Ever heard of the 80/20 rule in business?

The 80/20 rule, also known as the Pareto principle, states that 80% of the results come from 20% of all causes (or inputs) to a given event. In business, one goal of the 80/20 rule is to identify and prioritize the inputs that are likely to be most productive. For example, once CEOs have identified the factors that are critical to their business success, they should focus their efforts primarily on those factors.

Park City Angels member Ted McAleer joined our Keiretsu Forum Northwest & Rockies Roadshow to discuss go-to-market strategies for helping emerging startups avoid failure. He believes that the failure of the entrepreneur is the failure of the investor, a risk that can be avoided by simply developing a well-thought-out strategy, with metrics and performance indicators at all stages.

Here are the 3 most common reasons for startup failures, according to CB Insights:

Product Market Fit – 35%

Ran out of Cash – 38%

Wrong Team – 20%

In addition to the first three reasons, we have an insightful blog from investor and entrepreneur Rob Neville where he dives into the many reasons why startups fail. Let's talk about reason number one.

- Identifying a good Product Market Fit

Product-market fit describes the degree to which a company's target customers buy, use, and tell others a reasonable amount of a company's product to sustain the growth and profitability of that product. So why is it so important to implement it? Why do so many angel investors need proof of product viability before investing in a company?

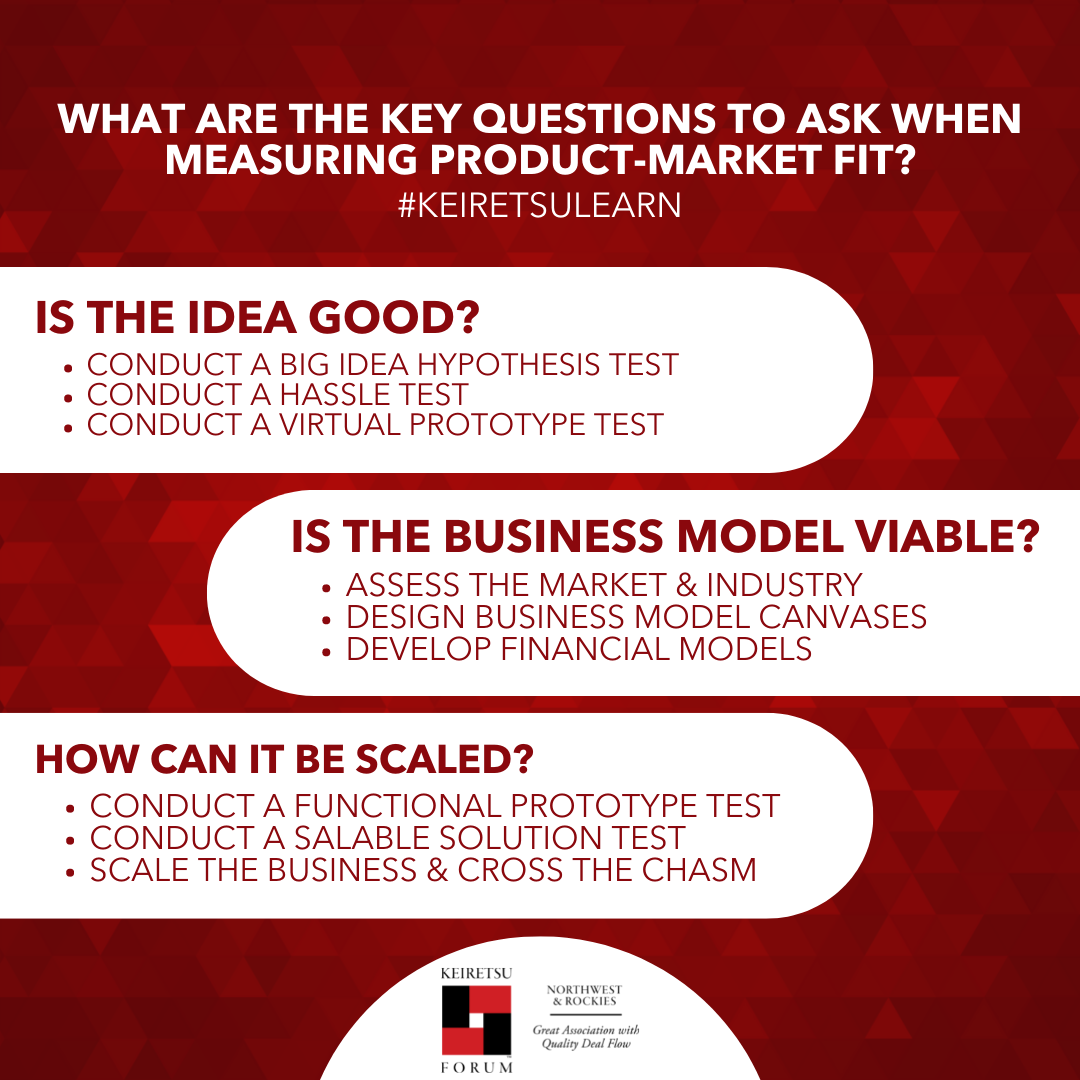

This is because an entrepreneur & their team can't focus on other strategic goals such as increasing or upselling existing users until they develop a product that people are willing to pay for. In fact, these initiatives can be seen as counterproductive, if they haven't determined that there is enough market for their product to sustain themselves and make a profit, it can backfire. When you work with entrepreneurs, whether they're in early stage, seed, or late stage, you need to do an audit with them. Ask them the following questions about their product or service: Is this idea a good idea? Is the business model viable? And how can it be scaled? Here are some more questions and tests you can use to ensure that the company you are interested in has a good product-market fit.

If they haven't done these three tests, you really don't know if the idea they're after is good. If the idea is good and they pass all three tests, then you move on to the business model viability. Entrepreneurs can often build products, but it's important to know if they understand the market and industry. It is also important to note that entrepreneurs often do not represent the entire competitive landscape. In fact, they should study it better and understand if the product or service is a niche product in a certain region, or if they really have the ability to scale it.

How does a good go-to-market strategy impact product market fit?

