You probably already know that starting a business can be a challenging journey. Few companies have the right product-market fit, the right team, and the right business model to guarantee their future success. Have you ever wondered where most businesses go wrong? How and why, do they fail? The factors that hinder success are often not just one, but many. As an investor and entrepreneur, it is important to understand why before you invest and/or start a business.

Rob Neville has been active in the Keiretsu Forum NorCal region for ten years, initially as an entrepreneur and investor. In the Portland chapter of our April 2022 Roadshow, he outlines the top three reasons start-ups fail. They are as follows:

TOP REASONS WHY START-UPS FAIL

According to Rob Neville, the top three reasons start-ups fail are capitalization, poor product-market fit, and teams. The reasons below cover over 90% of start-up failures.

1) CAPITALIZATION

The first hurdle start-ups need to acknowledge after their launch is that they don’t have enough capital, this can be due to the failure to raise money, or that they did not raise enough money.

The CEO must be a good storyteller

The process of raising capital is closely tied to whether the CEO is a compelling storyteller. At the end of the day, if you cannot tell a story about your company, you cannot motivate your audience to write a check. Any CEO who cannot do that will have a hard time raising money. Rob recalls hearing presentations from companies in the past, where the idea was great, but the presentation did not convince him to write a check. During the due diligence process, he often helps revise presentations and coaches CEOs on how to tell the company story more persuasively.

Address the most important risks early

From a capitalization perspective, start-ups are always risk-oriented, so as an investor, everything is about addressing those risks. During the due diligence process, it is important to identify significant risks early on, before any funds are invested in the company.

Align GANTT Charts, Revenue Usage, and Financials

A GANTT chart is a bar chart that represents a project timeline. Rob recalls that he rarely encountered a company's GANTT chart where the revenue and financials were all lined up. As an investor, it is important that you work with the company to adjust all elements on the chart and accurately reflect it in all other documents.

Talk to primary vendors

It is vital not to blindly believe what the company says, and to have a dialogue with other stakeholders such as primary vendors. Example: If there is a manufacturer that makes widgets for a company, you should talk to them and confirm that the timeline shared by the company matches their timeline for delivering a complete and functional product. If not, adjust the GANTT chart and financial data accordingly.

Appropriate security and terms

Proper security is an important factor in this process, as you take many risks when investing in a business. So, whether you see a $1 billion valuation or even a $100 million valuation, if the company is coming to angels for investment, the numbers are probably not 100% credible. It's wise to spend a lot of time making sure safety measures are in place. Investors generally prefer convertible bonds to SAFEs because they are safer.

2) PRODUCT-MARKET FIT

The second hurdle to overcome is product-market fit. As an investor, don’t simply trust the data the company provides, do your due diligence to see if the product has a place in the market or not.

Validate every assumption

The CEO said the product is in high demand. Don't believe it.

The CEO said the product has a 70% profit margin. Don't believe it.

Don't believe in assumptions and don't listen to opinions. If there's one thing to watch out for, it's peer-reviewed data. For example, if a company is making assumptions about data, then every number they talk about, every number in their executive summary, and every number in their slideshow needs to be correlated, challenged, and validated.

Rebuild TAM/SAM/SOM

It is important to develop your Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM) and challenge the business with your data. In most cases, they will probably just adjust their model based on your input.

Market Validation (early traction, survey)

How to measure market efficiency? The first step is to look at customer acquisition cost (CAC) and lifetime value (LTV). This can be done by mapping sales in the marketplace, but if a company isn't already selling anything, it's important to know the size of its customer base. This can be done initially with a qualitative survey; you use your network for this. Next, conduct quantitative research with the help of the company to understand who the customer is and what their buying process is like.

Mega Trends

Never invest in a sinking ship. Any investment you make should be in an expanding industry. Therefore, adapting the product to the market is critical, which is why investors should spend a lot of time talking to as many customers as possible during the due diligence process.

3) TEAM

If a company has a good team, all other factors generally fall into place. As an investor, how do you approach the challenge of understanding the people behind the company?

Get to know the board and team

For angel investors, the only real opportunity to meet the team of the company you invest in is during the due diligence process. So, what can you do to overcome this challenge and know if the team behind the company has what it takes to make the company successful? Spend time with them formally or informally. A due diligence meeting is one thing, but you can also meet informally, such as for dinner or set up discussions during a sporting event. Conduct secondary reference and background checks, talk to as many people as possible, and make sure any data shared by the CEO and executive team is validated by these checks.

Wild Assertions/Lack of Humility

Always pay attention to any assertions made by the CEO. If he or she makes an exaggerated statement, treat it as a red flag. As an investor, you don’t want wild assumptions, you want a humble CEO who understands the ups and downs and sticks to the facts.

Relevant Experience

It is important that the core team working for the company are investing their own money into the business and are there in a full-time capacity. It is imperative to judge teams by their backgrounds and whether they have the grit and tenacity to move the company forward.

