Mark Girouard, CEO and founder of Stage Right Ventures, and member of Keiretsu Forum Northwest & Rockies joins us as our keynote speaker as we wrap up our last March 2022 Forum session in Portland/Oregon. In his speech, he talks about what he likes and dislikes about Term Sheets, and how you can use them to your advantage.

Mark started his keynote by pointing out the importance of a balance sheet. He explained that the balance sheet is the financial basis for understanding capitalization and dilution. Cash is generated by issuing company stock. When debt is converted into equity (convertible bonds) or equity is issued, these events lead to new capitalization events and may dilute existing shareholders. He went on to stress the importance of capitalization tables. Mark says the CAP table is the history of every good or bad Term Sheet the company has written. It helps if the investors make an effort to analyze the reason why the company continues to raise money in the first place.

A Term Sheet is a document exchanged between two parties that contains the terms of their agreement. It is a summary of the main points of the agreement and clarifies any differences before finalizing any legal agreement. While the Term Sheet will not change the balance sheet or CAP table, the execution of the related agreements will. Mark sees the connection between the balance sheet, CAP table, ownership claims, and Term Sheet. They are usually offered by companies, but can also be offered first by investors.

According to Mark:

- A Term Sheet is a person's idea of a possible agreement that affects the terms of ownership. It starts negotiations and hides many potential points that investors and companies must ultimately agree on, either implicitly or explicitly.

- A Side Letter is a condition that a particular investor requires outside the scope of the Term Sheet. It is advisable to commit to an investment once you have understood all the components of the document.

Summary: When you look at a CAP table, Term Sheet, Balance Sheet, Ownership & Investment, you have a clear idea of the company's situation.

SO, WHAT ARE THE MAKINGS OF A TERM SHEET?

Mark explained that in his experience, there is no standard format for Term Sheets. Some are long, some are short, but they generally provide information related to funding, pricing, liquidation preferences, governance, cost, and timing. It also depends on the business, but the main parts of the Term Sheet are:

- Liquidation Preference

- Dividends

- Conversion into Common Stock

- Voting Rights

- Board Structure

- Drag Along Rights

CATEGORISING THE ‘TERMS’ IN A TERM SHEET

Mark noted that companies or investors can distribute Term Sheets to start negotiations, and often target terms that favor the author of the document. Each party can be either informed, foolish or nefarious and designed to encourage or deter behavior through the business process set out in the Term Sheet. Generally, the terms within a Term Sheets fall into the following categories:

Economic Terms: Price, Liquidation Preference, Pay-to-Play, Vesting, Exercise Period, Employee Pool, and Anti-dilution.

Control Terms: Board of Directors, Protective Provisions, Drag-Along Agreement, and Conversion.

Other Terms: Dividends, Redemption Rights, Conditions Precedent to Financing, Information Rights, Registration Rights, Right of First Refusal, Voting Rights, Restriction on Sales, Proprietary Information, and Inventions Agreement, Co-Sale Agreement, Founders’ Activities, IPO Shares Purchase, No-Shop Agreement, Indemnification, and Assignment.

HOW DO SIDE LETTERS IMPACT YOUR INVESTMENT?

A Side Letter contains clauses that supplement or in some cases modify the terms of the investment agreement and are usually contained in a letter approved by the parties. Side Letters are often used to grant special rights and privileges to lead investors. (Seed investors, strategic investors, individuals with large commitments, employees, friends, family members, or government-regulated individuals.) Bad Term Sheets or a complex set of unique investor needs may require side letters.

Side Letters cover the following areas:

- Information Rights

- Resale Exemption

- Pro-Rata Rights

- Most Favored Nation

- Board Observer Rights

- Attorneys’ Fees

- Any other contractual right, waiver, and an amendment to the Term Sheet or Investment Agreement

