The fundamental desire of every investor is to experience peace of mind while watching their portfolio grow stronger with minimal risks. However, the future remains unpredictable, and market fluctuations can pose significant threats to even the most carefully curated investments. So, how can investors safeguard their portfolios from these inherent market risks? As it turns out, diversification is your only safety.

Several experts advocate that diversification is the best way to reduce risk in such a volatile world of investments. A well-rounded and safe portfolio is one that is spread out across stocks, bonds, and alternatives. In this blog, we deep dive into the average risk-return differential and discuss how to build a diversified portfolio that offers decent returns at minimal risk.

Understanding Market Volatility and Diversification

An analysis of S&P 500 data revealed that the market's long-term volatility is approximately 18. This means that the index fluctuates up and down by about 18% but averages a 10% positive return over the longest period.

As per this study, a stock portfolio consisting solely of stocks typically plots close to 18 in terms of volatility with a 10% return. However, bonds with less volatility and lower returns can be introduced to this all-stock portfolio to reduce its overall volatility. By doing so, you can plot the portfolio on what is known as the efficient frontier. Any portfolio based on this efficient frontier will have the least risk for the expected return.

To reduce the volatility of the S&P 500, Harry Markowitz suggested diversification of assets by combining stocks with bonds. For instance, adding 20% bonds to a stock portfolio reduces the volatility from about 18% to approximately 14%. However, it is essential to note that the returns also decrease. As you add more bonds, the portfolio approaches the risk-reward ratio of bonds. The most efficient portfolio, often cited as being around 70% stocks and 30% bonds, achieves the lowest risk—less than 10%—while maintaining a high return, close to 7%.

The components of the efficient frontier are various asset classes. US stocks represent one class, while international stocks from developed nations and emerging markets constitute others. Each asset class has its unique risk-reward ratio. By strategically combining these different asset classes, we can construct an efficient portfolio that sits on the efficient frontier, thereby optimizing the balance between risk and return.

Alternative Investments – The Key To Diversification

The goal of every investor is to move the efficient frontier at least to the left and hopefully up. Simply put, get the same return for less risk or more return for the same risk. But this cannot be done with just stocks, and that’s where alternative investments come into play.

