Cleantech is the sector defining the future. But it’s not for the faint of heart. Cleantech policies have undergone dramatic shifts over the last decade, with one administration emphasizing energy independence and the next injecting federal investment in renewable energy. Feeling confused? That is exactly how investors and entrepreneurs in the sector feel.

Trump’s 2016 tenure saw a greater focus on fossil fuels, but then Biden flipped the script with incentives and grants to support cleantech companies. Now that Trump is back in 2025, the sector faces another pivotal moment. Will the administration have a pro-clean energy stance? Will clean energy startups struggle to raise capital? Or will private investment, global funding, and corporate ESG mandates sustain cleantech's growth?

Let’s break down what’s next for the US cleantech sector and where the smartest bets lie in an unpredictable future.

Cleantech Policy Shifts: From Trump 2016 to Biden 2020

The cleantech sector has seen dramatic shifts in policy over the past two U.S. administrations, affecting investors and entrepreneurs. During Donald Trump's first tenure, the withdrawal from the Paris Climate Agreement and changes to environmental regulations reflected a shift toward prioritizing domestic energy production and reducing regulatory burdens. The administration slashed the EPA’s budget and replaced the Clean Power Plan with the more lenient Affordable Clean Energy rule.

While the administration focused on energy independence and deregulation, renewable energy continued to expand due to declining technology costs, state-level initiatives, and the availability of tax credits. Renewable sources generated 19.5% of total electricity in 2020, up from 14.9% in 2016. However, investor sentiment remained cautious, with limited federal support creating uncertainty. The absence of strong incentives meant that sector growth was fueled more by market forces than government backing.

In contrast, the 2020-24 government developed several pro-renewable policies, including the Inflation Reduction Act (IRA), which has allocated over $100B in grants to clean energy projects. The IRA catalyzed a 71% increase in private investment in clean technologies, leading to renewable energy generation rising to 21.4% of total electricity by 2023.

Investor sentiment shifted overwhelmingly positive, driven by federal incentives that spurred rapid expansion in clean energy manufacturing and infrastructure. The sector has not only attracted funding but also created substantial job opportunities. Now, during President Trump’s second term, there is a significant question mark over the future of cleantech and how the sector can evolve.

Investment Landscape: Uncertainty, But Also Opportunity

As an angel investor, you may face a more challenging environment as policy uncertainty increases. A shifting regulatory climate means you must continually assess the risks, which may result in reduced investment activity. But there is no reason to lose hope. Several states continue to invest heavily in clean energy regardless of policy changes. California, for instance, continues to invest in clean energy to meet its ambitious targets, such as achieving 100% carbon-free electricity by 2045. On the other hand, New York is committed to investing in clean energy to meet its 70% renewable electricity goal by 2030. The state has also created the Office of Renewable Energy Siting, which aims to reduce permitting timelines from up to ten years to as few as two years.

You may need a strategic shift at this time. Instead of relying on federal incentives, focus on nurturing businesses with clear commercial viability, strong unit economics, and adaptability to state- and corporate-driven demand.

Which Cleantech Sectors Could Still Thrive?