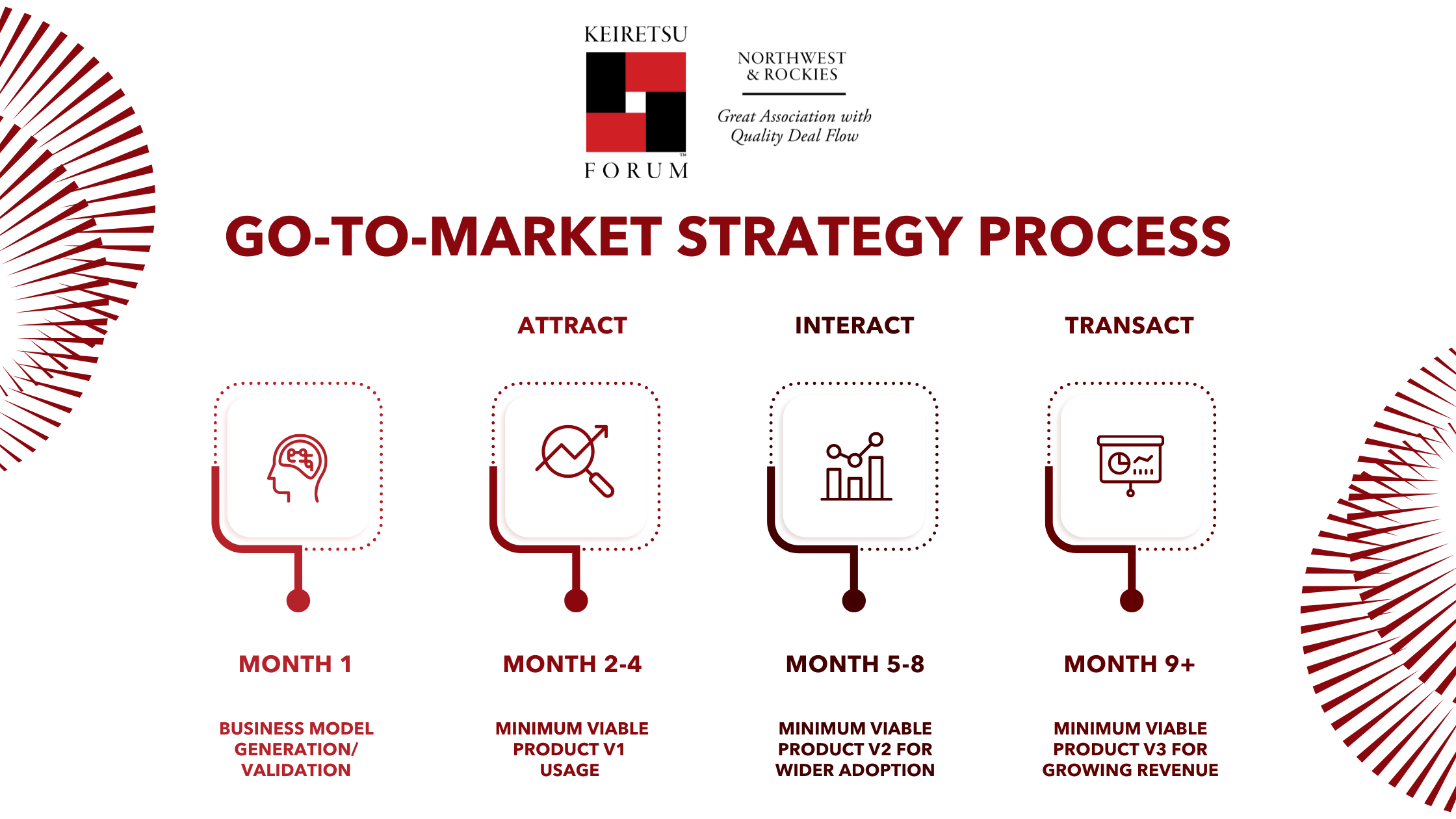

The challenge with go-to-market strategies is that the timing of entry depends on technology. The term "Minimum Viable Product" or MVP is a product with enough functionality to attract early customers and validate product ideas early in the product development cycle. In industries such as software, MVPs can help product teams gather user feedback as quickly as possible to iterate and improve products. So, you will see that the product has gone through different versions during the initial stages of its release, namely MVP v1, MVP v2, MVP v3, etc.

If an entrepreneur continues to build a minimum viable product without customer feedback, it is likely that the product will never be successfully launched. The bare minimum for a truly viable product is to get people to interact as betas, then strategize how to convert those betas into paying customers, and then expand those paying customers to what Ted calls non-discounted, full paying customers. By systematically executing this process and regularly providing customer feedback to the development team and improving the product or service, a company can gain confidence in its product-market fit.

