“Health care is inefficient. It's chaotic”, says Greg Critchfield. As a biotech executive, board member, and advisor to life sciences companies for over 15 years, Greg believes that the sector, often called recession-proof, poses large and interesting problems. In his keynote, he spoke to us about the challenges of investing in life sciences, the inevitability of progress in healthcare, and how companies can stand out in the flurry of technological advancement.

Shaping Better Lives & Outcomes

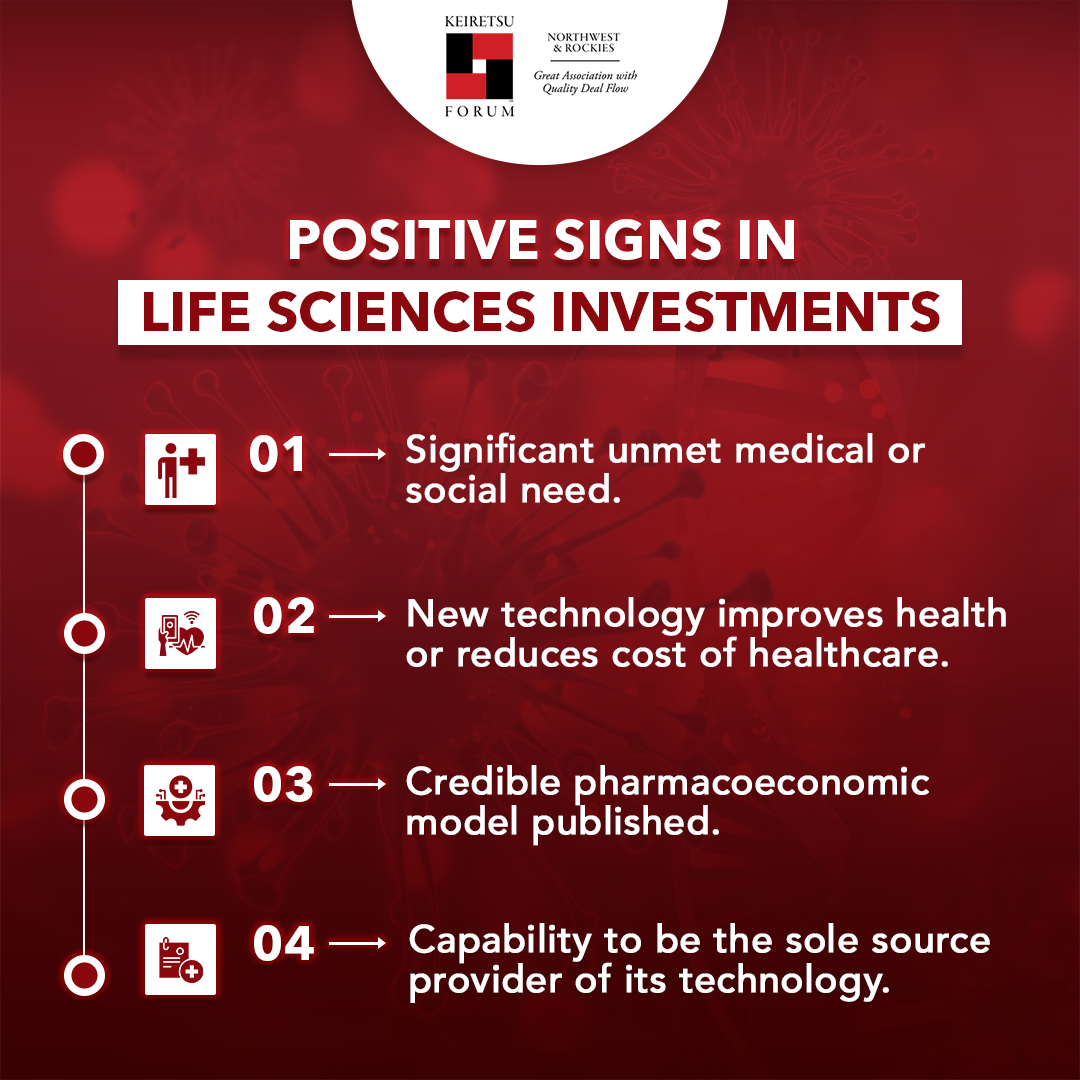

Life-changing technologies start with identifying a significant medical, biological, or social need; it has to be something that can make a real difference in human lives. The bigger the problem, the more interesting it is. Is technology making things faster, better, and more affordable? In that case, it may deserve attention.