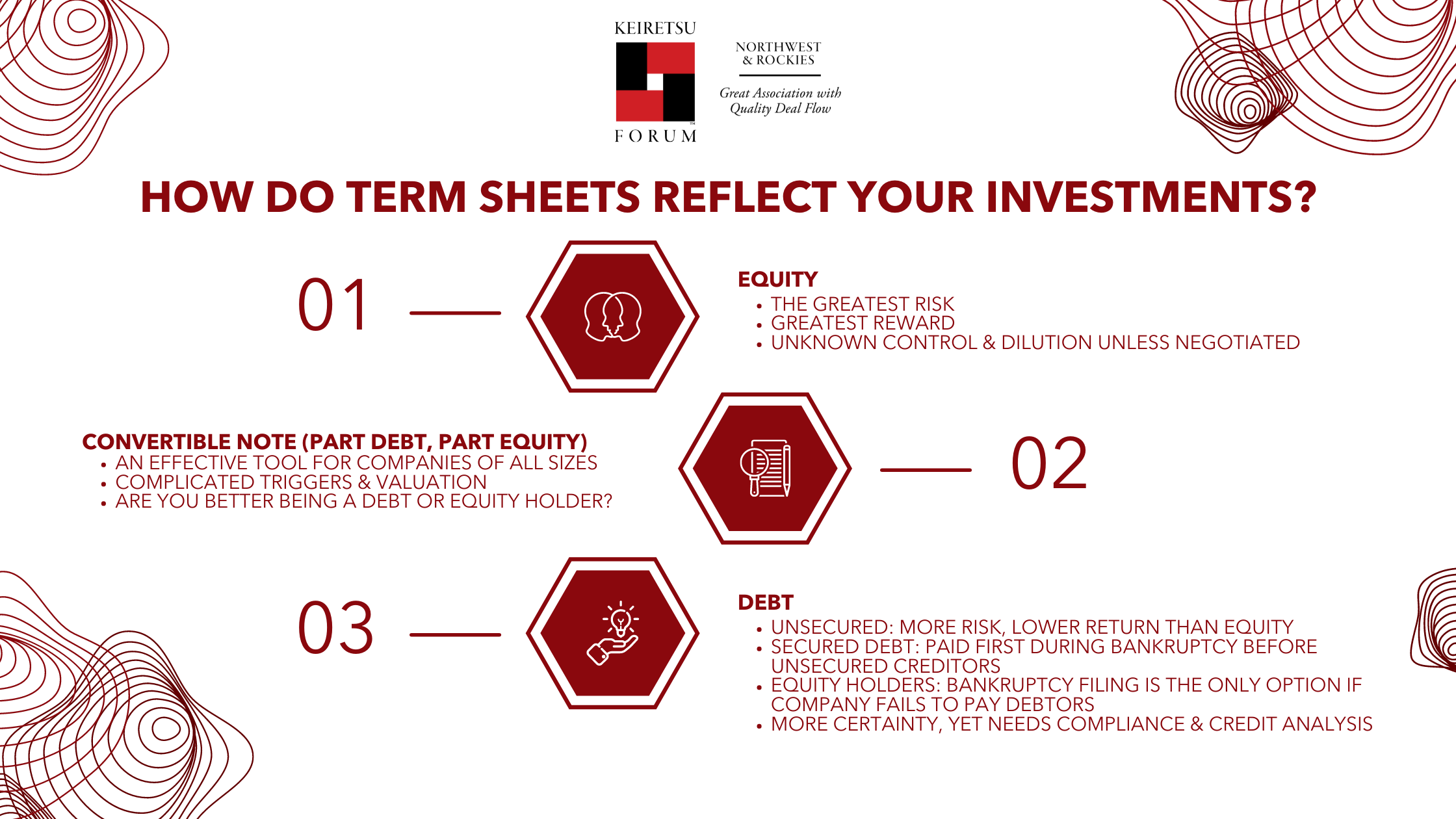

WHAT DO TERM SHEETS REFLECT ABOUT YOUR INVESTMENTS?

There are 3 main investment types to be aware of: Equity, Convertible Notes & Debt. All other investments like options and warrants are byproducts of these 3 basic types. A Term Sheet can contain one or all potential investment decisions. Mark goes on to say that a Term Sheet can lead to an investment agreement and a potential relationship of five to seven years or more. It is important to realize that for those looking for funding, the supply of Term Sheets is endless and must be chosen wisely before engaging in this type of relationship.

WHAT ISN’T A TERM SHEET?

The Term Sheet does not contain all the information needed to make an investment decision. It's mostly a depiction of the market and helps in starting a conversation between investors and companies. Ideally, Term Sheets allow for the creation of a "possible agreement" zone for the parties to reach an agreement in further discussions. Term Sheets are non-binding, brief, general, limiting, and should not be agreed upon without a deeper introspection and an assessment of the capabilities of the parties. Here are some of the key elements missing from the Term Sheet:

- Conversation with anyone in the company during happy hour or over coffee

- Prior Term Sheets

- Term Sheets sent to other investors

- Side Letters that have been signed or not yet signed

- Other agreements affecting the interests of other investors

- The Investor’s interests unless they created the Term Sheet

- A clear indication of who has their “Skin in the Game” in the past, present, or future