- Managing the company’s cash flow

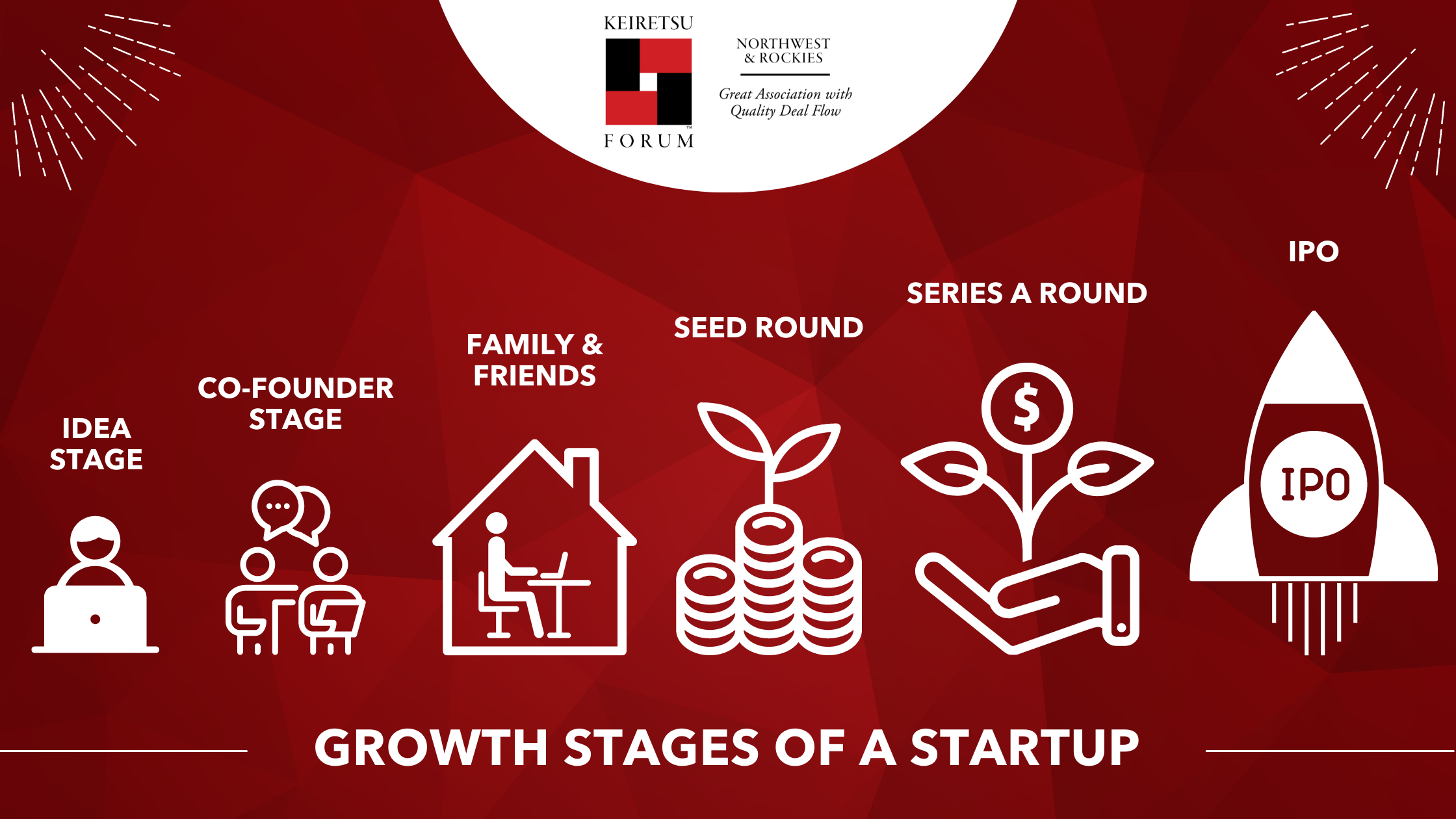

Another big thing you need to consider as an investor is that startups may run out of cash. When a startup has gone through the co-founder, family, and friends’ stage and is now coming to an angel investor, it is necessary to determine your role in the company, especially if the product or service is technology-based. It's also required to thoroughly research the company's financials to understand how much money is raised in each round and how the money is being spent. As you continue to work with entrepreneurs, make sure they understand what happens to the CAP table when the company structure changes.