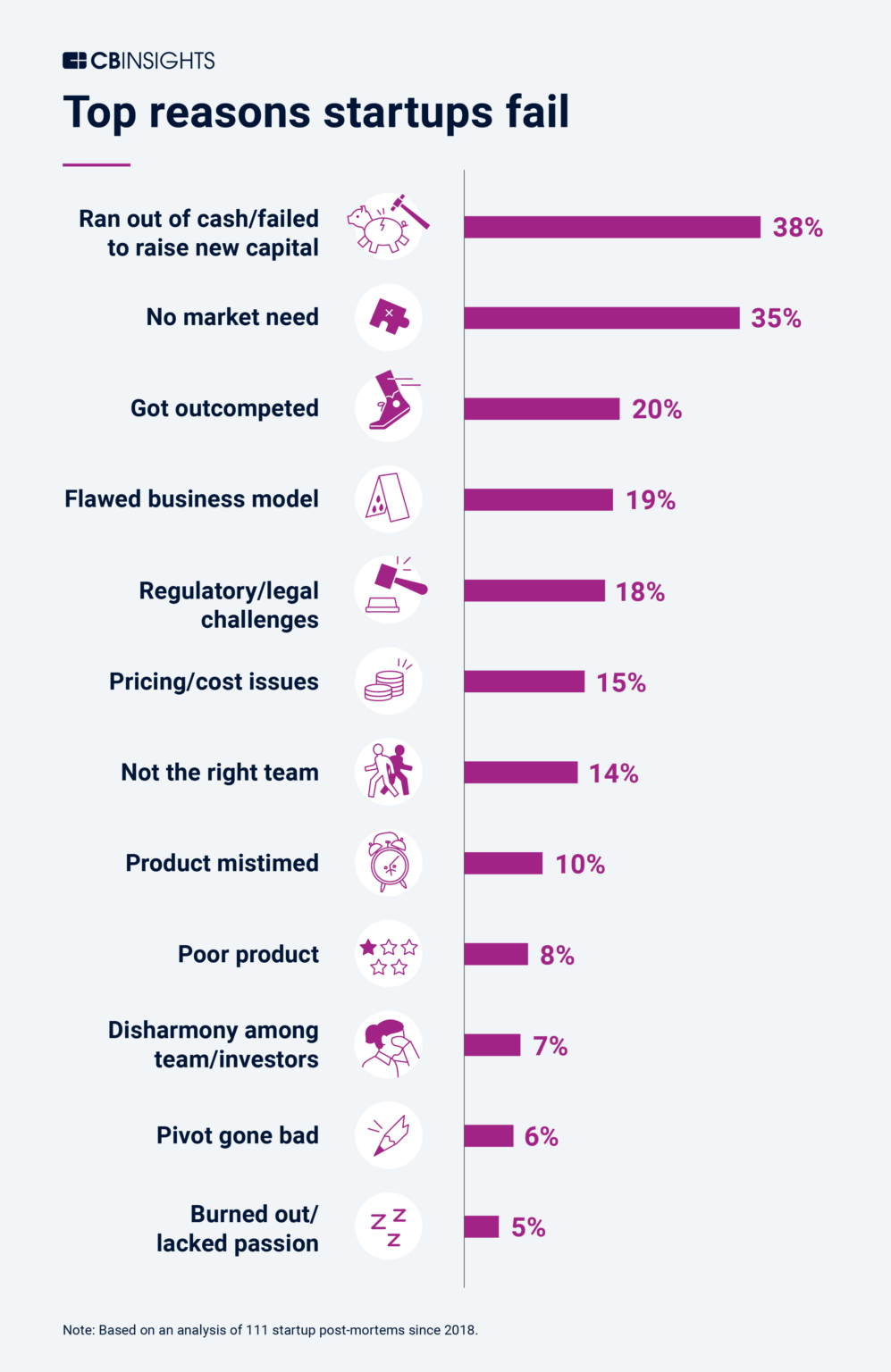

The following chart by CB Insights outlines additional reasons why start-ups fail.

Rob’s Due Diligence Philosophy

- Due diligence is more than checklists and fact-checking

- The Due Diligence process should shape the company into a viable and investible entity

- How can this be done? Focus on what makes start-ups crash

- It should validate your pre-defined investment criteria

- Due Diligence continues well after the DD report is done

Rob explained that as an investor, you should always go beyond the due diligence checklist. When a company comes to you and you have a legitimate interest in the company and see areas for improvement, it's important to take action, especially when doing due diligence. If the CEO can't tell the company's story well, you should spend weeks or even months helping them solve the problem and turn it into something convincing. The process of due diligence shapes a company into a viable and investable entity, not just through its pitch presentation, but also through its financials and go-to-market strategy. This can only be achieved by taking an active role in the company. If you have completed the due diligence process, you may not be ready to invest 100% in the company. You can invest the minimum amount and watch the company’s performance over time, and once you are confident that it can achieve its goals, you can go ahead and invest more money. Thus, the due diligence process continues way beyond the completion of the report.

ABOUT THE SPEAKER

Rob Neville is a successful entrepreneur now turned angel investor. As CEO of Savara, Rob attracted one of the largest historical amounts of angel investment ($50m from 400 angels including $15M from Keiretsu) - Savara was listed on NASDAQ in 2017. Prior to co-founding Savara, Rob founded and served as CEO at Evity, which he subsequently sold to BMC Software returning 30X to angel investors in just over 1 year. Based on his work at Savara and Evity, Rob was honored as a three-time finalist for the Ernst & Young Entrepreneur of the Year Award, winning the life science award in 2018. Rob now serves as a repeat judge in the Earnest & Young Entrepreneur of the Year Award. Rob is currently Managing Director at Springbok Ventures, investing in and assisting early-stage start-ups. Click here to watch his keynote address.