- The full agreement and understanding of all related parties

WHAT MARK LIKES WHEN IT COMES TO INVESTING

In general, Mark said, as an investor, he wants to have a clear view of the money he has invested in the company and the exit. He also wants to have a thorough understanding of what can be achieved, and a consensus between all parties to make that happen. Specifically, he is looking to be paid a return of his money and then a return on his money. He went on to say that if there is no prioritization or confusion on this process, then it is not an investment. Clear approval and compliance to hit milestones, not comfort or charity, is what he or other investors are looking for. It is important to strike a reasonable balance of performance to pay back regarding the right investment type, soft needs, and term types. In essence, it is important to note starve the company and also not to let them run wild.

| Investment Type (Mechanism) | Soft Needs (Non-economic) | Term Types |

|

|

|

WHAT MARK DOESN’T LIKE, WHEN IT COMES TO INVESTING

Mark outlines things he doesn't like about investing, such as bad deals, little accountability, and more. He also suggests some things to watch out for as an investor. Bad Deals have Bad Terms and Bad Communication and are surrounded by vultures every step of the way.

| Bad Terms | Bad Communication | Vultures in the past, present, future |

|

|

|

TYPES OF INVESTMENTS THAT MARK RARELY LOOKS AT

Mark follows Warren Buffett's two investing rules:

- Don't lose money

- Don't forget the first rule

He went on to say that he rarely considers any term or activity that doesn’t put investors first or create exit opportunities for investors. According to Mark, any Term Sheet that confuses this is not one to look at. He explained that people in the finance and funds industry love terminology and jargon, but if you start with enough bad terms, it's best to stay away from bad deals with no exit possibility. While it's nice to have a range of terms, it's more important to stay away from bad deals. Unless the terms are easy and take into account all parties, it can go a long way in achieving a realistic exit and be a nightmare to align interests.

Here are some examples:

- Events that never happen: It's nice to have clear rights, but more complex terms only come to play after certain events occur. It is important to understand the probability of such events

- Rights that don’t apply to me: Many of the “rights” have colloquial names that help investors close deals on the edge. Often these terms can be used to justify economics or control, which may not be a "right" at all. It is important to know which terms do not apply to you and which terms generally apply to others. Find out which rights affect your investment.

- Performance Exuberance: any term that includes an exuberant, illogical share price trigger based on performance that has never occurred

- Bad incentives: Incentives based on negative performance. Sometimes people use this word to see if you're listening.

MARK’S EXPERIENCES AS AN INVESTOR

A Term Sheet is a combination of what happened before, what worked, what didn't, and people's favorite terms. If a company messes up, there are fewer terms available, but usually seeks to pit one group against another. Here are some examples of important terms to be aware of:

- Invest now, I will send you the investment agreement later

- Penny warrants when only a few investors remain

- 50% discount for family members on IPO/exit

- Dividend and payroll liabilities on exit

- Excessive control terms for certain parties

- Excessive economic terms for certain parties

- Pricing triggers, valuation triggers, performance, and share issuance to management

- Any benefit/penalty to either party

- Over a period of time, the encouragements and discouragements for specific parties get outlandish in good and bad deals

AN EXAMPLE OF TERM SHEET NEGOTIATION

Balancing the interests of all key parties is critical to a successful Term Sheet. Excluding certain groups creates problems. The following parties are listed in order of importance:

- Previous Investors

- New investors

- Founders

- Staff (to develop the business)

The table below is based on Mark’s personal experience. It is an example of leading the next down round, bringing consistency, and hitting milestones.

| The Past | The Event | The future |

|

|

|

TERM SHEETS AS A SCIENCE

In the end, Mark pointed out that every time you see a Term Sheet, it indicates something bigger and more comprehensive. Mark believes that Term Sheets are a science where you can play your cards and influence the value of your company in the future. He asked do you want to own 100% of a $1 million company or 1% of a $1 billion company? He went on to say that when valuations rise, ownership falls, and when investors' money is used efficiently, economic performance improves. Increasing the percentage of ownership of less valuable property and wasting cash is sure to lead to failure! Finally, Mark points out that every time you see a Term Sheet, it points to something bigger and more comprehensive.

ABOUT THE SPEAKER

Mark Girouard is the CEO and Founder of Stage Right Ventures, an Advisory, Investment, and Technology Firm focused on building high-quality companies with a successful divestment plan. His extensive background in corporate finance and transaction services uniquely positions him to provide expertise and advocacy for entrepreneurs and investors. His exclusive approach drives clients to build enterprise business value, robust financial models, integrated solutions, and profitable transactions. Click here to watch his keynote address.