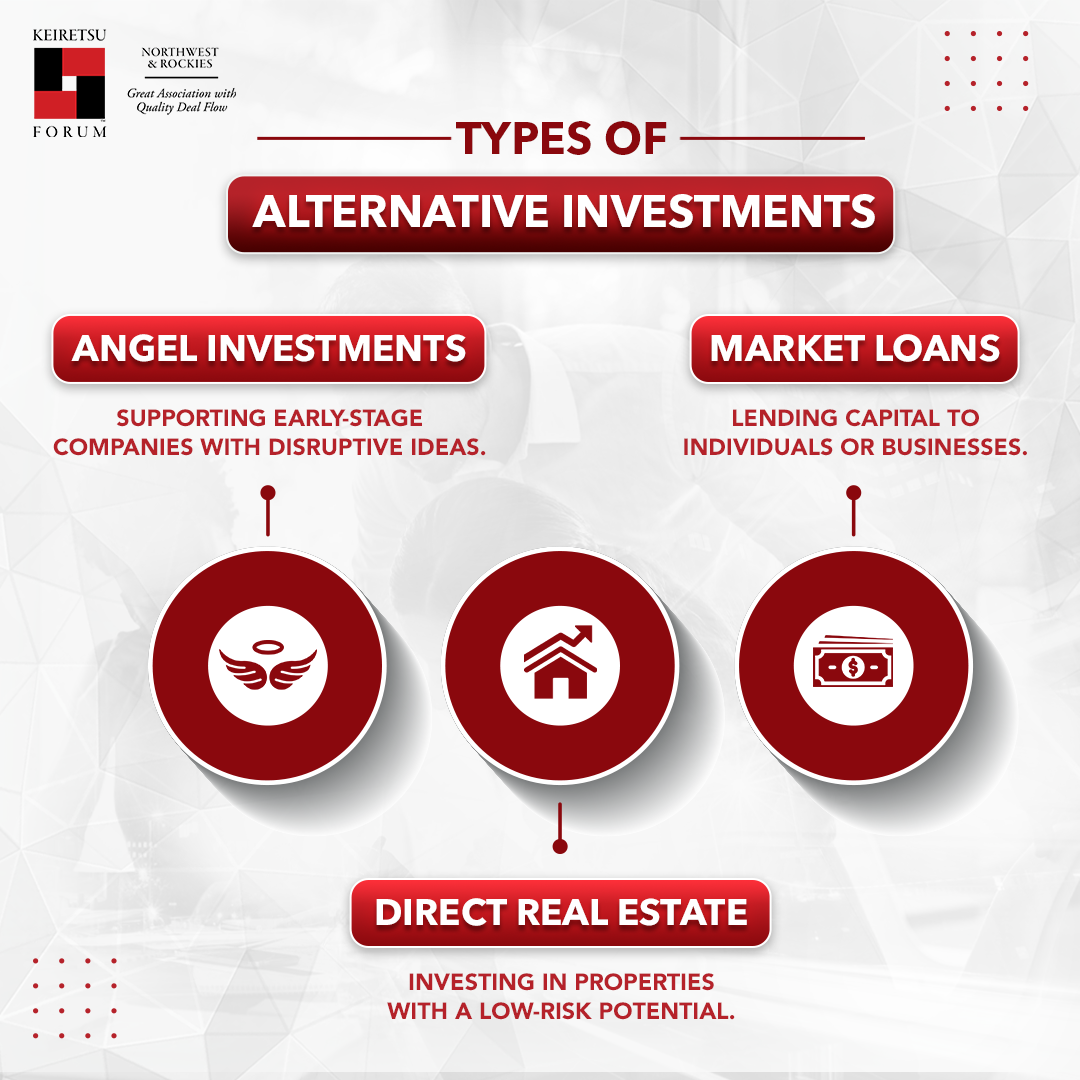

Alternative investments encompass any asset class that is not a stock or bond. This broad definition allows for diverse investment opportunities that can provide unique benefits to a portfolio. As angel investors, the focus is mainly on:

- Angel Investments: These are high-risk, high-reward investments in early-stage companies with potential significant returns.

- Direct Real Estate: Investing directly in real estate properties can offer stable income and potential appreciation, often with a lower correlation to stock market movements.

- Market Loans (Peer-to-Peer and Peer-to-Business): These investments involve lending money directly to individuals or businesses, bypassing traditional financial institutions and potentially earning higher interest rates.

The primary reason for incorporating alternative investments into a portfolio is their lack of correlation with traditional stocks and bonds. Their dissimilar price movement is beneficial because it can help move the efficient frontier to the left. In other words, alternative investments can reduce overall portfolio risk while maintaining or increasing returns.

Improving The Efficient Frontier – How The Pros Do It

Investing in alternatives can be your key to improving the efficient frontier. Here are a few notable instances which back the theory:

The BlackRock Approach

BlackRock, one of the world's largest investment management firms, has long been at the forefront of portfolio optimization strategies. An interesting aspect of their strategy is their incorporation of alternative investments. By adding a 15% allocation to alternatives, the firm asserts that it can effectively shift the portfolio's efficient frontier to the left and upward. This movement represents an improvement in the risk-return profile, potentially offering higher returns for the same level of risk or lower risk for the same level of returns.

What's particularly noteworthy about this approach is its versatility. The principle doesn't just apply to the 70/30 split; it holds for various traditional portfolio allocations. Whether an investor has a 60/40 stock-bond mix, a more conservative 50/50 split, or any other conventional allocation, adding a minimum 15% alternative investment component can potentially enhance the portfolio's efficiency.

The Yale Success Story

When Dave Swensen took over the Yale Endowment in 1985, alternative investments comprised only a small portion of the total portfolio. Over time, Swensen significantly increased the concentration of alternatives so that now less than 30% of the portfolio is in stocks, while over 70% is in alternative investments.

Swensen's approach has diversified the endowment's investments and optimized returns, setting a benchmark for other institutional investors. His innovative strategies and the resulting performance of the Yale Endowment serve as a testament to the power of alternative investments.

Tips To Mitigate Business Risk and Boost Returns

Here are some proven tips for all investors looking to build a strong and diverse portfolio:

- Always diversify away your business risk. You're not compensated for investing in business risk. This fundamental principle of investing underscores the importance of spreading your investments across different asset classes.

- By allocating to dissimilar price movement asset classes, you can potentially reduce the volatility of your total portfolio. A classic example of this strategy is combining stocks, bonds, and alternative investments. Each asset class tends to respond differently to market conditions, providing a wide moat against market fluctuations.

- You can increase your efficient frontier by carefully selecting the right alternatives for your portfolio. This means achieving higher returns for the same level of risk or maintaining your returns while reducing overall portfolio risk.

- Consider allocating more than 20% of your portfolio to alternative investments. This can help you shift your efficient frontier to the left, opening up new opportunities for higher returns at lower risk levels.

Harry Markowitz said, “Diversification is your only free lunch.” Spreading your investment over a series of high-performing stocks with low risks is an idea that does not cost a dime and sets you up for a more robust portfolio. Use the above insights to evaluate your current portfolio and find the proper stock-bond calculation that fits your investment goals.

We cannot predict the future, but we can undoubtedly secure it.