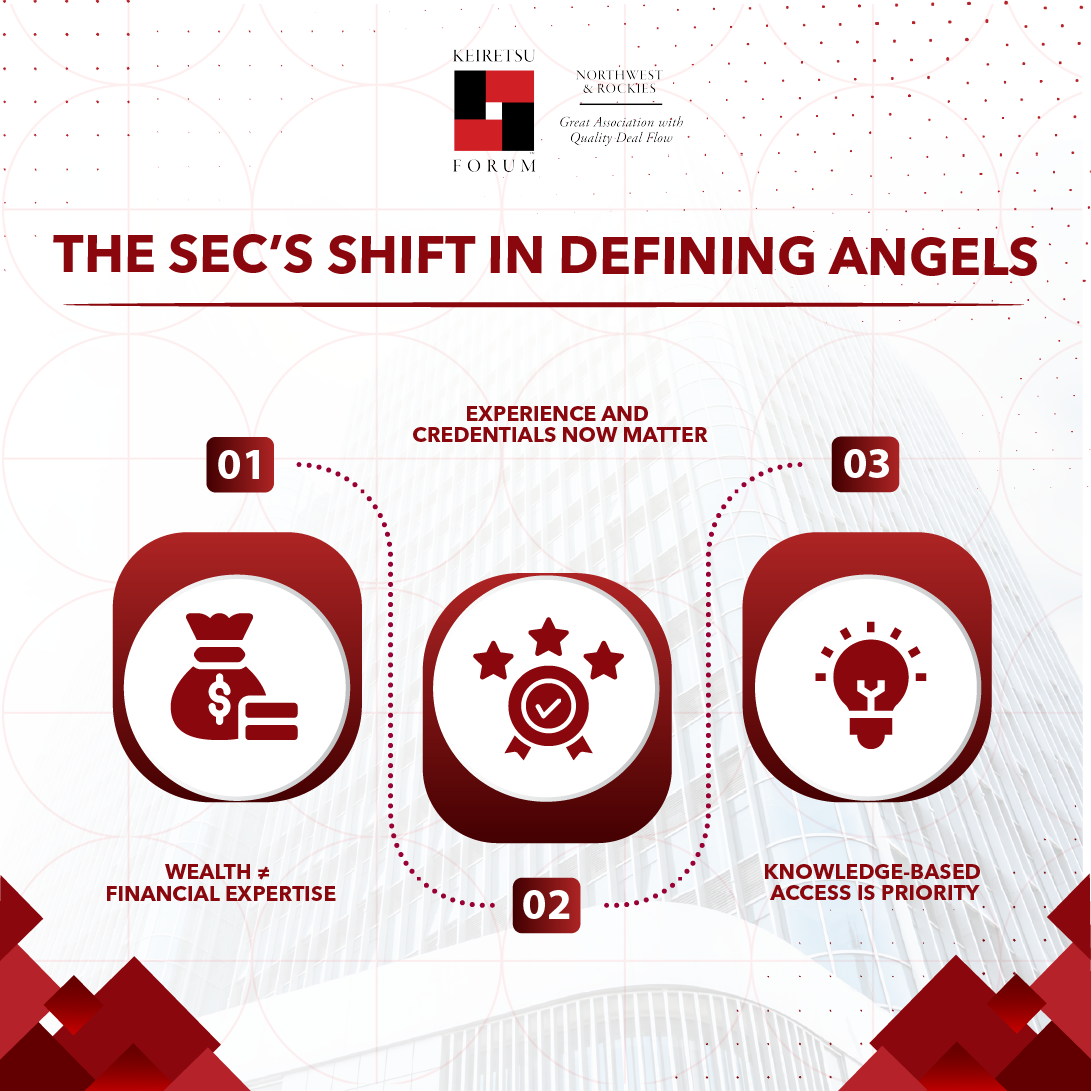

Over time, critics have argued that wealth does not necessarily equate to knowledge. Conversely, many financially literate professionals (operators, analysts, or early employees at high-growth businesses) have found themselves excluded despite their hands-on experience with private markets.

Recognizing this mismatch, the SEC took its first meaningful step away from a purely wealth-based model in 2020.

The First Shift: Experience and Credentials Enter the Equation

In recent years, the SEC introduced limited alternatives to traditional wealth thresholds. Certain professional certifications, licenses, and roles now qualify individuals as accredited investors, even if they fall short of income or net worth requirements.

This marked a philosophical shift.

Rather than asking only “How much money do you have?”, the framework began to ask “What do you know, and how did you acquire that knowledge?”

Although these changes were narrow in scope, they established an important precedent: sophistication can be demonstrated through education and experience—not just balance sheets.

By 2026, that precedent is increasingly difficult to ignore.

Why the Pressure to Expand Is Growing

Several converging forces are pushing regulators to rethink accreditation more seriously.

First, private markets are no longer niche. An increasing share of innovation, job creation, and value formation now happens within private companies that may stay private longer than ever before.

Second, entrepreneurs are raising capital earlier and more frequently from angel investors, often in sector-specific domains like AI, climate, healthcare, and advanced manufacturing. These areas benefit from investors with domain expertise, not merely financial capital.

Third, retail investors are already accessing complex financial products in public markets, from options trading to thematic ETFs. The argument that private investments are uniquely “too complicated” appears less convincing in this broader context.

Together, these factors raise an uncomfortable question: does restricting private market access still serve its original protective purpose, or is it unintentionally concentrating opportunity among fewer participants?

Education-Based On-Ramps: A Possible Middle Ground

One of the most discussed pathways for reform is education-based certification. This approach reframes the standards instead of lowering them.

Under such a model, individuals could qualify as accredited investors by completing rigorous coursework, exams, or training programs focused on private market risk, due diligence, portfolio construction, and liquidity dynamics. The emphasis shifts from financial capacity alone to informed decision-making.

For regulators, this could offer a defensible compromise, i.e., expanding access while reinforcing investor responsibility. For investors, it introduces a measurable on-ramp that rewards preparation rather than inherited advantage.

While the SEC has yet to formalize a broad education-based system, ongoing discussions suggest that knowledge-based qualification is gaining credibility as a policy option.

Implications for Angel Investors

For existing angel investors, any expansion of accreditation raises understandable concerns. More participants could mean increased competition for allocations, compressed timelines, and heightened valuation pressure.

But there is another side to the equation.

A more diverse investor base, particularly one grounded in education or operating experience, could strengthen syndicates, improve diligence depth, and bring strategic value to early-stage businesses. Entrepreneurs often benefit from capital that comes paired with insight, networks, and functional expertise.

Moreover, broader participation can increase market liquidity and resilience over time. Private markets thrive when trust, transparency, and competence scale alongside capital.

The key question is not whether access should expand—but how thoughtfully it is done.

What This Means for the Future of Private Capital

If current trends continue, the accredited investor of the future may look different from the one defined decades ago.

We may see a hybrid model emerge: traditional wealth thresholds alongside formal education pathways, experience-based qualifications, and potentially tiered access based on investment size or risk profile.

For angel investors, this evolution underscores the importance of process discipline, differentiation, and value-added engagement. As access widens, the edge will belong to those who bring more than capital to the table.

Ultimately, the evolution of accreditation reflects a broader truth about private markets: maturity requires inclusion, but inclusion must be earned.

As the SEC continues to explore new on-ramps in 2026 and beyond, angel investors would do well to stay ahead of the conversation. The question of who gets to invest is foundational to how the next generation of entrepreneurs and businesses will be funded.