- Creating the perfect team structure

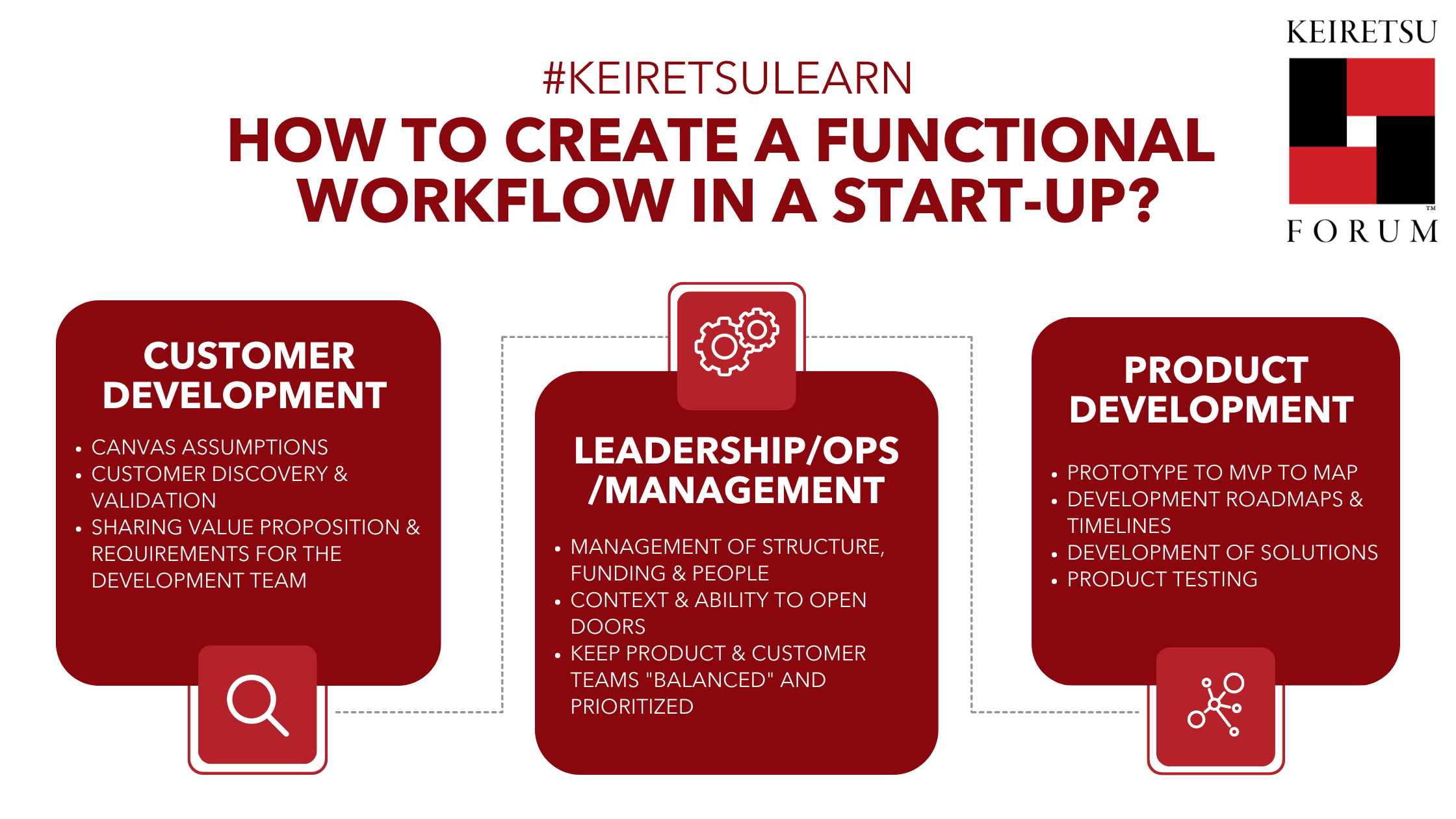

Angel investors often feel that they do not want to be on the board of directors of the companies they invest in. This is because, you stand to undertake a lot of fiduciary responsibilities, and when you invest in many companies, having too many board memberships can take up a lot of your time! One thing all investors can agree on is that in a go-to-market strategy, having a solid advisory board is crucial. For example, if you are interested in a company, and you are in conversation with the co-founder that is raising a pre-seed round. It is important to know the background of the co-founders. Do they have expertise in customer development and product development? Because if they don't, they will fail. In recent years, there have been many entrepreneurs aged 21-30 without much leadership and management experience. This is where angel investors can join as advisory board members, developing policy recommendations and helping young entrepreneurs make the most impactful decisions.

If you are planning to invest in a startup and want to evaluate their workflow, or are a board member of a startup and want to improve their current process, here is a quick guide to the steps each department needs to follow to ensure a smooth process within the organization:

Sometimes you meet visionary entrepreneurs who are good at product or customer development but don't know how to build or lead a team. Building and leading teams effectively are what most seasoned investors have achieved in their day. Angel investors play an important role in a company's go-to-market strategy and overall company growth by counseling these young entrepreneurs. The advisory board or core team must have members with a thorough understanding of all of the company's business functions. Take note! Never add too many ‘leader of leaders’ to a company's advisory board. This means that almost every seasoned angel investor can be considered a leader of leaders, but when you put too many angels into a startup team, the hierarchy pyramid collapses. Organizational balance is key to its success, so how can this be achieved?

Achieving organizational alignment in a startup

This is another essential element of a go-to-market strategy. An entrepreneur and the core team must understand the importance of strategic planning. Here are a few KPIs suggested by Ted for each team, they can be further developed as the startup scales.

- Mission: Define why the company exists

- Vision: Aspirational outcome determines the description of long-term success

- Strategic Objectives: If achieved, results will lead to the realization of the vision

- KPIs: How to know if results are being delivered, it also forms the basis of the company and its partners' scorecards

- Strategic Initiatives: Short-Term Attack Plans and 14/30/90-day plans to achieve quarterly goals

- Structure: how the company uses its human resources and how we organize our partner resources