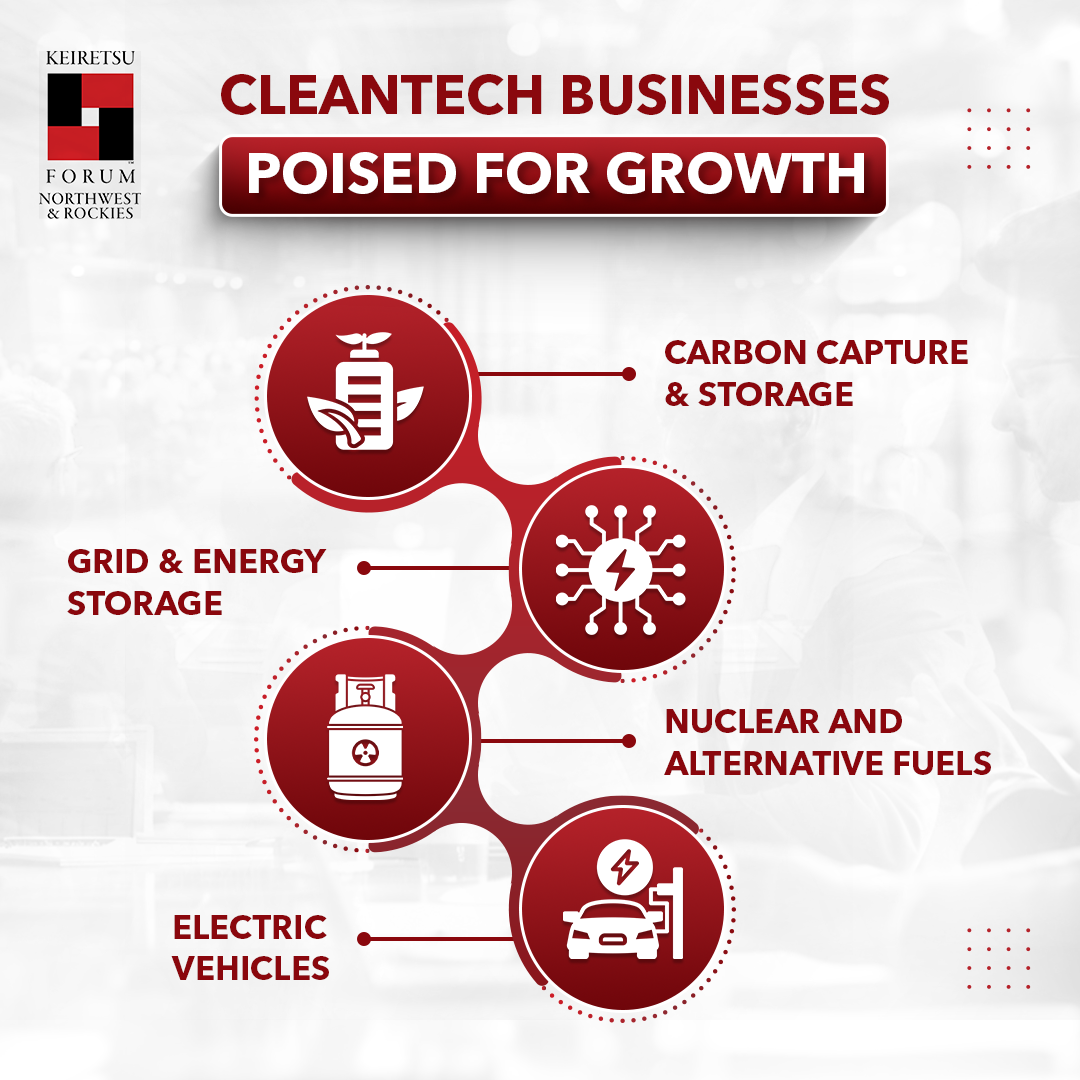

Despite potential policy headwinds, some cleantech verticals are poised to remain resilient:

- Energy Efficiency & Industrial Decarbonization – Cost-cutting solutions that improve energy efficiency in buildings, factories, and data centers will remain attractive as businesses aim to reduce operating expenses. Industrial decarbonization technologies, such as fuel switching to hydrogen or biomass, have shown potential to reduce emissions by up to 85% across most industrial sectors, aligning with growing corporate sustainability commitments and regulatory pressures. Elon Musk’s crucial role in Trump’s tenure has brought optimism for Electric Vehicles (EVs), especially after President Trump openly advocated for the brand.

- Carbon Capture & Storage (CCS) – Since CCS has previously received bipartisan support, companies innovating in this space may still find government backing. The Carbon Capture Coalition has outlined a comprehensive policy blueprint to support the scaling up of carbon management technologies, including Carbon Capture and Storage (CCS), which could lead to significant investments and project deployments across the U.S.

- Nuclear and Alternative Fuels – A Trump administration may favor nuclear energy, hydrogen, and alternative fuels as part of a broader "energy dominance" agenda. The administration will likely be bullish on atomic energy, aiming to compete against Russian and Chinese civil nuclear exports in the global market. This strategy includes supporting next-generation technologies, such as small modular reactors and microreactors.

- Resilient Grid & Energy Storage – Investment in grid resiliency and battery storage is expected to continue, at least at the state level, to counter harsh weather, which can disrupt traditional energy infrastructure. State-level initiatives and private investments are expected to drive advancements in energy storage technologies, ensuring that power systems can withstand and recover from such events efficiently.

Cleantech: A Sector Redefining Itself

Despite potential near-term challenges in the federal cleantech initiatives, the sector is unlikely to disappear. Savvy investors and entrepreneurs must adapt to a landscape driven more by private market forces, state-level policies, and global sustainability trends. For those willing to navigate uncertainty, opportunities will still exist to build and invest in transformative cleantech solutions that shape the future of energy and sustainability.

References:

https://www.eenews.net/articles/consumer-and-business-spending-on-clean-tech-soar-under-biden/

https://esgnews.com/biden-awards-over-100-billion-in-clean-tech-grants-ahead-of-trump-transition/