Time, effort, and capital come together to breathe life into discoveries and transform them into practical solutions. From pre-clinical testing to approval, new drug and device approval in the US takes about 12 and 7 years on average, respectively. It is a lengthy and expensive process. Not to mention the complexities of identifying real problems, performing research, and conducting clinical trials. Still, the last 30 years have seen great progress in the way we understand basic disease processes, with new cancer trials making headlines almost every few months.

Companies that succeed in life sciences often have expert teams well-versed in product, market, and regulations. But who else is a crucial player in this story? Apart from the technology or the business model, value also comes from the people investing in the company! Therefore, knowing their value system is important too. In other words, investors create what Greg calls potential energy. The startup’s team then turns into kinetic energy with their performance. We live in a world where the pace of innovation is at an all-time high. For technology to achieve its ROI targets and give investors returns in shorter time horizons, it has to be a game-changer in shaping patient experiences and influencing what doctors and experts do. Showing the product’s worth —both in health benefits and economic benefits —often requires some demonstrations. Presenting studies or making logical inferences may be needed to get to market quicker and smoother.

Unique Healthcare Solutions at Scale

Human health and life sciences deal with problems that affect all humans wherever we may be. Hence, scalability needs to be analyzed with care. For investors active in this sector, the following questions become pivotal:

- What does the target company do and is their technology scalable?

- How does their technology reach every nook and cranny, addressing diverse and complex needs in different parts of the world?

- Can they provide the technology to the markets to allow them to develop as they must develop in each geographic area?

Greg advises companies to try and become the sole service provider of groundbreaking technology. It involves considerable strategic thinking, key partnerships, and unique market approaches that make it hard for others to reproduce what you bring to the table. Patents, trademarks, and other IP tools are all resources that make a difference. At a time when information travels at breakneck speeds, being unique is priceless. “There's never been as many things known as we know today,” says Greg.

The ability to discover additional things and launch different products is viewed as a plus. Once a new platform is launched, it can act as a medium to continually bring new and enhanced products to the forefront. What is unique about the pharma world is the flux and flow of new data. The holy grail of today may lose its value tomorrow if fresh research points to another solution. But the strategy cannot be centered on it alone. Becoming a low-cost producer and using strategic pricing helps companies stand as a formidable force against competitors, ensuring valuable technology remains accessible and robust in the market.

Founders and Funders

Finally, we come to the people who make it all happen: the funders and the founders. Investors, at the end of the day, invest not only to build the technologies but also to get a return on the technology. If it takes decades to get there, naturally, investor interest takes a dip. Entrepreneurs, on the other hand, need just the right touch of naivety to plunge into the unknown and embrace uncertainty. Add to that the secret sauce—enthusiasm, or, an entrepreneur's unwavering belief and fervent championing of their technology. A pinch of objectivity is essential too. The successful ones will most likely be the realists, grounded in data and flexible in strategy. They understand that in science, a plan set in stone won't cut it. Flexibility, data-driven decision-making, and the ability to pivot are crucial.

Life sciences hints at a future where possibilities are endless. Investors remain a crucial part of this ongoing transformation and will do well to look closely at the technology, evaluate the market potential, and know more about the people behind the curtain. Investing in life sciences is becoming a part of something bigger, a world where capital contributes to the greater good.

About the speaker

Dr. Gregory Critchfield is a distinguished medical professional with a background in Microbiology, Medicine, and Biophysical Sciences. He has served on the faculty of three medical schools and worked as a clinical pathologist with Intermountain Healthcare. He was also the Chief Medical and Science Officer at Quest Diagnostics, Inc., and President of Myriad Genetic Laboratories, Inc.

Dr. Critchfield has contributed significantly to various areas of laboratory medicine and has served as an independent director in several life science companies. He was the Chairman and CEO of Sera Prognostics, Inc., a women’s health company, from 2011-2023 and led fundraising of over $300M. He currently serves on the board of the Center for Medical Innovation at the University of Utah and as a Trustee of Bear Lake Watch.

You can watch his entire keynote here: https://keiretsuforum.tv/key-insights-for-successful-life-science-investing/