- Budget: How a company uses its financial resources

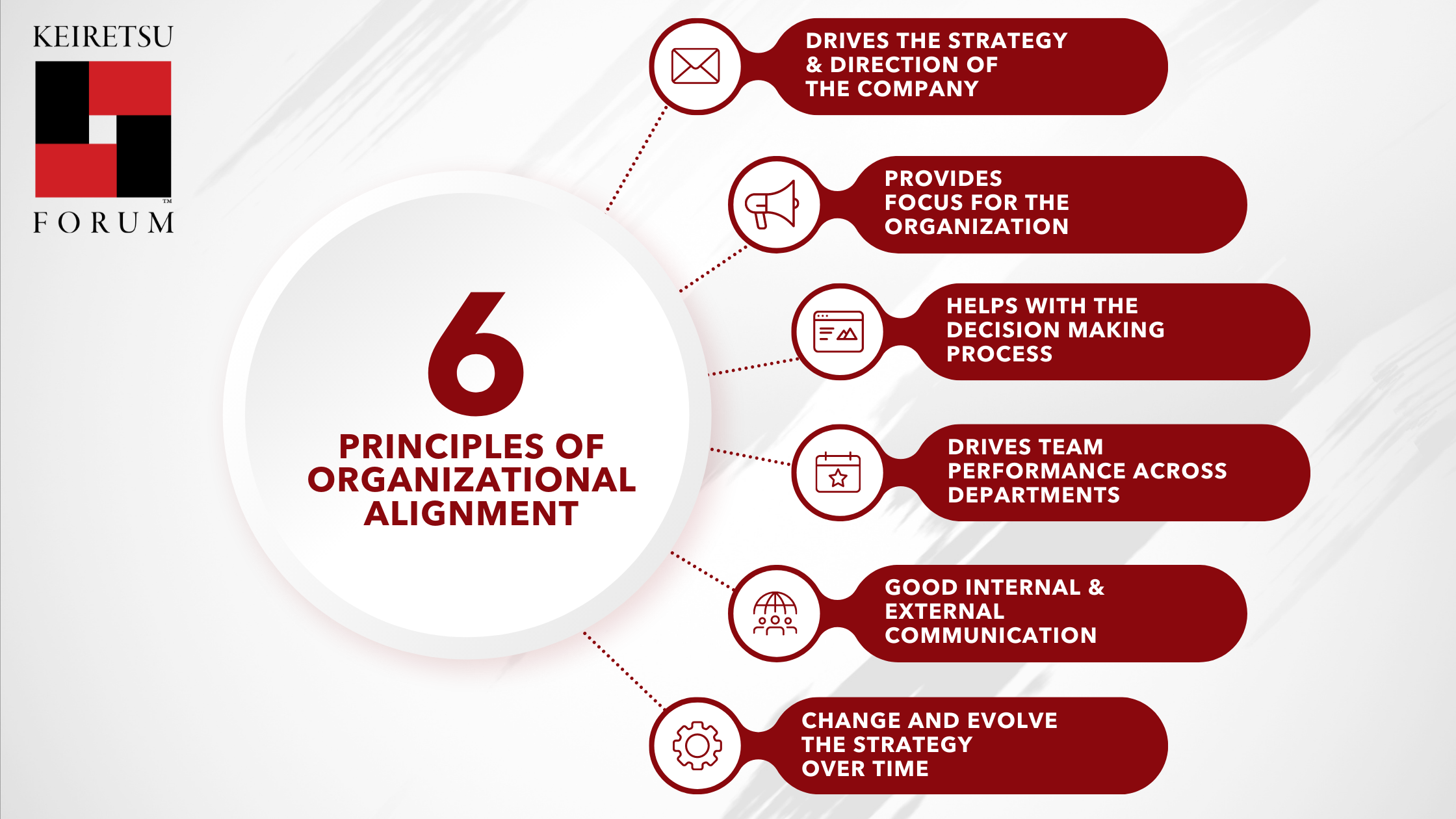

Here are also a few principles that startups can adopt:

Going back to the Pareto Principle, Ted noted that creating organizational alignment and a metrics-based strategy provides the 80/20 focus to the business. It supports a company's decision-making process, facilitates the performance of all business functions, and most importantly, enables smooth communication between internal and external stakeholders. As you go through multiple funding rounds, you may find that the company's metrics improve quarter-to-quarter. It's important for every part of the business to have at least one metric. To define metrics, make sure they are smart, specific, measurable, and achievable. Don't get overwhelmed in the process, take it step by step, making sure the entrepreneur and their team are in sync, it's a surefire way to achieve common goals and be successful.

About the Speaker

Ted McAleer has been working with Utah’s Startup community since 1999. He is currently the VP of Operations at Rebel Medicine and prior to this Ted was VP of business Development at Braveheart Wireless, an IoHT Medical Device startup. From 2015 to 2018, Ted was the first Managing Director of PandoLabs, a business incubator and accelerator based in Park City, Utah where he worked with over 100 Entrepreneurs and their companies and developed a methodology for scaling companies from 2 to 20 employees that he captured in PandoLabs Institute. From 2006 to 2014, Ted was the 1 st Executive Director of USTAR (Utah Science Technology and Research Initiative), the State of Utah’s signature technology - based economic development initiative. Prior to USTAR, McAleer spent 5 years in a variety of leadership roles with Campus Pipeline, a Utah - based venture - backed EdTech startup that raised $80+ million during the “dot com” era. Click here to watch his keynote.